A Simple Way To Outperform The S&P 500

Post on: 6 Июнь, 2015 No Comment

As an investor who likes to outperform the S&P 500, I discovered a very easy-perhaps the simplest-way to outperform the market index in the long run.

This method requires one to be patient and disciplined, and to take a passive approach to investing that does not involve stock trading, stock picking, market timing, short-selling or any form of active management. It is similar to a couch potato style of investing that requires an investor to invest in a portfolio of index funds (e.g. ETFs), hold them for the long-term (e.g. at least 10 years) and ignore the stock market’s daily fluctuations.

While I was working as a financial adviser, I learned that the U.S. Stock Market as a whole always increases a lot in the long-term, due to the country’s economic growth, companies’ higher profits and global expansion, innovation, and more jobs as well as wealth being created in the economy. Economic recessions happen from time to time, but the U.S. economy has always survived and become stronger afterward. As a result, I believe that it can be prudent to invest in index funds for those who do not want to invest in individual stocks.

Intelligent Investors, such as Warren Buffett and Charlie Munger, have outperformed the S&P 500 by picking great stocks and investing in them for the long-term. This requires a lot of skills, discipline and self-study.

A very simple way to outperform the S&P 500 that I found is this: invest in a portfolio of U.S. Small Cap ETFs, hold them for the long-term, and invest more in them when the market plunges the most (e.g. during an economic recession).

Small Cap ETFs tend to outperform the S&P 500 in the long-term because the underlying small cap companies usually have higher revenue growth rates-with more risks-than the mid or large cap companies.

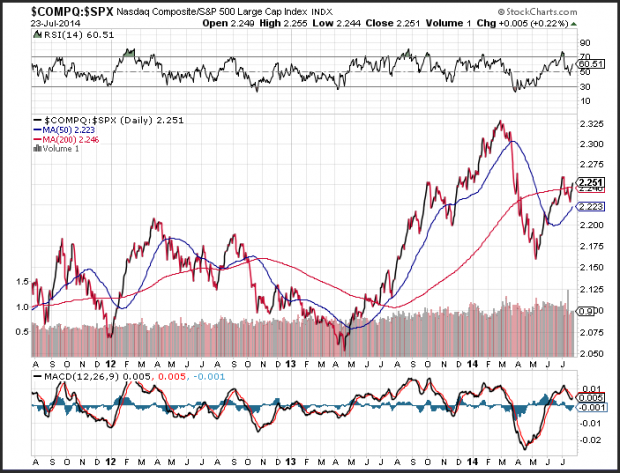

When we compare the U.S. Small Cap ETFs (IJR. VB. SLY ) to a S&P 500 ETF (NYSEARCA:SPY ), we notice that they all outperform the S&P 500 in the long-term.

For example, between Dec. 18, 2006 and Dec. 16, 2013, the three Small Cap ETFs gained around 60% while the S&P 500 ETF gained around 29% (see above image).

Between Dec. 22, 2008 and Dec. 16, 2013, the three Small Cap ETFs gained above 150% while the S&P 500 ETF gained around 108% (see above image).

The only time that we see the U.S. Small Cap ETFs underperforming the S&P 500 is when it is a bear market or when the economy is in a recession (e.g. 2008 financial crisis). This is when the Small Cap ETFs tend to experience larger drops than the S&P 500. But this is also the best time for us to invest in them because that is when they are greatly undervalued.

Although many people consider Small Cap ETFs to be riskier and more volatile than the S&P 500, they are well-diversified in many small cap companies and they are less risky if we are investing in them for the long-term (e.g. at least 10 years).

If you want to outperform the S&P 500 without picking stocks, you can simply invest in a portfolio of U.S. Small Cap ETFs (e.g. IJR, VB, SLY), hold them for the long-term, and add more positions to them when you see large drops in their prices.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.