Absolute Commodity Index

Post on: 18 Июнь, 2015 No Comment

You are here: Home Indexes Specialty asset class Commodity

Absolute Commodity Index

The objective of PCM’s Absolute Index Strategy is to achieve total returns with little or no correlation to equities and bonds. The Index will achieve its objective by choosing from a basket of pre-selected commodity ETFs including agricultural crops, livestock, precious metals, oil, and natural gas. Quantitative risk management screens use short term U.S. Treasuries or an allocation to cash to reduce drawdown in lieu of inverse ETFs. The Index may rotate bi-monthly. Prior to January 1, 2012, the Direxion Commodity Trends Strategy Mutual Fund was used.

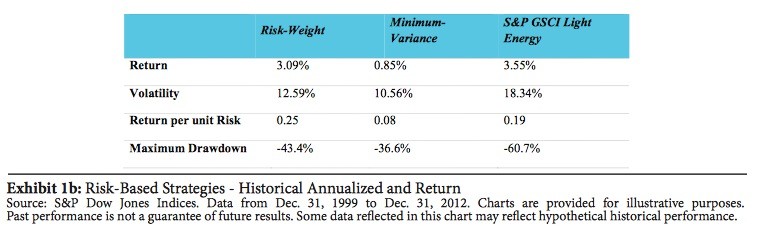

Performance & Statistics

Disclosures

- PCM Absolute Indexes represent model and hypothetical performance prior to April 2011 and actual model performance going forward to current date . One cannot invest directly in this index. One can only invest in accounts that attempt to track the holdings and results of the index. There is no guarantee that any client will achieve performance similar to, or better than, an index mentioned herein.

- Disclosure: Provident Capital Management Inc. Absolute Index sm

- Provident Capital Management, Inc. owns and actively manages quantitative indexes that have a total-return approach. The indexes are rotated bi-weekly, monthly or quarterly depending on the index. Periodic adjustments to structure or strategy may be made from time to time at the discretion of Provident Capital’s Investment Committee.

- Third-party investment professionals, including, but not limited to registered investment advisors and broker/dealers, may make available separately managed accounts (SMAs) that attempt to track our indexes. Provident Capital Management, Inc. may attempt to track the index, but will operate in full discretion as the implementation of index in client accounts. Difference in holdings and percentage of holdings between actual accounts and the index may occur. PCM’s Absolute Index selection uses an approach selecting the ETFs based upon a multi-factor quantitative approach.

- There are three primary types of actively managed indexes developed and managed by PCM:

- Macro: Broad based equities, fixed income, currencies and commodities. Tactical: Equities and fixed income specific to countries, sectors and certain commodity ETFs. Asset Class Specific: Such as Absolute Metals Index, Absolute Energy Index or Absolute Currency Index.

