About Fixed Income Mutual Funds

Post on: 26 Апрель, 2015 No Comment

Function

Fixed income mutual funds are used to provide broad exposure to bonds without your having to purchase the bonds themselves. Many investors use such funds to provide diversification from stocks, or to provide current income.

Benefits

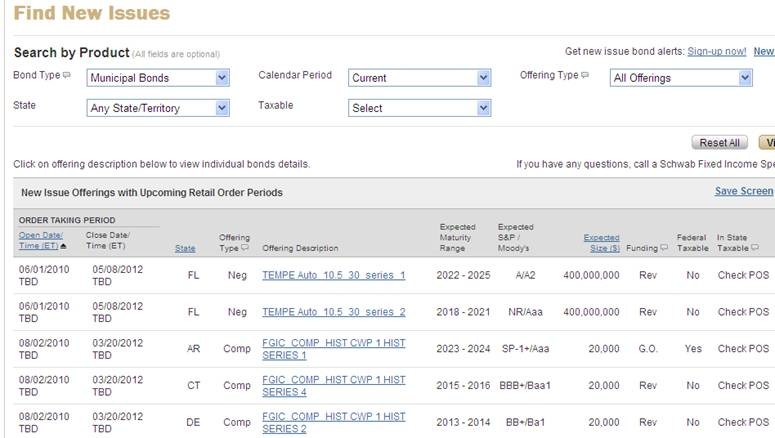

Investing in bonds tends to be a bit more involved than investing in stocks, primarily because the bond market is very different. Retail-level investors generally rely on a brokerage bond desk to make trades. By using a fixed income mutual fund, investors can get an investment in bonds without having to buy the bonds directly.

Considerations

Over long periods of time, bonds tend to have a lower return than stock-based investments. Thus, a large allocation to fixed income funds is better suited to investors with closer-term goals. Additionally, the interest paid by many bonds is fully taxable as ordinary income. Make sure your tax situation makes sense with your fixed-income investments.

Warning

Fixed income mutual funds need only invest in bonds to earn the name. However, there are many kinds of bonds that are risky. Do not assume that an investment in a bond fund means additional safety without investigating the individual fund.

Types

Resources

More Like This

What Are High-Yield CDs?

You May Also Like

For regular income, diversification and liquidity, fixed-income funds fit the bill. These mutual funds typically invest in mortgages, bonds or both. Primary.

Growth & Income Mutual Fund; Fixed Income Funds; X. Must See: Slide Shows. Fixed Income Funds. Fixed Income Funds There are two.

Fixed-income mutual funds invest in securities ranging from no-risk investments such as certificates of deposit (CDs) and Treasury securities to below-investment.

In the search for safety and returns, some investors turn to either a money market mutual fund or a fixed income fund.

A security's yield is the amount of income that individual security generates. Income is different than capital gains. The dollar amount of.

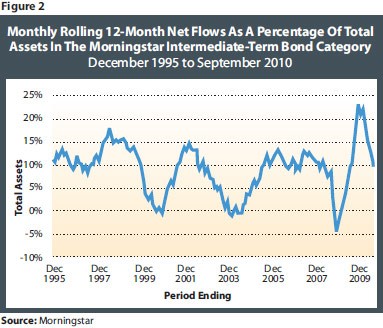

The most common structure for income funds is as open-end mutual funds. The Investment Company Institute counted 1,869 taxable and tax-free mutual.

Mutual funds that guarantee interest are called fixed-income funds, or simply income funds. Fixed-income funds invest in bonds and other securities that.

Fixed income investments are securities that pay. The main reason to invest in corporate bonds is current income and. Copyright.

A laddered bond strategy or buying a fixed income mutual fund allows more liquidity and diversification.

A cash flow analysis provides baseline figures of the funds available for retirement before and during your retirement years. not just.

An annuity is a financial product offered by an insurance company that is designed to provide income for retirement. Annuities can provide.