After 2008 carnage worsthit funds are bouncing back

Post on: 19 Апрель, 2015 No Comment

SamMamudi

NEW YORK (MarketWatch) — The good news for many value investors is that their mutual funds are rocketing during the current market run. The bad news is that they still have a long way to go to recoup last year’s losses.

As of Friday’s close, there were four retail value mutual funds up more than 32% in 2009, and each of these funds lost at least 45% in 2008, according to Morningstar Inc.

It’s easier to come back up when you lose so much, said Michael Breen, senior fund analyst at Morningstar. These funds are making up on lost ground; there’s a lot of room to grow.

The biggest gainer on the year so far is Touchstone Large Cap Value TLCAX which is up 44%. But the fund could be a poster child for last year’s losses, as it was down 74%.

Another big gainer, Vanguard Capital Value VCVLX, -0.29% has a similar story to tell: The fund is up 38% year-to-date after losing 49% in 2008.

Last year’s straggler, Bill Miller’s Legg Mason Opportunity LMOPX, -0.31% which was down just more than 65%, has also roared back in 2009, up 31%. See related story.

Bouncing back

Breen said this year’s surge has been fueled in large part by gains in the financials and energy sectors. Many value managers jumped into energy last year when oil came off its highs and were hurt as oil continued to slide. As oil’s price has risen this year, the sector has enjoyed a boost.

In financials, the well-publicized troubles of the firms continue, but there’s at least one difference compared to late last year, said Breen: Going concern issues have abated.

People thought many of these firms many of these firms could go under, he said. As those fears have eased, the stocks have bounced back.

Still, the moves are relative. While Bank of America Corp. BAC, +0.00% is up more than 40% in the past month and its stock is trading at about $13, as recently as August it was above $30.

Another factor that dragged down value-style stocks last year was worries about debt levels. Breen said Royal Caribbean Cruises Ltd. RCL, -1.03% is an example of what happened to such stocks.

In early September, Royal Caribbean’s stock was trading near $30 a share, but it fell to about $6 a share in late February — a roughly 80% drop — on fears about its debt levels, said Breen. But since its low in early March, the stock has bounced back to about $16.

Royal Caribbean’s stock moves was a pattern repeated across other leveraged companies in recent months.

Once they restructured their debt and it was clear liquidity was coming back to the market, [their stock] went on a run, said Breen.

Breen said despite the outperformance of some funds, investors shouldn’t bank on outsized returns for the rest of the year.

The market’s still highly volatile and I don’t think we’re out of the woods yet, he said. But he added that value funds, which typically take a patient, long-term view of companies, are a pretty good recipe for success over the long run.

A growth fund wins

It’s not only value funds that are seeing dramatic rebounds. The top performing growth fund this year, William Blair Small Cap Growth WBSNX, -0.15% is up 32% after falling 47% in 2008.

Greg Brown, mutual fund analyst at Morningstar, said the fund was hit so hard last year because it focuses on small companies, typically with a market capitalization of less than $500 million.

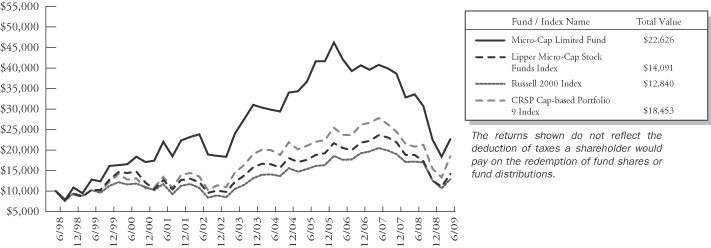

Micro-cap companies got hit so hard because of the perception that they didn’t have the resources to weather the storm, said Brown.

Having come through the storm, some of the upswings have been dramatic. VistaPrint Ltd. VPRT one of its largest holdings, is up almost 100% this year.

Brown gave particular credit to the William Blair fund’s managers, Karl Brewer and Michael Balkin, for sticking with their approach even in a terrible market.

Investors emotions are so fickle, and to have that manager’s state of mind [and buy stocks at the bottom], it’s incredible, he said.