ADX DMI Strategy Performance Test Results

Post on: 4 Май, 2015 No Comment

ADX DMI Strategy Performance Test Results

Mar 8, 2009: 6:07 PM CST

A reader recently asked me to look into the possible Edge or strategy performance results from using the DMI+ and DMI- crossovers (components of the ADX Indicator). Lets see the results, describe the strategy, and see how it performed.

The line of thinking goes that when DMI+ crosses above DMI-, then an uptrend is in place and that should give you an edge when trading akin to a Trend Following System. For more information, visit StockChart.coms page on the ADX Indicator .

The strategy expects to capture large swings from a big trend move and enter you in the direction of that trend. The system I created (simply) for testing takes advantage of both sides of the market, in that its always in the market and goes long when DMI+ (Positive Directional Movement) Crosses Over DMI- (Negative Directional Movement) and then exits and reverses short when DMI+ Crosses Under DMI-.

No stops were used and no commissions were factored into the testing. Testing runs from January 1998 to present. The results you see are pure data from TradeStation.

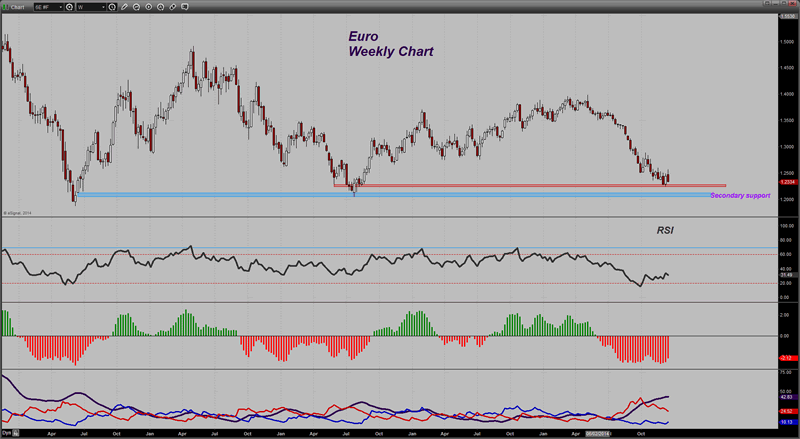

Before looking at the results of randomly selected stocks (by me), lets look at the strengths and weaknesses of this system on a chart:

(Click for larger image)

The system goes long when the Green line crosses above the Red line (indicator). Its expected to capture large swings or trend moves and indeed it does. This is the DIA around 2004 Daily and it captured two big wins.

Unfortunately, the indicator crossed frequently from the period of June 2005 to September 2005, resulting in numerous whipsaws for small losses. Are the profitable trades enough to overcome all the small, whipsaw losses?

Unfortunately, no.

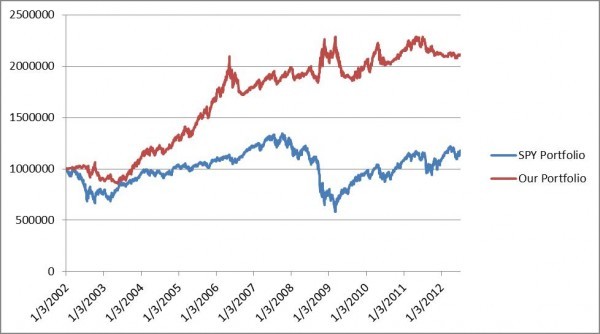

I tested this across 8 randomly selected stocks including the DIA and SPY and the results are presented in the following table:

Again, here are the parameters:

1998 2009 daily bars; 1,000 shares per trade; no commissions. Always in the market; no stops.

Over the 10-year period, 3 of the 8 stocks returned positive results, though that would have been eroded once commissions and slippage were factored in.

The Profit Factor which is the Average Winner (Dollar Terms) divided by the Average Loser (Dollar Terms) is attractive, and in most cases, the Average Winner is at least two times larger than the average loser (giving us an average Reward/Risk ratio of about 2 to 1).

The problem with this strategy lies in the numerous small losses that erode the edge of the larger average winner to the smaller average loser.

The win-rate for these stocks all was less than 33%, meaning only 1 in 3 trades resulted in a profit. A 2 to 1 reward/risk ratio cannot overcome a strategy with a win-rate of 33%.

Remember, these are just raw data, and if youre interested, you can run your own tests and try to include filters such as demanding the ADX must be over a certain value (to filter out choppy environments) or some other method to try to reduce the numerous whipsaws.

Corey Rosenbloom

Register (free) for the Afraid to Trade.com Blog to stay updated

4 Responses to ADX DMI Strategy Performance Test Results

- 3A%2F%2Fwww.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D32&r=R /% Neil Says:

Hi Corey,

Just one indicator for trade setup might not be a very good idea. But yes this indicator too can be used together with other indicators/anlaysis techniques.

Anyways I would like you to tell me how to set up charts for intraday trading, I mean though I know how to analyse and stuff, but never have been a day trader, more of a trend, or swing trader. So, just wanted to know what kind of settings should one use for day trading. Although I know its like to each his own, but would love to know what kind of indicators and settings would you use for day trading.

Thanks in advance

3A%2F%2Fwww.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D32&r=R /% Corey Rosenbloom Says:

Hey Neil,

Thats sort of the point Im trying to make. One indicator in isolation never has the edge needed across all market conditions to make a worthwhile stand-alone strategy. Its the artful combination that creates edge.

View the post

to get insights into my charting style.

[. ] ADX DMI Strategy Performance Test Results [. ]

3A%2F%2Fwww.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D32&r=R /% Jettababe18 Says:

you dont mention where the ADX line is located during the whipsaw effect. Could be the reason for any losses during that time period.