A Simple FirstDayoftheMonth Trading System for ETFs

Post on: 30 Апрель, 2015 No Comment

When I traded for hedge funds I would put together a portfolio of diversified trading systems much in the same way that a mutual fund manager might put together a portfolio of diversified stocks.

So, for instance, a trading system that trades stocks only on the first day of the month might be uncorrelated to a trading system that is trading in and out of bonds and is in a trade all year long and switches once a year. My ideal basket of trading systems would be systems that are rarely in the market (so Im mostly in cash), and have very low volatility. So, for instance, if you are daytrading a bond ETF, its less likely you will be down 20% in a day than if you were buying or shorting a biotech stock like Dendreon (NASDAQ:DNDN ).

Lots of things happen on the first day of the month that lead to irrational behavior. For one thing, many people get money in their 401k plans and if they are feeling flush than often some or much of that money gets allocated into stock funds. In other words, if people were up last month, they are more likely to put more money into stock funds.

The opposite is true of bond funds. People dont like to have too much money in low volatility bonds. So if their bond funds are too successful (i.e. they grow too much) people tend to reallocate out of bonds and into stocks.

Lets combine these two ideas into a low-stress trading strategy. Its low-stress because we are going to be trading ETFs and not stocks (stocks can easily go up or down 30% in a day whereas its relatively rare that stock or bond ETFs move that much in a day) and also its low-stress because the strategy discussed below is in cash 99% of the time (because you are only potentially trading on the first day of the month). Finally, its low stress because the rules are very simple. No rocket science is involved. No Chaos theory or neural networks. If anyone ever tries to sell you a strategy based on any of these then run as far as you can in the opposite direction. Trading systems need to be intuitive and simple.

The First Day of the Month Strategy:

Well be working with two categories of iShares ETFs:

IF the last day of the month went up for any of the above ETFs THEN for that ETF that went up:

If the ETF we are trading is one of the emerging market ETFs then BUY at the close on the last day of the month. SELL at the close on the first day of the month. In other words, you buy and hold for one day.

If the ETF we are trading is one of the bond ETFs then SHORT at the close on the last day of the month. COVER at the close on the first day of the month.

That s it. Youre in the market only 1 day each month. And some months youre not in the market at all. On any given month, you might only trade one or two of the ETFs but not all of them.

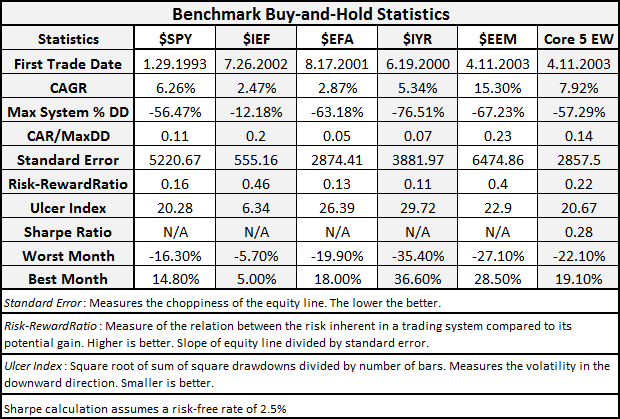

The results over the past 10 years are:

On 279 total trades, 80% (222) were winning trades. Overall, the average return per trade was 0.54%.

73% of the long trades were profitable and 83% of the short trades were profitable.

Not so bad in a period where the market indices were all negative in the same time period.

I did a very simple simulation using 33% of the equity in a portfolio for each trade. Since 2001, here are the results:

The past 9 years in a row were positive, with 2001 only modestly negative (0.51%), click to enlarge.

A couple of things to point out:

A) Youre only in the market one day of month. A diversified basket of trading systems would have additional systems that work well in the rest of the month. As it stands, this system returns an average of 5% per year despite very low exposure.

B) If on a particular first day of the month only two of the ETFs are calling for trades then you can potentially make those trades larger than in the above simulation. This wouldve improved the historical results.

Remember, when developing a trading strategy, focus on the following principles:

- Keep it simple

- Make several mini-trading systems like the above, that are mostly uncorrelated with each other.

- Keep volatility low by using ETFs, such as the iShares ETFs mentioned above.

Disclosure. no positions