About the disturbing disconnect between markets and the real economy

Post on: 16 Март, 2015 No Comment

Summary: Today we have a guest post about the often discussed but still mysterious disconnect between the US risk markets and the US economy between Wall Street and Main Street. Since the crash, economists and investment strategists have confidently predicted it will close soon, certainly when the economy accelerated back to near normal speed. So far neither has happened. Todays guest post by Lance Roberts examines this important phenomenon.

Markets Vs Economy The Great Disconnect

From StreetTalk By Lance Roberts

23 February 2015

Posted with his generous permission.

Since Jan 1st of 2009, through the end of 2014, the stock market has risen by an astounding 148.8% (based on Fed Reserve quarterly data). With such a large gain in the financial markets we should see a commensurate indication of economic growth.

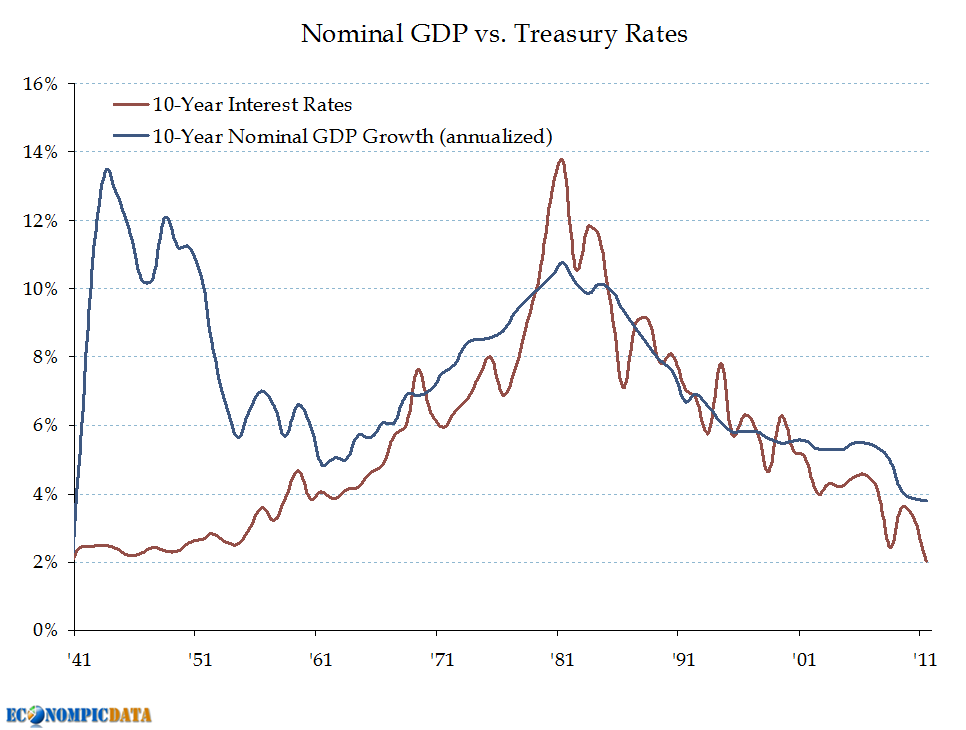

The reality is that after three massive Q.E. programs, a maturity extension program, bailouts of TARP, TGLP, TGLF, etc. HAMP, HARP, direct bailouts of Bear Stearns, AIG, GM, bank supports, etc. all of which total to more than $33 Trillion and counting, the economy has grown by a whopping $1.9 trillion since the beginning of 2009. This equates to just 13.5% growth in real GDP during the same period that the market surged by more than 100%.

However, as shown in the chart above, the Feds monetary programs have inflated the reserve balances of member banks by roughly 403% during the same period. The increases in reserve balances, which the banks can borrow for effectively zero, have been funneled directly into risky assets in order to create returns. This is why there is such a high correlation, roughly 85%, between the increase in the Feds balance sheet and the return of the stock market over that period.

Unfortunately, while Wall Street benefits greatly from repeated Federal Reserve interventions Main Street has not. Over the past few years, while asset prices surged higher, personal consumption expenditures have remained mired at levels typically associated with very weak economic expansions. This is reflective of continued weak income growth which has been a function of a large amount of slack in the labor force.

