Actively Managed ETF

Post on: 8 Апрель, 2015 No Comment

With all the attention and assets flowing toward exchange-traded funds, new variations on these funds were inevitable. Say hello to the latest flavor: actively managed ETFs. Up until now, all exchange-traded funds have been indexers, such as Spiders ( AMEX: SPY ) , Diamonds ( AMEX: DIA ). and Cubes ( Nasdaq: QQQQ ). designed to track certain benchmarks. Now, a few bold explorers are going where no ETF has gone before.

Uncharted territory

In recent weeks, AER Advisors and XShares Advisors have both filed papers with the SEC to launch actively managed ETFs. From the initial filing, it appears that these funds won’t differ significantly from traditional ETFs. AER’s approach would rely on a set of rules to pick stocks for its funds. Changes to the portfolios would be announced each Friday, then carried out the following Monday. XShares announced it would disclose its holdings once a day. Managers would be able to trade throughout the day before disclosing their holdings at day’s end.

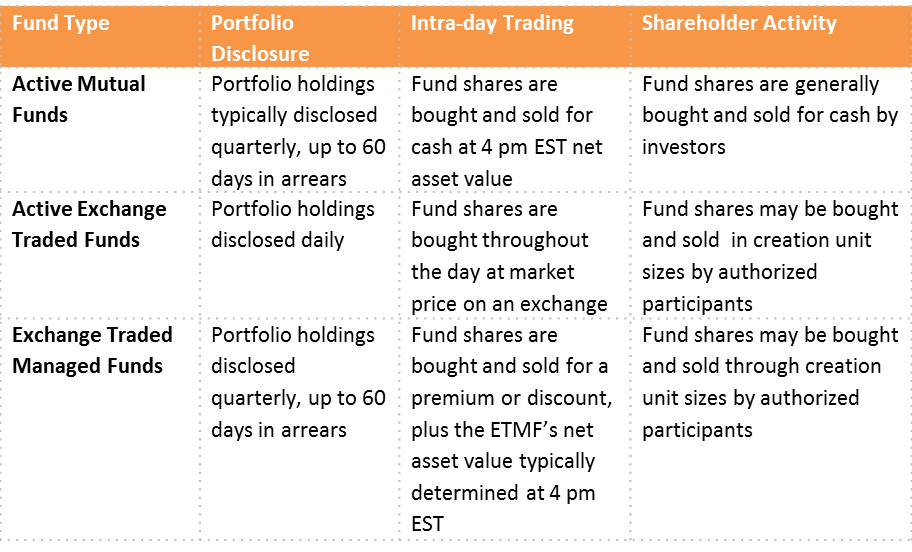

Because these funds deviate only slightly from traditional indexing ETFs, they may be more palatable to the SEC. Unlike traditional mutual funds, which only disclose their holdings a few times a year, ETFs disclose their holdings and net asset value every 15 seconds to facilitate ongoing trading. As a result, actively managed ETFs’ will be challenged to balance their need for portfolio transparency against their managers’ desire to make effective active trading decisions.

Pros and cons

In theory, actively managed ETFs could have some important advantages over similar mutual funds. Exchange-traded funds typically have lower expense ratios than open-ended mutual funds, though that advantage probably won’t be so pronounced in actively run ETFs. In addition, ETFs can be more tax-efficient than traditional mutual funds; they don’t have to meet ongoing shareholder redemptions, so they don’t distribute capital gains. Proponents of actively managed ETFs simply see them as the next logical step in investing evolution — a fund combining ETFs’ trading flexibility with an investment professional’s stock-picking expertise.

However, actively managed ETFs will likely face several problems. There’s a chance that the underlying value of the fund’s holdings will differ from its trading price. This disparity may create arbitrage opportunities for eagle-eyed traders, harming ETF-holders. Pricing disparity isn’t a concern with traditional index-based ETFs, given the ongoing transparency of their holdings. But actively managed ETFs will make less frequent holding disclosures, increasing the likelihood of pricing discrepancies.

However, even that more limited transparency may discourage many investment managers from running active ETFs. If investors can regularly see what stocks active ETF managers are buying, they may simply mirror those strategies and buy the same stocks on their own. These front-runners can mooch off the manager’s expertise without paying any of the ETF’s expenses.

New and improved?

It’s too soon to tell whether actively managed ETFs are the investing world’s next big thing. Even if all the regulatory hurdles are met, other pitfalls remain. As actively managed ETFs proliferate, their average expense ratio may similarly expand. That’s already happening with traditional ETFs, eroding their cost advantage against similar mutual funds. For now, big ETF players such as Barclays ( NYSE: BCS ) and State Street ( NYSE: STT ) are sitting tight — but don’t be surprised if they offer their own active ETFs in the future.

In practice, the majority of traditional mutual funds don’t even beat the market. Investors are often better off with an index fund. If most funds lag the market, most actively managed ETFs probably will, too. A new package doesn’t necessarily change the underlying product.

It’s all but certain that the industry will embrace actively managed exchange-traded funds. Fools should steer clear of the initial mad rush into this new fund flavor. Take some time and see how active ETFs shake out before you buy into the hype.

More actively managed Foolishness:

ETFs? Traditional mutual funds? Discover which investments will make the most money for you, with a free 30-day trial to the Fool’s Champion Funds newsletter.

Fool contributor Amanda Kish lives in Rochester, N.Y. and does not own shares of any of the companies or funds mentioned herein. The Fool’s disclosure policy looks great in a tracksuit.