A Look At Four Great Dividend Stocks

Post on: 3 Май, 2015 No Comment

Special note: Today, we have a guest post by Ben. He writes for Sure Dividend and hes sharing an article about four excellent stocks and how they rank within the framework of his 8 Rules of Dividend Investing. I dont allow guest posts very often, and Ben and I have been in discussion about this article for more than a month now. But he took a lot of time to put this post together and I think theres some real value here. In addition, I spent considerable time formatting everything. I hope everyone enjoys it!

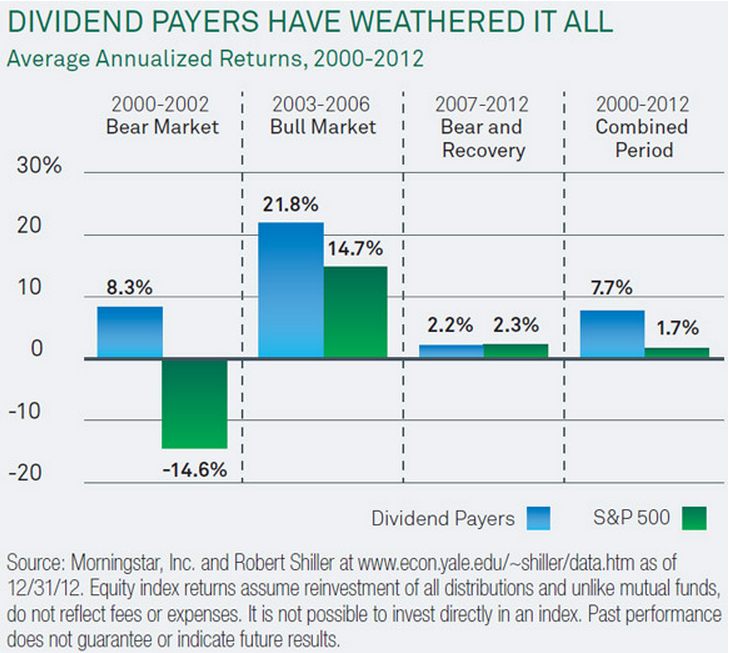

Dividend growth stocks make an excellent choice for investors seeking both income and growth. Dividend growth stocks raise their dividend year after year, growing their owners income streams. Who doesnt want a rising standard of living year after year? Not only do dividend growth stocks have practical appeal, they have also historically outperformed non-dividend paying stocks by about 7.8 percentage points per year from 1972 through 2013. Not a bad excess return, for simply buying stocks that raise their dividends year after year.

Dont Overpay

It is not always a great time to buy dividend growth stocks. The trick is to buy when dividend growth stocks are trading at fair or better prices. Unfortunately, the stock market is overvalued at this time. The Shiller P/E ratio (or PE 10), which measures the current price of the market divided by average earnings over the last 10 years, shows the market is near the same valuation levels of the 2007 crash. The only time the stock market has been more overvalued than today, outside of the late nineties and 2000s, is just before the Great Depression, in 1929. These are scary times for stock investors.

Many dividend growth stocks have taken part in the market rally, and are now overvalued. Buying stocks trading at high P/E multiples has historically diminished investor returns. On the other hand, buying high quality dividend growth stocks at fair value or less than fair value is an excellent way to build long-term wealth.

“Its far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Warren Buffett

Despite the overvalued market, there are still several dividend growth stocks that I believe are trading for fair value or less, and offer income growth, safety, and stability for investors willing to hold through the ups and downs of the stock market.

This article will take a look at four businesses I believe are trading at fair or better prices. The current events of each business will be examined below, along with what has made them bargains. Finally, each business dividend attractiveness will be analyzed using the 5 Buy Rules from the 8 Rules of Dividend Investing .

Undervalued Retail King: Wal-Mart

Wal-Mart is the worlds largest retailer, and 11th largest publicly traded company. The company is trading at a substantial discount to its historical PE 10 ratio.

Wal-Marts stock is depressed because it has shown lackluster performance in recent history. Wal-Mart has not increased comparable store sales in its flagship US Wal-Mart stores since the fourth quarter of the companys fiscal 2013. Sams Club has fared better than Wal-Mart US, but has still seen mediocre comparable store sales growth. The company had flat comparable store sales growth this quarter, following 2 consecutive quarters of declines.