After Getting Pounded Exxon Mobil Bounces Back

Post on: 19 Апрель, 2015 No Comment

- Page Title:

- Page URL:

This page has been successfully added into your Bookmark.

2 followers

Follow

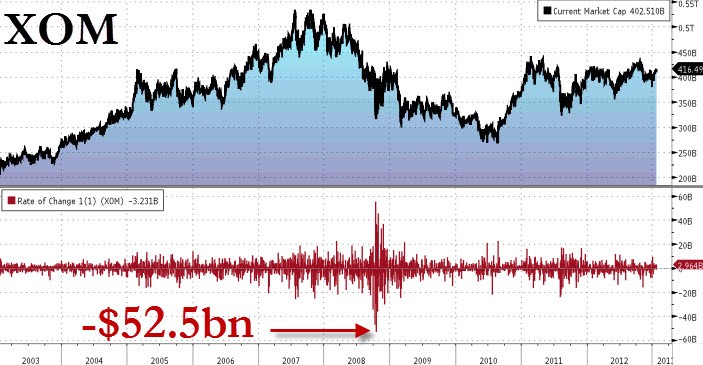

December has been brutal on energy stock prices the world over. The plunging oil price has sent shockwaves through global bourses with the energy sector being particularly hard hit by the oil glut. WTI (West Texas Intermediate) crude oil and Brent crude have hit 5-year lows and are now trading below $60 per barrel. The net effect has been crushing on petrochemical companies with Exxon Mobil (XOM ) being particularly hard-hit in the initial salvo. The share price of Exxon Mobile Corporation dropped to a 52-week low on December 12, 2014 when it hit $86.60 per share. The sharp price drop came hot on the heels of WTI crude plunging to $57 p/barrel.

The December Bears maul the markets

The markets have been dragged lower by the December Bears; a combination of weak global demand and an oversupply of black gold on the markets. OPECs recent decision not to cut oil supply has pushed the oil price into freefall mode with no apparent safety net in sight. The oil ministers from Saudi Arabia and the UAE announced that they would not be reducing oil supply and will wait for the markets to find their own equilibrium. In the U.S. the decline in the share price of Exxon Mobil has accelerated with large-scale production of shale oil from U.S. producers.

The present situation in the markets harkens back to 1987 when the infamous Black Monday rocked the markets. Around that time Saudi Arabia cut production while other OPEC members continued supplying oil. As a result of past failures, Saudi Arabia and other oil rich gulf nations have decided to protect their market share at all costs. The poor forecast for oil in 2015 has led to greater pessimism among investors of energy stocks. Morgan Stanley recently released a report anticipating slumping oil prices well into the New Year.

Why ExxonMobil is getting hammered by weak oil prices

Exxon Mobil has widespread upstream operations encompassing production and exploration activities. These are especially vulnerable with weak oil prices and profitability is all but non-existent as the oil price continues to tumble. As a direct consequence, energy stocks investors and fund managers have been dumping energy stocks en masse. Liquidity is now the order of the day among many investors – as alluded to by multiple fund managers. Investors would rather sell many of their shareholdings of profitable and unprofitable companies than risk losing their investments in a strong bear market.

Exxon Mobil reported weaker than expected Q3 results, with figures coming in $297 million lower year-on-year. The company reported quarterly earnings figures of $6.4 billion, with production volumes averaging 3.831 million barrels of oil p/day. That translates into a 4.7 percent decline year-on-year. Additionally, ExxonMobil reported decreased levels of liquid production with 2,065 million barrels p/day (-6.1% year-on-year).

Should you buy or sell Exxon Mobil stocks?

Since energy stocks have sharply retreated from their all-time highs – owing to persistent oil price weakness – investors have been short on all the big petrochemical companies. However, they are still looking for value stocks and Exxon Mobil is definitely a value stock. Since the price is now significantly lower and the fundamentals are sound, there is long-term value in Exxon Mobil. One of the most significant recent upgrades for XOM was from Underperform to Market Perform. The price target for the stock was also raised from $85 to $95 at BMO Capital Markets. Sentiment is actually now bullish on the stock which had a 52-week high of $104.76 and a 52-week low of $86.19. The social sentiment for the stock is neutral, making it a definite hold stock opportunity.

About the author:

Brett Chatz is a graduate of the Economics and Management Faculty of UNISA University (South Africa) and he completed post-graduate studies at the University of Haifa. He is a published author (Serum), financial columnist & cricket writer. Nowadays, Brett covers finance and stock markets regularly, while providing from his expertise to well-known firms such as Intertrader. UK CFD & Spreadbetting provider and other leading finance players.