A Married Put Position

Post on: 14 Апрель, 2015 No Comment

Did you know you can buy stock insurance.

A Married Put is like insurance for your stock purchase. We are all familiar with car and house insurance, but how many people know that you can buy insurance against a loss in stock price.

It’s not actually called stock insurance, but as you will learn in this lesson it works essentially the same way.

It doesn’t take much skill to implement the strategy. You just have to understand the mechanics of options and how they work.

All I ever hear is that options are risky and you should stay away from them. After learning about the Married Put, I hope you change your mind like I did. This strategy can save the average investor thousands of dollars.

When I first learned about Married Puts, I was quite upset that my broker or financial advisor had never spoken about them before.

**On a side note**, I wish mutual fund managers would employ this strategy so people don’t have to watch their portfolio value plummet during bear markets. In any other industry you’d be fired if you didn’t perform, but oh no, not mutual funds. They just tell you to keep investing more by dollar cost averaging.

That’s okay though. You can use options trading to make up for those losses!

A Married Put is Insurance Against Loss.

To understand this strategy you have to remember that a Put option gives its owner the right, but not the obligation, to sell a certain stock at a specified price on or before a specified date.

Establishing a Married Put position is what the investment community would consider as hedging your investment.

The best way to understand hedging (establishing a Married Put) is to think of it as insurance.

When you buy insurance you are protecting, or hedging yourself against an unexpected event. Much like the insurance you buy for a car.

Imagine you bought a car for $10,000. You would most likely purchase insurance for your car to protect yourself against accidents, burglaries, etc. You pay an insurance premium and that’s it, you’re now insured.

If you were to wreck your car the next day and it’s rendered a total loss, the insurance company would issue you a check for the value of the car $10,000.

So essentially the only money you lost was the insurance premium you paid. In a sense Married Puts work the exact same way.

Let’s take a look.

A stock and put option get married.

A Married Put is when an investor purchases a Put option and at the same time purchases an equivalent number of shares of the underlying stock.

The two are joined as one. There are two components to the position, a Put and a Stock, however both of them together make up the position.

If you get rid of one of the components (they get divorced) then you no longer have a Married Put position.

This position is established when an investor wants to purchase insurance against a possible decline in the stock price.

No matter how much the stock falls in price during the option’s lifetime, the Put grants the investor the right to sell shares at the Put’s strike price up until the options expiration date.

How Many Puts Should You Buy?

Keep in mind: 1 stock option contract represents or equals 100 shares of the underlying stock.

So in order to implement the strategy correctly you need to purchase a number of put contracts equivalent to the number of shares held.

Married Put Example.

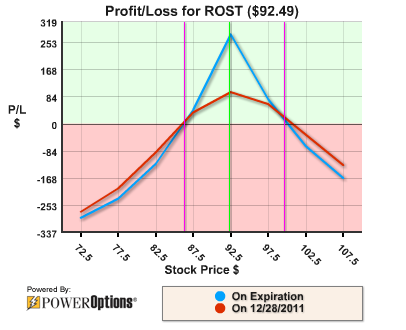

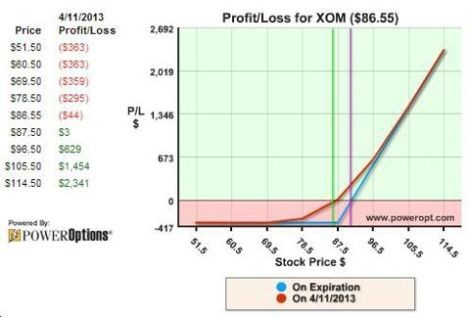

An investor buys 100 shares of XYZ stock @ $90. As protection against a price decline, he/she also buys 1 XYZ March 90 Put for $2. Your cost basis in this trade is now $92. So the stock would have to move up in price to $92 before you break even.

Once the stock moves above $92 the investor will have a profit on the overall position. The maximum gain on this position is unlimited since there is no limit to how high the stock can go.

The important part, and primary objective of this type of trade is seen when the stock price declines.

The purchase of the Put guarantees the investor a sale price of $90 for the stock. So no matter how far the stock price falls the maximum loss is limited to what the investor paid for the Put option, $200 ($2 * 100).

Without the Put your maximum loss is the entire $9,000!

Can you see how this is like an insurance policy to protect your stock from a big loss?

Of course if the stock doesn’t drop in value the Put will expire worthless, but as with any other insurance policy, you should recognize that this is merely the price of protection.

After all, if you buy auto insurance and don’t have an accident you don’t feel cheated, do you?

When the Put expires you can buy another Put to continue the protection. When you car insurance policy comes up for renewal don’t you usually renew it? Well it would be wise to renew your stock insurance also.

The premium paid for the Put option eats into your profits, but spending a small amount of money to protect a larger investment is not such a bad deal.

It’s considered unwise to live without car and house insurance so the same thing should apply to stock investing.

A Look Back at Past Failures.

Do you remember Enron, Bear Stearns, etc. How many investors would have been protected if they also bought a Put on those stocks?

Heck, I’ve got a few battle scars of my own from my pre-option trading days. I watched my money get flushed down the toilet with the stock price.

I remember when Enron stock plummeted. I watched people frantically ride it all the way to the bottom. Phrases such as, it just has to go back up, were all too common.

When you’re losing money, you often lose your mind also.

Somehow you convince yourself that a stock just can’t fall any lower. We all know that’s not true.

In my experience, I’ve never seen a Married Put investor concerned about a catastrophic drop in stock price, at least up until the Put’s expiration date. If the price gets too low they will exercise their option and move on to a better stock.

Lesson Review

A Married Put is when an investor purchases a Put option and at the same time> purchases an equivalent number of shares of the underlying stock.

- Establishing a Married Put position is what the investment community would consider as hedging your investment

- A Put option will provide you with insurance against a stock market loss

- Purchase a number of Put contracts equivalent to the number of shares held

Module 3: Basic Strategies