A quick guide to low or nofee investing online

Post on: 16 Март, 2015 No Comment

Q: Is there a way to buy just one stock without incurring a monthly fee, as many online brokerages charge small investors?

A: You make an interesting observation. Several of the popular websites designed for smaller investors charge subscription fees.

For instance, Buyandhold.com, charges $6.99 a month for its investment plan, which includes two trades. And FolioFn, an online brokerage service designed to help investors easily build diversified portfolios, charges $15 a quarter unless you make four or more trades. It also has an option that charges $29 a month in exchange for free commissions.

Such subscription fees may be a good value for some investors. For instance, if you regularly invest twice a month, the roughly $3.50 per trade commission from Buyandhold.com isn’t a bad deal. And if you’re a frequent investor, maybe FolioFn’s fees work for you.

But I can understand your aversion to signing up for yet another monthly subscription. Most of us already have a stack of monthly financial obligations, like cellphone bills and rent, so it’s hard to sign up for another one, if you don’t need to.

To answer your question, you absolutely do not need to pay such fees, even if you’re a small investor.

Sharebuilder is an example. This online brokerage has subscription services that either charge $12 a month or $20 month. These plans give you six and 20 free trades a month, as you can read here .

But Sharebuilder also offers a Basic service with no subscription fee. You just pay a $4 commission for each stock you buy. You might also consider opening an account with one of the deep-discount online brokerages, like Sogo Trade. Zecco or Tradeking. which charge low commissions of $3, $4.50 and $4.95.

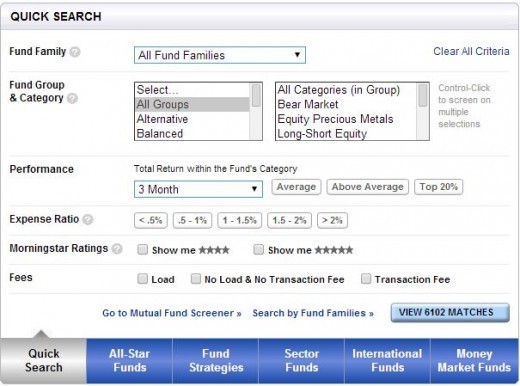

Just this year, smaller investors get another option to keep fees down. Both Fidelity and Charles Schwab are allowing investors to buy and sell certain exchange-traded funds (ETFs) for free. This is a great deal for investors who might have a little to invest, and don’t want to get chewed up with commissions.

Currently, Fidelity is offering 25 iShares ETFs to customers for no commission, as you can read here. And Schwab has 8 free ETFs, listed here .

Matt Krantz is a financial markets reporter at USA TODAY and author of Investing Online for Dummies and Fundamental Analysis for Dummies. He answers a different reader question every weekday in his Ask Matt column at money.usatoday.com. To submit a question, e-mail Matt at mkrantz@usatoday.com. Click here to see previous Ask Matt columns. Follow Matt on Twitter at: twitter.com/mattkrantz