A Look At Berkshire Hathaway’S 2Q Holdings

Post on: 6 Апрель, 2015 No Comment

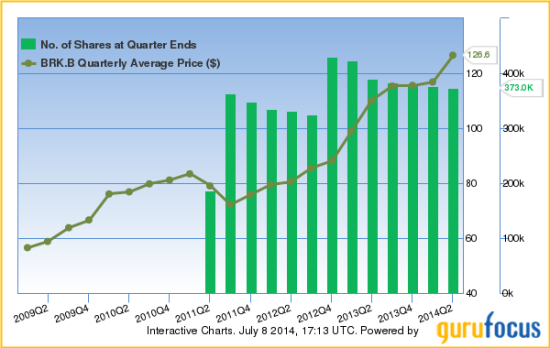

Warren Buffet’s Berkshire Hathaway revealed its positions for the second quarter of 2011 in an SEC regulatory filing. Not many positions were changed during the second quarter compared with the first. According to the company’s latest 10-Q, the value of Berkshire Hathaway’s equity, fixed income and other investment portfolio is approximately $114 billion.

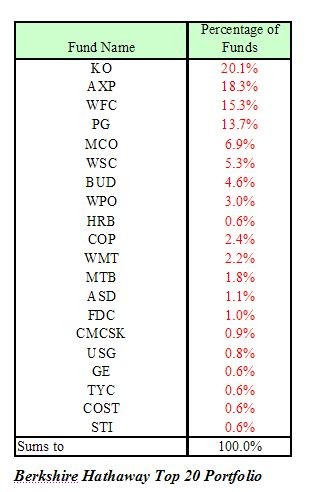

The Coca-Cola Co/ (KO ) remains the largest holding in Buffett’s portfolio and the position remains unchanged from the first quarter. Coca-Cola has a total position of $13.2 billion in the portfolio.

Wells Fargo (WFC ) is the second-largest position in the Berkshire portfolio, which added 9.7 million WFC shares for roughly $275 million during the second quarter. Wells Fargo is seen as one of the safer financial sector stocks owing to its limited mortgage investment exposure.

Berkshire Hathaway initiated new positions in Verisk Analytics (VRSK) and Dollar General (DG). Verisk Analytics provides data management and system support for insurance companies. Buffet was an early investor in the company prior to it going public and he received class-B shares of the company. Many of these shares have been converted to class-A common equity which could be a reason for this new position. More class-B shares of Verisk are set to be converted in October, which should see this position increase by year end.

The firm purchased 1.5 million shares of Dollar General during the second quarter. Discount retailers are seeing sales grow as the economic situation becomes more unpredictable. Dollar General recently revealed that it is concentrating more on increasing sales and market share rather than improving margins or profitability. Markets have reacted with some skepticism and the stock has lost close to 10 percent in the last two month.

The biggest change in position for the quarter was an 88 percent increase in the stake of Master Card (MA ). Buffet added 189,000 shares to the 216,000 shares picked by new fund manager Todd Combs. Combs previously headed CastlePoint Capital Management, which had a strong position in Master Card.

The only position that was lowered this quarter was Kraft Foods (KFT ). Berkshire Hathaway shaved off around 5.5 percent of its holdings in the company. Buffet has been critical of Kraft’s acquisition of Cadbury stating, Counting all of the costs involved including the undervaluation of the Kraft shared given, you’re probably paying in the range of maybe 17 times earnings for Cadbury, I think is a big mistake. He, however, does look intent to stay on as Kraft’s largest investor, and Kraft remains a top-5 holding in spite of the lowered position.

The form 13-F that funds above $100 million in size are required to file does allow the exclusion of data if the firm is in the process of building or liquidating a position, to prevent copycat investing. Berkshire Hathaway’s quarterly 10-Q filing indicates that around $3.6 billion has been spent on purchases during the quarter, but adding up portfolio purchases for the second quarter doesn’t even give us half a billion dollar of purchases. This means that close to $3 billion in undisclosed purchases have been made during the quarter.