Active Versus Passive Management In High Yield Bond Funds

Post on: 7 Апрель, 2015 No Comment

There is broad academic literature on the subject of active management versus passive management in equities. Over long time intervals, it has been shown that the fees charged by active fund managers rarely justify the excess return, or alpha, generated by these managers. As a wider array of index offerings emerges for speculative grade corporate bond investments, it is prudent to examine whether this fee-adjusted underperformance holds for bond investments as well.

Launched in late 2007, the SPDR Barclays High Yield Bond ETF (NYSEARCA:JNK ) uses a passive management strategy designed to track the total return performance of the Barclays (nee Lehman) High Yield Very Liquid Index. With roughly 4.5 million shares trading daily, this high yield bond index fund has itself become more liquid than the benchmark sized underlying bond issues in its moniker. With a comparatively low expense ratio of 0.4%, evaluating this fund against other un-leveraged high yield closed end funds becomes an important exercise.

To form a comparison universe, I headed to the Closed End Fund Association website. To best test the hypothesis regarding relative performance of active management, I chose to examine only un-leveraged closed end funds since the index is in un-leveraged form. Of the forty-nine closed funds in the high yield corporate bond asset class, forty-three contain leverage, which greatly shrinks the dataset, but excluding leveraged fund provides for more like comparisons. I further excluded three newer funds, which did not have enough of a history to compare against the Barclays index. These exclusions left me with three funds from the same family: Western Asset Managed High Income Fund (NYSE:MHY ), Western Asset High Income Opportunity Fund (NYSE:HIO ), and Western Asset High Income Fund (NYSE:HIF ).

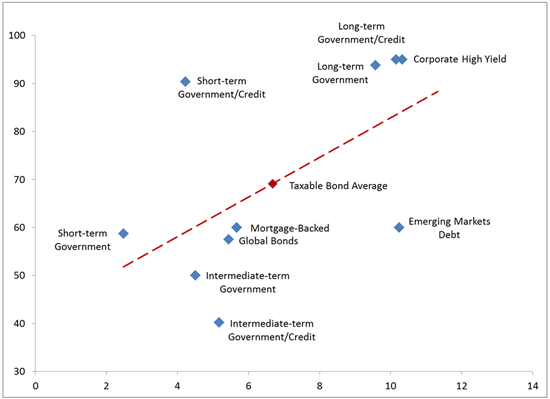

Examining the market returns of these funds against the returns of the Barclays High Yield Very Liquid Index from 2000 through current showed that the active management outperformed on a risk-adjusted basis.

click to enlarge

JNK* returns are for the Barclays High Yield Very Liquid Index

However, stripping out the effect of the current market premium, two of the funds underperformed based on net asset value returns. The third fund, HIF, outperformed in the sample period on the back of its outperformance in the depths of the last credit cycle in 2001-2002.

The reason for the difference between market return and net asset value returns is borne out of the change in the fund premium over time. MHY traded at a -2.7% average discount to net asset value over the trailing ten years, but now trades at a nearly 6% premium. HIO traded at a -4.4% average discount over the trailing ten years, but now trades at a 2.6% premium. The change in this relationship has driven market outperformance even though the net asset value returns have underperformed the index. Given the pro-cyclicality of closed end discounts, expect these funds to underperform the index and its replicating fund JNK when the high yield bond market underperforms.

The takeaway from this article should not be focused on these three closed-end funds, but the broader active versus passive debate. As one can see by the stark resemblance of their return profiles, MHY and HIO have a correlation coefficient with the Barclays U.S. High Yield Index of greater than 0.98. Their expense ratios of 0.92% and 0.89% are significantly higher than JNK’s 0.4%. As high yield credit spreads tighten, this fifty basis points paid to the manager will weigh more heavily.

Investors should not be willing to pay a premium to net asset value and the higher expense ratio to own any of these actively managed funds given their relative cost and high correlation with the index. Unless the fund is going to deliver significant alpha as HIF did in 2001-2002, buyers of the lower cost index fund will outperform on a net basis in future periods.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.