- Disclosure Provident Capital Management, Inc. Absolute Indexes sm PCM’s index performance may reflect the reinvestment of dividends. Performance does not include management custodial or trading fees. Investment products that may be based on Provident Capital Management’s Absolute Indexes are not necessarily sponsored by Provident Capital Management, Inc. and Provident Capital Management or any affiliate, advisor or representative does not make any representation regarding the advisability of investing in them. Indexes have an inception date of January 1, 2003 unless otherwise noted in this document. The closing price on the last trading day of the period is the buy and sell price. Inclusion of a mutual fund or exchange traded fund in an index does not in any way reflect an opinion of Provident Capital Management regarding the investment merits of such a fund. None of the funds included in the index have given any real or implied endorsement or support to Provident Capital Management or to any index owned or operated by Provident Capital Management. Provident Capital Management reports index results to Morningstar. January, 2 2012 Provident Capital Management switched from monthly reporting of index data to Morningstar to daily reporting of the calculated index value based upon the closing price of the underlying index holdings through an electric submission process. As this is an actively managed index Provident Capital Management may add or remove ETF candidates for any reason including but not limited to volume, liquidity and ETF issuer related events. Provident Capital Management’s Absolute Index Approach Absolute Indexes typically include one or more ETFs that are inverse to the long positions. The inverse ETFs must meet the same criteria as the long ETFs to be included in the active index. Should the ETF(s) not meet the inclusion criteria then the percent allocated to the non-investable ETF will rotate into cash or a cash equivalent ETF. As the index selects a number of ETFs based upon the quantitative criteria for the index, and if the respective Index includes an inverse ETF, it is possible that the index may be simultaneously in a long position and an inverse position in the same asset class or even similar ETF. One cannot invest directly in an index. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. One of the limitations of hypothetical model performance results is that they are prepared with the benefit of hindsight. There are numerous other factors related to the markets in general or to the implementation of any specific trading or investment strategy which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. Not all ETFs that are current candidates for the Absolute Index were available during the timeframe reported. Provident Capital’s Investment Committee makes every attempt to stay current with the availability of ETFs or other investments that may meet the standards of liquidity and transparency to be included as a candidate in any of the indexes. Results shown are for the index strategy, not actual performance in any Provident Capital accounts. Returns shown are not indicative of actual performance for any client account. Although data shown is gathered from sources believed to be reliable, Provident Capital Management, Inc. cannot guarantee completeness and/or accuracy. Investment portfolios illustrated in this report can be scheduled or unscheduled. With an unscheduled portfolio, the user inputs only the portfolio holdings and their current allocations. Provident Capital Management calculates returns using the given allocations assuming monthly rebalancing. Taxes, loads, and sales charges are not taken into account. With scheduled portfolios, users input the date and amount for all investments into and withdrawals from each holding, as well as tax rates, loads, and other factors that would have affected portfolio performance. A hypothetical illustration is one type of scheduled portfolio. Both scheduled and unscheduled portfolios are theoretical, for illustrative purposes only, and are not reflective of an investor’s actual experience. For both scheduled and unscheduled portfolios, the performance data given represents past performance and should not be considered indicative of future results. Principal value and investment return of stocks, mutual funds and ETFs products will fluctuate, and an investor’s shares/units when redeemed will be worth more or less than the original investment. Stocks, mutual funds, and ETFs are not FDIC-insured, may lose value, and are not guaranteed by a bank or other financial institution. Portfolio statistics change over time. Inclusion of a mutual fund or an exchange traded fund in a Provident Capital index does not in any way reflect an opinion of Provident Capital Management, its Directors, Officers or employees regarding the investment merits of such a fund, nor should it be interpreted as an offer to buy or sell such fund’s securities. None of the mutual funds or exchange traded funds included in an index has given any real or implied endorsement or support to Provident Capital or to this index. Used as supplemental sales literature, the index or portfolio reports must be preceded or accompanied by the current disclosure. The underlying holdings of the portfolio are not federally or FDIC-insured and are not deposits or obligations of, or guaranteed by, any financial institution. Investment in securities involve investment risks including possible loss of principal and fluctuation in value. The information contained in this report is from the most recent information available to Provident Capital Management and Morningstar as of the release date, and may or may not be an accurate reflection of the current composition of the securities included in the portfolio. There is no assurance that the weightings, composition and ratios will remain the same. Benchmark Returns and Non-Provident Capital Management Indexes Benchmark returns may or may not be adjusted to reflect ongoing expenses such as sales charges. An investment’s portfolio may differ significantly from the securities in the benchmark. Standard & Poor’s 500 Index (Total Return) (“S&P 500”) is a broad-based unmanaged index of 500 stocks, which is widely recognized as a representative of the equity market in general. The MSCI All Country World Excluding US Index (Net Return) (“MSCI ACWI Ex-US”) is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed (except for the U.S.) and emerging markets. The Barclays Capital Aggregate Bond Index (Total Return) (“BarCap Aggregate Bond”) is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed- rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS. SPDR Gold Trust ETF (GLD, objective is for the Shares to reflect the performance of the price of gold bullion, less the Trust’s expenses. iShares S&P GSCI Commodity-Indexed ETF (GSG), seeks to track the S&P GSCI Total Return Index, comprised of energy, industrial & precious metals, agricultural, and livestock commodities exposures. Vanguard MSCI Emerging Markets ETF (VWO), invests in stocks of companies located in emerging markets around the world, such as China, Brazil, Taiwan, and South Africa. The Goal of VWO is to closely track the return of the FTSE Emerging Index. Trade Weighted U.S. Dollar Index: Major Currencies (TWEXMMTH): A weighted average of the foreign exchange value of the U.S. dollar against a subset of the broad index currencies that circulate widely outside the country of issue. Major currency index includes the Euro Area, Canada, Japan, United Kingdom, Switzerland, Australia, and Sweden. Source is the U.S. Federal Reserve. The Portfolio 60/40 Benchmark is a blend of the S&P 500 Index (60%) and the The Barclays Capital Aggregate Bond Index (40%). Provident Capital uses this benchmark to reflect the allocations used in the model portfolio at the time of rebalancing, incorporating a widely-recognized benchmark for each asset class. Dow Jones Moderate Portfolio Index A benchmark designed for asset allocation strategists who are willing to take 60% of the risk of the global securities market. It is a total returns index that is a time-varying weighted average of stocks, bonds, and cash The DJModPI is the efficient allocation of stocks, bonds, and cash in a portfolio whose semideviation is 60% of the annualized 36 month historic semideviation of the Dow Jones Aggressive Portfolio Index (DJAggPI). Stocks are represented by the DJAggPI. Bonds are represented by an equal weighting of the following four bond indexes with monthly rebalancing: Barclays Government Bonds Index, Barclays Corporate Bonds Index, Barclays Mortgage-backed Bonds Index, and Barclays Majors (ex U.S.) Bonds Index. Cash is represented by the 91-Day T-Bill Auction Average. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Any projections, market outlooks or estimates in this presentation are forward-looking statements and are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Provident may change the exposures and index compositions reflected herein at any time and in any manner in response to market conditions or other factors without prior notice to investors. None of the indexes referred to herein reflect the deduction of the fees and expenses to be borne by a client, whose separately managed account may trade and invest in different financial instruments than those in a particular index. Concentration, volatility and other risk characteristics of a client’s account also may differ from the indexes shown herein. Each of the above indexes is included merely to show general trends in the market during the periods indicated. Inclusion of these indexes is provided only for reference purposes and is not intended to imply that any Provident Capital Management index was comparable to any index in either composition or element of risk. There is no guarantee that any client will achieve performance similar to, or better than, an index mentioned herein. Disclosure for Standardized and Tax Adjusted Returns The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate thus an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than return data quoted herein. An investment in the fund is not insured or guaranteed by the FDIC or any other government agency. The current yield quotation more closely reflects the current earnings of the money market fund than the total return quotation. Although the fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the fund. Standardized Returns assume reinvestment of dividends and capital gains. It depicts performance without adjusting for the effects of taxation, but are adjusted to reflect sales charges and ongoing fund expenses. If adjusted for taxation, the performance quoted would be significantly reduced. After-tax returns are calculated using the highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after tax returns depend on the investor’s tax situation and may differ from those shown. The after tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as 401(k) plans or an IRA. After-tax returns exclude the effects of either the alternative minimum tax or phase-out of certain tax credits. Any taxes due are as of the time the distributions are made, and the taxable amount and tax character of each distribution is as specified by the fund on the dividend declaration date. Due to foreign tax credits or realized capital losses, after-tax returns may be greater than before tax returns. After-tax returns for exchange-traded funds are based on net asset value.