Activist Investors Do They Really Help

Post on: 28 Апрель, 2015 No Comment

Recent Posts:

Activist Investors: Do They Really Help?

Hedge fund manager Bill Ackman is undoubtedly the poster boy for shareholder activism. His recent shootout with the former CEO and board of Canadian Pacific Railway (NYSE:CP ) helped goose the price of its stock by 60% over the 10 months the two sides waged a proxy battle leading up to its annual meeting in May.

Still, the question remains whether activist shareholders add permanent long-term value to the companies theyre railing against or if its simply a matter of dumb luck. Lets take a further look.

Heres how the CP events played out: Ackmans Pershing Square bought its first shares on Sept. 23, 2011 at $46.41 and then went on a month-long (26 trading days) buying spree. Over the course of that time period, Ackman acquired more than 20 million shares of the railway an average of 795,000 shares a day. His biggest purchase was of $106 million in CP stock at an average price of $63.52 a share a move that came on Oct. 28.

That was the same day Ackman filed with the SEC, revealing his 12.2% stake in CP. Shares jumped 4.3% on the news. However, the excitement was short-lived; the next days trading brought the share price back to where it was before Ackman revealed his stake.

Until Pershing began purchasing shares, CPs average daily volume in the three months prior had been 803,000. In eight of the next 26 trading days after Sept. 23, more than a million shares were exchanged between buyers and sellers.

Its safe to assume the 31% increase in CPs stock over that month had everything to do with Ackman accumulating a thinly traded security and nothing to do with investor activism. Ackman can begin to take credit, though, when it comes to what happened to the stock after that.

Without his efforts to remove Fred Green as CEO and replace him with former Canadian National Railway (NYSE:CNI ) head honcho Hunter Harrison, the stock likely would have stalled. Admittedly, thats only speculation. Its possible the stock would have moved into the 80s with or without Harrison at the helm but Ackman does seem to have made an impact.

Either way, as a result of Ackmans high-profile hedge fund, activism has become a fashionable subject in the business media.

In Canada, for example, SNC-Lavalin Group (PINK:SNCAF ) has come under scrutiny in recent days as a potential target of activist shareholders due to its underperforming stock. With losses of 27% year-to-date, it fits the activist profile according to Maxim Sytchev a research analyst with AltaCorp Capital, a Calgary-based investment bank.

Sytchev values the entire business at $68.30 a share, considerably higher than the Sept. 27 closing price of $39.07. He believes an activist investor would push for the company to spin-off non-core assets such as Torontos Highway 407 toll road and for it to pay a special dividend.

This kind of conversation will certainly at least draw attention to its stock, which indeed appears considerably undervalued relative to its peers. However, its largest shareholder, Jarislowsky, Fraser Ltd. which own 14.4% of the outstanding shares believes drastic measures arent required to unlock value from the business.

And billionaire Stephen Jarislowsky of the group is one of Canadas all-time greatest investors, so he knows a thing or two about value. Id take his word for it but still keep an eye on the situation. It should get very interesting in the months ahead.

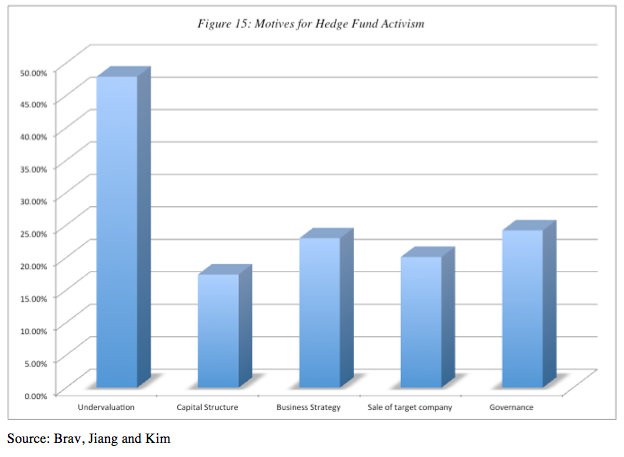

With this example in mind, lets look at what tangible long-term value activist investors tend to bring to the table. Four American university professors studied hedge fund activism from 2001 and 2006 in a widely distributed report Hedge Fund Activism, Corporate Governance, and Firm Performance . The authors found the following:

- Hedge fund firms generally target companies that are undervalued but profitable.

- The targets are usually not large caps.

- The targets have good liquidity.

- The filing of a Schedule 13D by an activist investor like Bill Ackman generates a 7% to 8% return based on a 40-day window stretching from 20 days before the announcement to 20 days after.

- EBITDA/sales at target firms increase by at least 4.7 percentage points within two years of the activist intervention.

- The median holding period of a targets stock by activist hedge fund investors is 20 months.

- Approximately 41% of hedge fund activism achieves stated goals.

- The median initial stake in a company is 6.3%.

- Hedge fund activists arent interested in control; rather they seek to initiate value-enhancing change.

- The average annualized return for hedge fund activists over the 12-20 month holding period is 33%.

- The returns from activists filing a Schedule 13D dropped from 15.9% in 2001 to 3.4% in 2006.

These are quite the findings. Looking at all of them, it appears the benefits of activism has diminished over time as more hedge funds enter the game and try to capitalize on this type of arbitrage. Its also clear that, even though a majority of the activism failed to meet stated goals, activist intervention is generally good for target companies because it forces them to re-evaluate how they are doing business.

Also, even though activist investors are usually long gone by the time a business has implemented real and lasting change, its more than likely that the stock will continue to benefit from those changes for some time to come.

With that being said, it makes no sense to implement an investment plan based solely on the moves of people like Bill Ackman. Instead, consider this simply another tool in the investor toolbox one that shouldnt hurt your investment performance, but could possibly help it.

Good investors are always learning from the experts.

As of this writing, Will Ashworth did not own a position in any of the stocks named here.