Advanced Options Strategies

Post on: 13 Июль, 2015 No Comment

Advanced Options Strategies

There are three major classifications of advanced strategies.

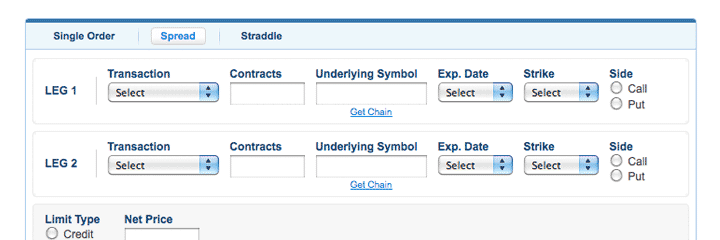

The Spread

The first advanced strategy is called a spread. This is the simultaneous opening of both a long position and a short position in options on the same underlying stock. The spread increases potential profits while also reducing risks in the event that the underlying stock behaves in a particular manner, as illustrated shortly.

In order to meet the definition of a spread, the options should have different expiration dates, different striking prices, or both. When the striking prices are different but the expiration dates are the same, it is called a vertical spread. This is also referred to as a money spread .

Vertical Spread, More than Margarine: You buy a 45 call and, at the same time, sell a 40 call. Both expire in February. Because expiration dates are identical, this is a vertical spread.

A Second Vertical Situation: You buy a 30 put and, at the same time, sell a 35 put. Both expire in December. This is also a vertical spread.

The vertical spread is created using either calls or puts. The spread can have different expiration dates or a combination of different striking prices and expiration dates. Spreads can be put together in numerous formations.

Spread strategies using short-term options expiring in six months or less are, of course, limited in value to that time range. However, spread strategies are far more complex when you combine short-term options with long-term equity anticipation security (LEAPS). These longer-term options may have a life up to three years, so the offsetting possibilities can be far more complex. Knowing, for example, that time value declines the most during the last two to three months, you can cover a short-position option with a longer-term LEAPS option. We qualify the term cover in this strategy. Although it is widely referred to in that manner, it is in fact more accurately a form of spread.

Thinking Ahead: You purchase a LEAPS 40 call that expires in 30 months. The stock is currently selling at $36 per share. You pay 11 ($1,100). Although time value premium is high due to the long-term nature of this option, you believe that the stock will rise in price during this period and that this will justify your investment. A month later, the stocks market value has risen to $41 per share. You sell a 45 call expiring in four months and receive a premium of 3. Three months later, the stock is selling at $44 per share and the short call is valued at 1. You close the position and take a profit of $200 (minus trading fees). You now are free to sell another call against the LEAPS, and you can repeat the process as many times as you wish.

The preceding transaction should be evaluated with several points in mind. The LEAPS cost $1,100 and you have already recovered $200 of that cost. The LEAPS is now in the money, so the price movement direction is favorable. This transaction took four months, so you have 26 more months before the long LEAPS call expires. You could repeat the short-term call sell again and again during this period. It is possible that you could recover the entire premium invested in the long position through well-timed short-term call sales and potentially still profit from the long position as well. This would be an ideal outcome, and you have two and a half years for it to materialize. In comparison to using only short-term calls, you have far greater flexibility using short-term options in combination with long-term LEAPS options.

Smart Investor Tip

Combining short-term options with long-term LEAPS expands the profit potential of many spreads.

A variation of the spread offers potential double-digit returns, especially using the high time value of LEAPS options. For example, you can combine a covered call and an uncovered put on the same stock and receive premium income on both. This strategy is appropriate if and when:

You are willing to write a covered call, recognizing that if exercised, your stock can be called away.

You are also willing to write an uncovered put, in full knowledge that if exercised, you will have to purchase 100 shares of stock above current market value. This is appropriate when the striking price, less put premium you receive, is a good price for the stock.

You structure the short call and put so that exercise may be avoidable through rolling techniques if and when the stock moves close to either striking price.

Double-Digit Returns: You own 100 shares of stock that you purchased at $26 per share. Today, market value is $30. You write 29-month LEAPS options on this stock. You sell a 35 call and a 25 put at the same time. Your total premium on these two LEAPS options is 11 points, or $1,100. That represents a net return, based on your purchase price of $26 per share, of 42.3 percent.

In this example, you would experience one of four outcomes:

One or both of the LEAPS options may expire worthless. In that outcome, the premium is 100 percent profit.

One or both of the LEAPS options may be exercised. If the call is exercised, you will give up shares at $35 per share. Your basis was $26 so your capital gain is $900, plus the call premium. If the put is exercised, you will buy 100 shares at the striking price of 25, so that your average basis would be 25.50 in this stock.

