AAII bullish sentiment reading

Post on: 16 Март, 2015 No Comment

Blame Chinas slowing growth. Blame the Fed. Blame the currency crisis in Argentina. It doesnt matter.

Investors are kicking off the New Year by panicking sending stocks down for three consecutive weeks. A mere month into 2014, and the S&P 500 Index is already down almost 4%.

At this point, you might be considering joining in the stampede for the exits. But dont even think about it!

Ever the contrarian, you know that I pay close attention to investor sentiment and look to do the opposite.

If you think thats a stupid mentality, take it up with Mr. Buffett. Hes the one who hardwired my brain to get greedy when others are fearful and fearful when others are greedy.

And as youll see in a moment, we could be on the cusp of an unmistakable call to action

Theres No Wisdom in Crowds

The masses are fair weather investors, in the words of Bespoke Investment Group. When the market rallies, they have been slow to embrace the advance. At even a hint of trouble, however, they rush for the exits.

And thats exactly whats happening right now

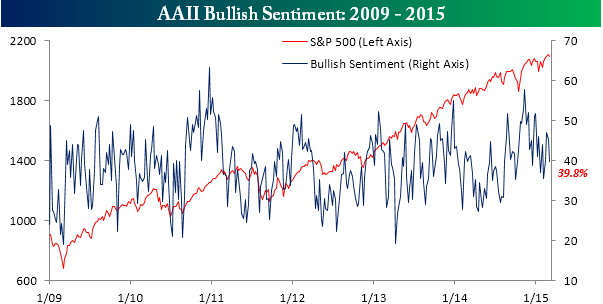

For four straight weeks, the American Association of Individual Investors (AAII) bullish sentiment reading has been plummeting (faster than the temperature in most parts of the country).

Last week, the AAII bullish sentiment reading fell to 32.18%. Thats nearly 23 points below the December peak of 55.06%.

Whats more, for the first time since August 2013, bearish sentiment rose above bullish sentiment to 32.76%.

Clearly, attitudes towards stocks are changing for the worse. Ironically, thats good news for us.

As Ive shared before, whenever bullish sentiment drops below 25%, stocks (almost) always rally.

Over the ensuing three months, they climb 6% higher on average. Then over the next six months, the gains reach almost 16% on average.

I cant think of a more obvious and reliable Buy signal over the last five years. If you can, let me know here .

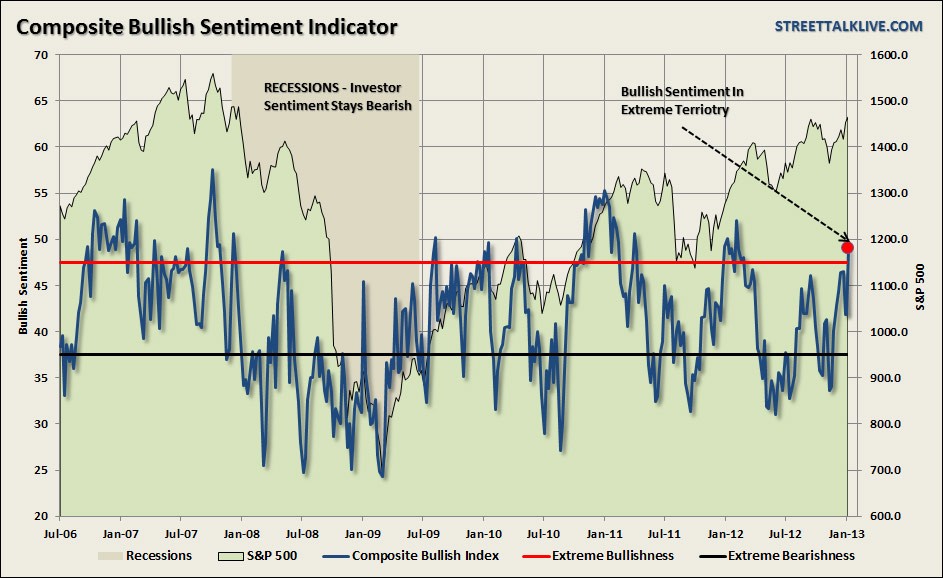

For those of you who want to discount the data because it only takes into account the current bull market, chew on this:

Since 1987, when bullish sentiment dropped below 19%, which is equal to a full two standard deviations below the long-term average, stocks rallied over the next six months 100% of the time.

In other words, the short-term and long-term data justifies our contrarian approach to investor sentiment readings.

Turning Back Time on Valuations

As it stands now, were a mere 7.18 points away from the critical 25% threshold being triggered.

Now, its not uncommon for sentiment readings to change by double digits in a single week. So come Thursday, when the next reading is released, we could get all the confirmation we need to start getting greedy. (Based on past examples, you could almost call it a mathematical certainty that stocks will blast higher if sentiment drops enough.)

Plus, its important to keep in mind that stocks represent much more of a bargain than they did six weeks ago.

After peaking near 17.5 times trailing earnings in December 2013, the S&P 500 Index is now trading for 16.5 times earnings. Thats almost 6% lower.

Whats more, its uncommon for bull markets to end at such reasonable valuations.

Bottom line: Everyone likes to call himself or herself a contrarian. However, its statistically impossible for everyone to claim the title.

As early as this week, you could get an opportunity to prove your true colors. Dont chicken out!