A tool to narrow fund choices

Post on: 15 Май, 2015 No Comment

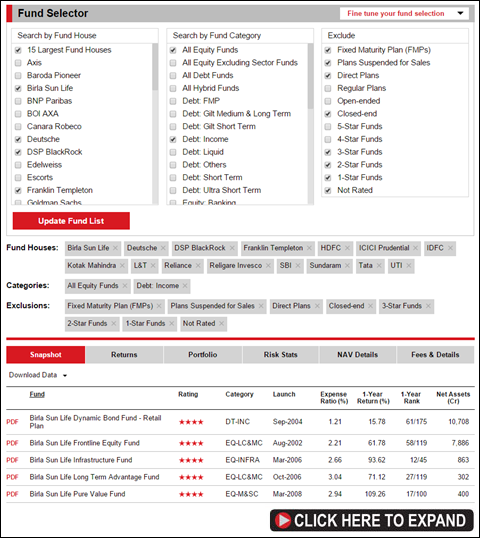

You want to invest in mutual funds, but the sheer variety you are confronted with has you bewildered. Well, if can shell out ₹595, Value Researchs Mutual Fund Yearbook 2015 will be a useful tool in your selection process (its cheaper by ₹100 for the digital version).

A yearly publication from Value Research, the book provides comprehensive details on fund mandates, performance, risk, rankings and so on. The Yearbook scores on the fact that, of the plethora of funds available across categories, only those that have consistently performed well have been selected and presented. Your choices, therefore, are considerably narrowed down.

Fund classification

To start with, the Yearbook breaks up the broad definition of equity, debt, and hybrids into smaller groups. Equity funds are primarily split along the market capitalisation of the stocks the fund invests in. Debt funds are classified on the strategy they follow in portfolio maturity long-term gilts, liquid funds, income funds that blend various maturities, and so on. The aim here is to select funds according to the risks involved, which makes it easier for investors to understand what theyre going in for. A longer duration debt fund, for example, involves higher risk. This classification also allows for more accurate comparison between funds.

A fund that invests purely in blue-chips is safer but will give lower returns than one that adds in a dose of mid-cap stocks, though both will otherwise normally be classified as a large-cap fund.

Fund details

Value Research ranks funds on a five-point scale that takes into account both five-year returns and the risk-return trade-off. Also of good use in the Yearbook is a crisp overview of the fund. Now, details on the funds portfolio and returns will obviously change; it can quickly become dated.

But what can help you are reviews of the funds strategy and the periods of worst and best performance. This latter feature explains how much the fund lost at its low point; comparing this number with its peers and benchmark will tell you how good that fund is at containing downsides, and what level of risk you will be taking. Another useful bit of information is on the funds manager and the period from when he/she began managing the fund. A change in fund manager can impact returns.

However, these fund snapshots for equity, hybrid and some debt schemes are clubbed together depending not on type, but according to what Value Research’s investment style. Therefore, funds are grouped into conservative growth, stable growth, aggressive growth, and so on.

While such a grouping may help decide on the core-satellite portfolio break-up, it becomes cumbersome for investors who are simply looking for, say, a monthly income fund or a large-cap equity fund.

(This article was published on March 8, 2015)