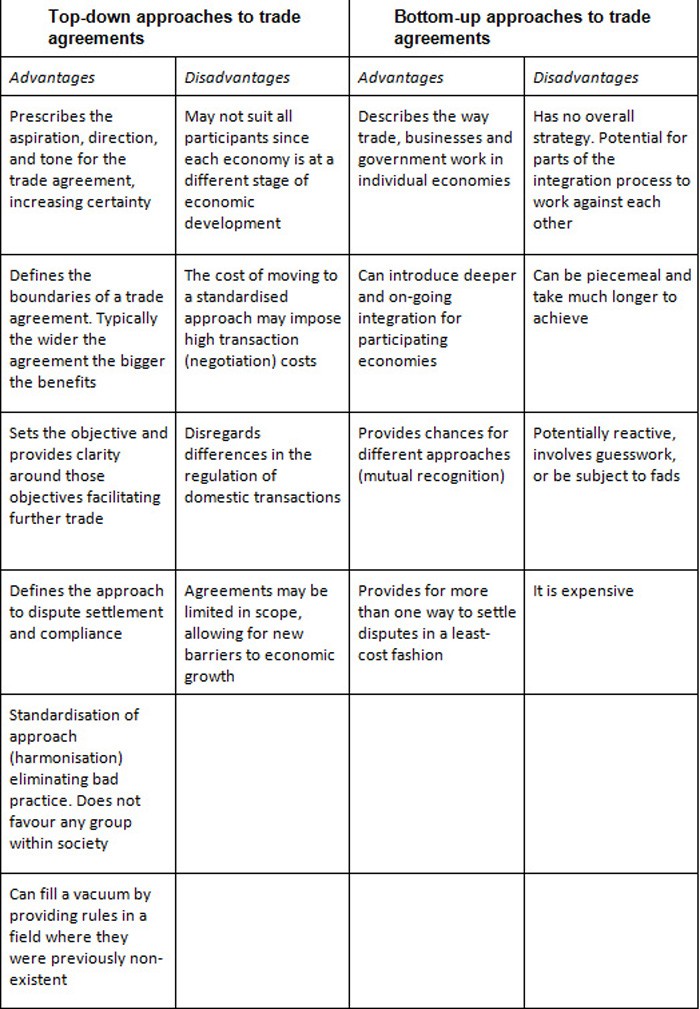

Advantages and disadvantages of ETFS

Post on: 8 Апрель, 2015 No Comment

Because of the passive management of ETFs, fees are low, and the turnover of securities is low, which (similar to index mutual funds) results in low capital gains taxes. See Table 16–3 for the advantages and disadvantages of investing in ETFs.

SHOULD AN INVESTOR INVEST IN INDIVIDUAL SECURITIES OR USE ETFS OR FUNDS?

The diversification achieved by mutual funds, closed-end funds, and ETFs minimizes the effect of any unexpected losses from individual stocks and bonds in a portfolio. Also, professional managers of mutual and closed-end funds may have quicker access to information about the different issues and may react sooner in buying or selling the securities in question. ETFs are similar to index funds and are not actively managed.

For investors willing to manage their own portfolios, a strong argument exists for buying individual securities over mutual funds. The rates of return on individual stocks have the potential to be greater than those earned from mutual funds. This statement is true even for no-load funds because in addition to sales commissions, other fees, such as 12(b)–1 and operating fees, reduce the returns of mutual funds. By investing in individual securities, you avoid these fees. ETFs generally have lower management fees than mutual funds. However, commissions are charged to buy and sell individual stocks, ETFs, and closed-end funds.

Table 16-3

The Advantages and Disadvantages of Investing in ETFs

ETFs bear similarities to open-end mutual funds, index funds, and closed-end funds. Knowing the advantages and disadvantages of ETFs will help you to determine which type of investment is more suitable to your needs.

* ETFs offer diversification (similar to mutual funds), but they trade as stocks. Even though the stock prices of ETFs that track the different indexes fluctuate when markets are volatile, the effect of the fluctuations on each of the indexes may be more muted than in a portfolio of individual stocks.

* ETFs charge low fees and generally are tax efficient in the management of these securities, making them similar to index funds. (Some newly introduced ETFs to the market have increased their fees, which suggests that investors should check the fees charged before investing).

* ETFs are bought and sold through brokers, just like any other stocks on the market at real-time price quotes during the day. Mutual funds can only be traded once a day at their closing prices.

* Investors do not need large amounts of money to be able to buy ETFs, which gives them broad exposure to a market index, a sector of the market, or a foreign country.

* The disadvantage of ETFs is that investors incur commissions to buy and sell shares, whereas no-load mutual funds charge no transaction fees to buy or sell shares. These transaction costs to buy ETFs make it uneconomical for investors who typically invest small amounts of money on a frequent basis.

* Sector ETFs may be too concentrated in their sectors to share in the gains of their sectors. In 2006, the telecommunications sector had large returns that were not shared by some of the telecommunications sector ETFs (Salisbury, 2006, p. C11).

If you have a small amount of money to invest, mutual funds and ETFs are better alternatives. A $2,000 investment in a stock fund buys a fraction of a diversified portfolio of stocks, whereas for individual securities, this amount might allow for buying only the shares of one equity company. Investing in mutual funds is good strategy if you do not have enough money to diversify your investments and do not have the time, expertise, or inclination to select and manage individual securities. In addition, a number of funds offer you the opportunity to invest in the types of securities that would be difficult to buy individually. ETF investors are not hampered by the minimum investment amounts set by mutual funds. Investors can buy a single share of stock in an ETF.

Table 16-4

Characteristics of Individual Securities versus Mutual Funds, Closed-End Funds, and ETFs

Individual Securities