One or both of the LEAPS options can be rolled forward to avoid exercise. The call can be rolled forward and up; and the put can be rolled forward and down. With each change in striking price, you change the eventual exercise value, so that upon exercise you would be more points ahead. If the call is exercised, you will gain five points more with a five-point roll. If the put is exercised, you will buy stock at five points less than before.

One or both LEAPS options can be closed. As long as time value falls, you may be able to close these short positions at a profit. However, they can also be closed to reduce losses if the stocks price movement is significant.

One interesting variation on the spread is the collar. This strategy involves three positions: buying the stock; selling an out-of-the-money call; and buying an out-of-the-money put. It is designed to limit both potential profits and potential losses. While trading costs may be high when collars are used for single-contract transactions, they are viable in some situations. The further out of the money the call and put, the more bullish your point of view. This strategy combines the most optimistic points of view, and when the short call pays for the cost of the long put, the potential loss is limited as well. Potential outcomes include exercise of the short call, in which the stock will be called away; inadequate movement on either side, resulting in little or no net loss; or your exercise or sale of the long put in the event of a decline in the stocks price.

Given the overall returns possible from selling long-term LEAPS calls and puts, the combined sale of a call and a put can produce very attractive returns; and exercise can be either avoided or accepted as a profitable outcome.

The Hedge

The second advanced strategy is the hedge. which has been discussed many times throughout this book in specific applications. For example, you hedge a short sale in stock by purchasing a call. In the event the stock rises, the short sellers losses will be offset by a point-for-point rise in the call. A put also protects a long stock position against a decline in price. So using options for insurance is another type of hedge. Both spreads and straddles contain hedging features, since two dissimilar positions are opened at the same time; price movement reducing the value on one side of the transaction tends to be offset by price movement increasing value on the other side.

Advanced strategies often produce minimal profits for each option contract, given the need to pay trading fees upon opening and closing. Such marginal outcomes do not necessarily justify the associated risks, so advanced options traders apply these strategies with large multiples of option contracts. When you deal in multiples, the brokerage deposit requirements are increased as well.

In the advanced strategy, what appears simple and logical on paper does not always work out the way you expect. Changes in option premium are not always logical or predictable, and short-term variations occur unexpectedly. This is what makes option investing so interesting; such experiences also test your true risk tolerance level. You may find that your risk tolerance is different than you thought, once you employ advanced option strategies. Being at risk is daunting, so think of the range of risks and costs before embarking on any advanced strategies.

The Straddle

The third combination strategy is called a straddle. This is defined as the simultaneous purchase and sale of an identical number of calls and puts with the same striking price and expiration date. While the spread requires a difference in one or more of the terms, the straddle is distinguished by the fact that the terms of each side are identical. The difference is that a straddle consists of combining calls on one side with puts on the other.

The spread example involving short covered calls with uncovered short puts can also be applied in the straddle. Instead of spreading with the use of higher call striking prices and lower put striking prices, both can be sold at or near the money. In this situation, premium income will be far greater, consisting of high time value on both sides. The chances of exercise are greater as well, and if you wish to avoid exercise, you will have to roll at least one of the straddle positions, and possibly both. If the stocks direction reverses itself, it could result in the need to roll the call forward and up and to roll the put forward and down.

If you enter an at-the-money straddle using short covered calls and short uncovered puts, you need to be prepared to accept exercise if it does occur. Because you keep the premium for selling these options, it can be a very profitable strategy.

The Strangle

A strategy combining features of both the spread and the straddle is the strangle. In this strategy, you will make a profit only if the stock has a significant move. A strangle consists of a long call and a long put with different striking prices but the same expiration date, and it is affordable primarily because both options are out of the money.

Strangle, Not Choke: You have been tracking a stock that has traded in a narrow range for many months. You expect a large price movement, but you dont know which direction it is likely to take. The stock currently trades at $43 per share. You enter a strangle, consisting of a 45 call and a 40 put, both expiring in seven months. The total cost of these two options is 4 ($400). As long as the stocks price remains between $36 and $49 per share, the strangle cannot be profitable (striking prices expanded by cost of both options). But if the price moves above or below that range, one side or the other will be profitable. In a short strangle, potential profits exist as long as options remain out of the money, and that profit range is expanded by the receipt of option premium.

The strangle is a strategy based on the belief that the stock will move substantially. Of course, because it requires the purchase of two options, the chances for success in this strategy are less than those for purchasing a single option. To enter a strangle, you should be confident that substantial price movement is likely to occur before expiration.

A related strategy partially solves the problem. As shown in the previous example, the cost of long options makes it difficult to reach and exceed a breakeven point. The iron condor is a variation on the strangle. It consists of four different options: long and short calls and long and short puts, all on the same underlying stock.