As an example the last two reports on economic growth have shown that more than large portion of the increase came from surges in healthcare-related spending. The problem is that higher healthcare costs reduce the discretionary spending capabilities of individuals and is one reason why retail sales has remained stagnant despite the drop in gasoline prices.

Of course, weak economic growth has led to employment growth that is primarily a function of population growth. Sustained levels of unemployment have reduced the standard of living for many Americans forcing them to turn to social support programs. Food stamp usage and disability claims have risen sharply since 2009 and currently remain near record levels. The chart below shows the percentage of real disposable incomes that are comprised by social benefits.

It is extremely hard to create stronger, organic, economic growth when the dependency on recycled tax-dollars to meet living requirements remains so high.

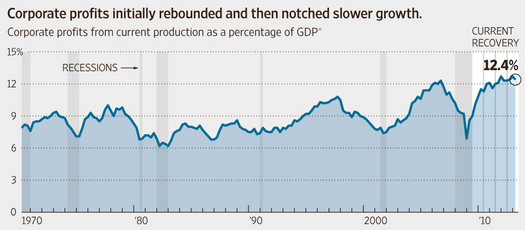

Corporate profits have surged since the end of the last recession which has been touted as a definitive reason for higher stock prices. While I cannot argue the logic behind this case, as earnings per share are an important driver of markets over time, it is important to understand that the increase in profitability has not come due to strong increases in actual revenue. As the chart below shows while earnings per share has risen by over 250% since the beginning of 2009 revenues have grown by less than 33%.

As expected, since the economy is 70% driven by personal consumption, and the companies that make up the stock market are a reflection of actual economic activity, it is not surprising that both GDP growth and revenues remained sluggish. Therefore, the question as to where corporate profitability came from must be answered? That answer can be clearly seen in the chart below of corporate profits per worker which is at the highest level in history (data through Q3 of 2014).

Click to enlarge.

Suppressed wage growth, layoffs, cost-cutting, productivity increases, accounting gimmickry and stock buybacks have been the primary factors in surging profitability . However, these actions are finite in nature and inevitably it will come down to topline revenue growth. However, since consumer incomes have been cannibalized by suppressed wages and interest rates there is nowhere left to generate further sales gains from in excess of population growth.

So, while the markets have surged to all-time highs, the majority of Americans who have little, or no, vested interest in the financial markets have a markedly different view. Currently, mainstream analysts and economists keep hoping with each passing year that this will be the year the economy comes roaring back but each passing year has only led to disappointment. Like Humpty Dumpty, all the Fed stimulus and government support has failed to put the broken financial transmission system back together again.

Eventually, the current disconnect between the economy and the markets will merge. My bet is that such a convergence is not likely to be a pleasant one.

-

About the author

Lance Roberts is the General Partner and Chief Portfolio Strategist for STA Wealth Management. He has over 25 years experience in the investment business, from private banking and investment management to private and venture capital.

Lance’s investment strategies and knowledge have been featured on CNBC, Fox Business News, Business News Network and Fox News. He has been quoted by a litany of publications from the Wall Street Journal, Reuters, Bloomberg, The New York Times, and The Washington Post. His writings and research have also been featured on several of the nations biggest financial websites such as the Pragmatic Capitalist, Credit Writedowns, The Daily Beast, Zero Hedge and Seeking Alpha.

He is also the host of Street Talk with Lance Roberts, Chief Editor of The X-Factor Investment Newsletter and the Streettalklive daily blog. Follow Lance on Facebook. Twitter and Linked-In

For More Information

Articles about our odd markets:

- “Stock market bubble warnings grow louder “, CNN, 19 August 2014 — “Some of the brightest minds in finance are sounding the alarm about a stock market bubble.”

- “US equity markets in ‘dotcom style’ bubble “, The Telegraph. 28 November 2014 — “The UK’s top professional investors think most asset classes are overvalued after years of easy money conditions.”

- “

Says Tesla’s China Sales Fell, No Profit Until 2020 “, Bloomberg, 13 January 2015 — My personal favorite bubble stock. - “The billion-dollar companies Silicon Valley investors ought to fear “, Financial Times. 20 February 2015 — “Late-stage private companies have not endured the scrutiny of the IPO process.”

Posts about our bubbles: