A TopDown Approach To Finding Stock Ideas

Post on: 16 Март, 2015 No Comment

With multiple resources in IBD, investors can go a number of different directions to find top stocks.

Here’s a streamlined, top-down approach to finding stocks using IBD, starting with the market, then the leading sectors and, finally, the best stocks.

Start with The Big Picture, IBD’s daily market analysis. The broad market exerts a huge influence on stocks, particularly growth companies.

In a weak market, few stocks make meaningful progress. Three out of four growth stocks go down, and in some cases suffer brutal sell-offs. It’s a dangerous time to own shares.

The Big Picture breaks down the market’s message, not the opinions of countless pundits. The Market Pulse alongside each column gives the current market outlook.

If you’re satisfied about the state of the market, check the NYSE and Nasdaq Research Tables, which are now divided by broad sectors, the best ones shown first.

Focus your search on the top several sectors, and pay special attention to stocks listed above a dashed line.

These are standout companies with superior fundamentals in their respective sector; they represent the best the market has to offer in terms of financial soundness.

This is an excellent starting point for finding stock ideas.

(Some sectors may not have any such stocks singled out for above-board numbers.)

Check also two tables that run on Page B3 most days: Stocks In Bases and Stocks Just Out Of Bases.

These will point out leading stocks whose charts are in price consolidations, or have recently broken out of bases.

If the Research Tables point you to financially superior stocks, these tables target leading stocks near proper buy points.

Stocks In The News is another source of ideas. The criteria for names making this selective list were recently tightened to better focus on stocks with the greatest potential.

Other sections such as the IBD 100, The New America and the IBD Timesaver Table are good sources too.

With each idea you find, make sure you research it thoroughly.

IBD Ratings will get you a head start. For most leading stocks, you can study a weekly chart in the IBD 100, Your Weekly Review, Big Cap 20 and Stocks In The News.

You can also view daily and weekly charts online at Investors.com.

If you want to look deeper into financials, the IBD Stock Checkup at Investors.com analyzes the company, gauging it against its rivals and the whole market. Be sure to read recent articles on the company.

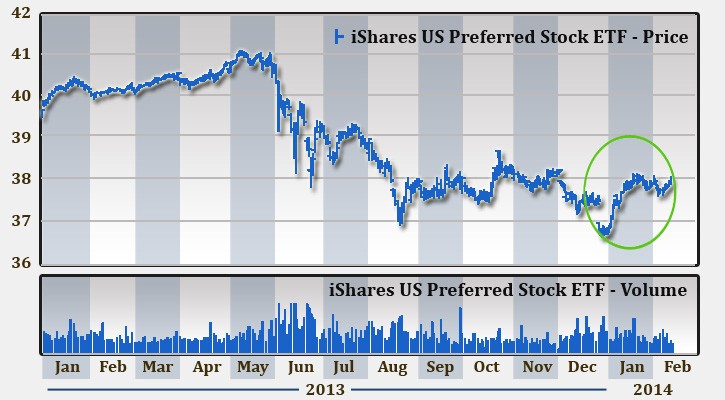

The stock market has mostly struggled since the February launch of the new stock tables. Few stocks have been winners in that time, but IBD resources would have alerted you to those.

The market made a follow-through on March 20, confirming a new uptrend 1 .

With conditions more bullish, you may have noticed at the time that Bucyrus International (BUCY ) was in a top sector (Machinery) and flagged atop the sector’s listings.

Bucyrus was finding support at its 10-week moving average 2. It made a new high April 15 3. rising 36% from there to a June 17 peak.