Active Share Measures Active Management

Post on: 8 Апрель, 2015 No Comment

How much active management is being done by your mutual fund manager? A new measure called Active Share may give you the answer.

In financial literature, there are numerous citations of studies showing that the average mutual fund manager underperforms his or her benchmark index after fees. However, research presented in 2006 by Martijn Cremers and Antti Petajisto of the Yale School of Management introduced Active Share, a new method of determining the extent of active management being employed by mutual fund managers and a tool for finding those that do outperform. (For more insight, read Words From The Wise On Active Management .)

The Research

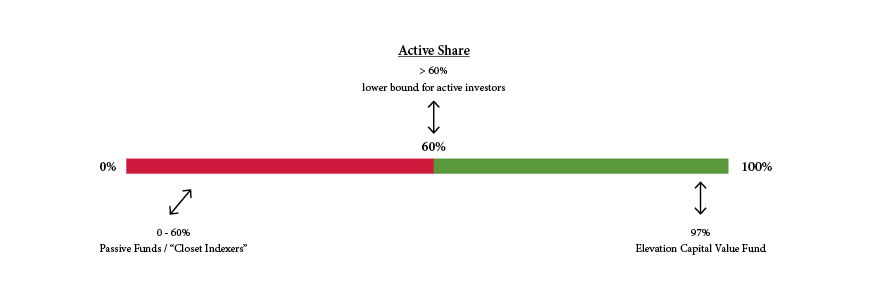

Active Share is a measure of the percentage of stock holdings in a manager’s portfolio that differ from the benchmark index. The researchers conclude that managers with high Active Share outperform their benchmark indexes and that Active Share significantly predicts fund performance.

Examining 2,650 funds from 1980 to 2003, Cremers and Petajisto found that the highest ranking active funds, those with an Active Share of 80% or higher, beat their benchmark indexes by 2-2.71% before fees and by 1.49-1.59% after fees.

Active Share is also useful in identifying closet indexers, or managers who claim to be active but whose portfolios are very similar to the benchmark portfolio. Identifying closet indexers is extremely important because active management fees can be a significant hurdle to outperforming the index for anyone holding a portfolio similar to its benchmark. (To learn more, check out Benchmark Your Returns With Indexes .)

This change is not all explained by the growth in index funds. In 1980, there were very few non-index funds with Active Share of less than 60%. In 2003, funds with Active Share below 60% had risen to 20% of funds and 30% of assets under management. The authors also found that Active Share and excess performance is higher among funds with fewer assets under management.

Measuring Activity

The traditional measurement of the extent of active management employed by a mutual fund relies on methods that compare a fund’s historical returns to those of its benchmark index. One such method, tracking error volatility, measures the standard deviation of the difference in a manager’s returns versus the index returns.

High tracking error volatility indicates a high degree of active management. The logic behind the measurement is that the makeup of the individual stocks in the portfolio will be reflected in the pattern of the returns. If the returns of the portfolio deviate from the index returns significantly through time, the makeup of the portfolio must be significantly different from the index.

While tracking error volatility makes sense and is easy to calculate, it only infers what the manager is doing in the portfolio and does not actually look at the underlying holdings.

In contrast, Active Share is found by analyzing the actual holdings of a manager’s portfolio and comparing those holdings to its benchmark index. By measuring active management in this way, investors can get a clearer understanding of what exactly a manager is doing to drive performance, rather than drawing conclusions from observed returns.

Calculating Activity

Active Share is calculated by taking the sum of the absolute value of the differences of the weight of each holding in the manager’s portfolio versus the weight of each holding in the benchmark index and dividing by two.

The Active Share number in this example is essentially saying that 50% of the manager’s portfolio differs from the benchmark index.

While the information related to Active Share may be enticing, the results are of little use unless they are persistent. Cremers and Petajisto find significant persistence in high Active Share managers’ abilities to continue to deliver excess returns relative to a benchmark index.

Difficulties