Active Shares

Post on: 8 Апрель, 2015 No Comment

It’s one of the oldest debates in the investment world — active management vs. passive management. Can active managers consistently beat the market, or would investors be better off sticking to an index fund? The debate often boils down to investors’ personal preferences. But some new research shows that more actively managed funds may have a better chance of beating their benchmarks.

Staying active

A new study by two Yale finance professors focuses on the concept of active share — the percentage of fund holdings that differs from holdings in the benchmark. For example, if a fund has 100 equal-sized holdings, and 60 of them are different from benchmark holdings, then the fund has an active share of 60%. Active share also takes into account the differing position sizes between a fund and its index. If a stock represents a 3% weighting in the index, and a fund holds a 4.5% position in the stock, the fund has a 1.5% active long position in that particular stock. All of the various long and short positions are added to arrive at the overall active share.

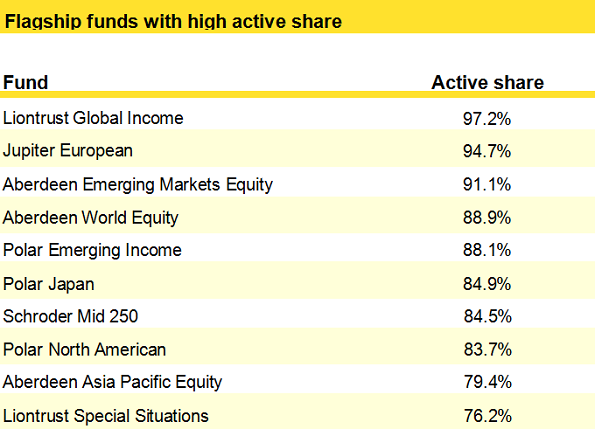

The researchers found that those funds with active share figures in the top 20% beat their benchmarks by roughly 1.4% on an annual basis from 1990 to 2003. However, those funds whose active share amounts ranked in the bottom 20% lagged their benchmarks by 1.4% during that time. The study concluded that active share is a good indicator of a fund’s ability to outperform its benchmark.

Beyond active share

So does this mean you should run out and look for a fund with the highest active share? Not necessarily. Despite the study’s findings, a high active share doesn’t guarantee great performance. In fact, if you think about it, it makes perfect sense that those funds that deviate the most from the benchmark have the greatest chance of beating it. How else can you beat the benchmark, if not by owning different stocks?

But it also follows that managers who deviate from the benchmark also have an equal chance of getting their picks wrong, and underperforming. While active share may be one useful tool in identifying decent funds, you should still focus most of your energy on finding funds with a consistent investment process, a management team with a long tenure, and a strong track record.

Exposing the imitators

At any rate, it’s likely that this concept of active share will become more widely used. In fact, Morningstar is considering adding active share measures into its fund data sometime this year. If it does, this information could become much more widely available to help investors find funds. It could also aid them in avoiding closet indexers, funds that resemble their benchmarks a bit too closely. These funds are sneaky, because they tend to charge investors the higher fees associated with active management, but provide only index-caliber performance. If this is the case, an investor would be better off moving either to a more actively managed fund, or to an actual index fund that charges a substantially lower fee.

The debate continues

The debate between passive and active investing will likely continue for some time. While active share may hold some promise for determining which funds are most likely to outperform, it won’t be a perfect measure. Ultimately, if you’re comfortable earning a market rate of return, and you don’t want to pay through the nose to get it, a broad-market index fund or an exchange-traded fund may be right for you.

But if you want a manager who can take advantage of changing market conditions instead of merely replicating an index, an actively managed fund is probably a better fit. For example, if you think growth stocks are cheap right now and poised to go higher, a growth-oriented mutual fund like Fidelity Capital Appreciation ( FUND: FDCAX ) will put you into companies like Monsanto ( NYSE: MON ) , First Data ( NYSE: FDC ) , Elan ( NYSE: ELN ). and Deere ( NYSE: DE ). Owning a fund that invests in these stocks will allow you to capitalize on the coming rebound in growth stocks.

No matter which type of fund you choose, make sure you do your research before buying, and keep an eye on the fund once it’s in your portfolio. Now that ‘s an active approach to investing that everyone can get behind.

For related articles:

Fidelity Capital Appreciation is a Champion Funds newsletter recommendation. Whether you’re a fan of actively managed funds or index funds, find out which investments deserve a place in your portfolio. Check out Champion Funds with your free 30-day trial today.

Fool contributor Amanda Kish lives in Rochester, N.Y. and does not own shares of any of the companies or funds mentioned herein. The Fool’s disclosure policy likes to stay active.