A Smart Way to Include International Stocks in Your Portfolio Total Return

Post on: 16 Март, 2015 No Comment

stocks

Investors seeking global stock exposure must decide how to allocate their money and when to adjust holdings. Here, a man looks at an electronic stock-price indicator in Tokyo this week. Associated Press

Last week, Jason Zweig made a persuasive case for going global . Valuations are indeed attractive, but there is yet another argument to be made in favor of including international stocks in a portfolio. It revolves around both diversification and, in a way, market timing.

The diversification argument is simple. Living in a global economy as we do, I wouldn’t consider limiting my stock buying to only my home state or country, and neither should you. In fact, I’d diversify into interstellar stock markets if I could. The argument that we get enough international exposure by owning U.S. stocks which do business overseas is flawed, and gets me to my second argument, market timing.

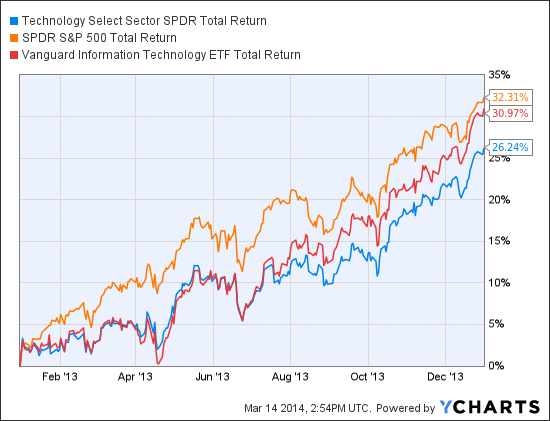

The chart below tracks the total return (with dividends reinvested) of the Vanguard Total Stock Market Index Fund (Admiral shares, ticker symbol VTSAX) and the Vanguard Total International Stock Index Fund (Investor shares, VGTSX) from the end of 2002 through the end of 2013. (The lower-cost Admiral shares of the international-stock fund didn’t exist for the entire period.)

Over this entire period, U.S. stocks slightly bested international.

Wealth Logic analysis of Yahoo Finance data

The chart demonstrates that the correlations are very high: U.S. and international stocks generally move in the same direction.

But correlation isn’t the same as total return. During the five-year period ended Dec. 31, 2007, before the real-estate bubble popped, U.S. stocks doubled, while international stocks tripled. The 14.2% annualized return of U.S. stocks was outpaced by that of international stocks at 24.6% annually.

Then both U.S. and international stocks plunged. In the nearly seven-year period since the end of 2007, U.S. stocks have gained an average 8.8% a year while international stocks declined by 0.9% a year.

So what does this have to do with market timing? Data from Chicago-based investment research firm Morningstar reveals that over the 10-year period ended Dec. 31, 2013, the average international-stock fund earned 8.8% a year, yet the average investor in those funds earned only 5.8%. Investors gave up an annualized three percentage points in return by timing the more volatile international stocks even more poorly than they U.S. stocks, where the performance gap was an annualized 1.7 percentage points.

A much better approach is to set a desired allocation between U.S. and international stocks and then to periodically readjust your holdings back to that plan.

The truth is no one knows whether international stocks will outperform the U.S. next year or even over the next five years. But by accepting the fact that we do live in a global economy and keeping a constant allocation between U.S. and international stocks, one is in a way timing the markets—at least compared with a buy-and-hold strategy. This means lightening up on international relative to the U.S. when it surges and increasing international relative to the U.S. now that it is badly lagging.

In the past, this rebalancing resulted in investor returns greater than the fund returns by buying low and selling high. As long as the human nature to chase performance remains, it’s likely that rebalancing will continue to work in the long run.

For well over a decade, I’ve been recommending that U.S. clients keep a constant mix of two-thirds U.S. and one-third international. When international stocks are surging, I typically get responses like “Why only a third—isn’t growth coming overseas?” When international stocks are lagging, however, it just feels wrong to many people to invest so much.

The folly of this thinking lies with the fact that not only do we not know whether international stocks will outperform, we also don’t know which countries to buy into. I’m with Jason Zweig on owning the entire rest of the world with ultra-low-cost index funds.

–Allan S. Roth is the founder of Wealth Logic , an hourly-based financial-planning firm in Colorado Springs, Colo. His contributions aren’t meant to convey specific investment advice.