A Find The Expected Rate Of Return On The Market Portfolio Given That The Expected Rate Of Return

Post on: 30 Май, 2015 No Comment

Search

Divisional hurdle rates Financial management and policy Case 1 . week 2 University of Maastricht Faculty of Economics and Business Administration Maastricht, 5th of November 2003 Danner, W. I 136964 Kuijt, R.J. I 130885 Steenvoorden, W.J.M. I 178829 Course Code: 6010v Group number.

2122 Words | 9 Pages

2005) 96633337 Juan (a) Expected Portfolio Return and Risk Expected Return Risk Covariance = (0.002)(0.06)(0.09)=0.0000108 (b ) Minimum Variance (Pendix Ltd) The minimum variance for this portfolio is 0.693, indicating that risk is minimized when 69.

Rate of Return on a Portfolio of Securities (Rp) Actual or Realized or Historic or Ex-post facto ROR on a portfolio for a one year investment is. Realized Rp = (Wealth at the end — Wealth at the beginning) / Wealth at the beginning. Symbol Rp will be used to denote rate of return on a portfolio.

3 Factors that Influence Rate of Return Any bondholder, or any investor for that matter, will allow three factors to influence his or her required rate of return . The three factors are the following: real (pure) rate of return . inflation, and risk premium. These three factors equal the risk free .

Risk and Rates of Return – North Central Utilities Content 1 .) Introduction 3 2.) Question 1 3 3 .) Question 2 4 4.) Question 3 4 5 .) Question 4 5 6.) Question 5 5 7.) Question 6 6 8.) Question 7 7 9.) Question 8.

This paperwork of ECO 316 Week 1 Chapter 4 Interest Rates and Rates of Return consists of: 4.1 Multiple Choice Questions 1 ) When you place your funds in a savings account at a bank, those funds are 2) Debt instruments are also called 3 ) A debt instrument represents 4) Simple.

Investments Decisions – Accounting Rate of Return (ARR) Calculating Accounting Rate of Return ARR= Average Net ProfitAverage Book Value The accounting rate of return simply involves using accounting numbers, average net profit coming from a company’s income statement and average book value of the.

Accounting rate of return The accounting rate of return (ARR) is a way of comparing the profits you expect to make from an investment to the amount you need to invest. The ARR is normally calculated as the average annual profit you expect over the life of an investment project, compared with the average.

Accounting rate of return Accounting rate of return (also known as simple rate of return ) is the ratio of estimated accounting profit of a project to the average investment made in the project. ARR is used in investment appraisal. Formula Accounting Rate of Return is calculated using the following.

INTERNAL RATE OF RETURN Many companies wants to have a return on their investment in a few years and begin to evaluate their projects optimistically calculating an internal rate of real return not yielding results in the end. This does not end up being expected by the companies; According to the.

Accounting Rate of Return (ARR) ARR provides a quick estimate of a project’s worth over its useful life. ARR is derived by finding profits before taxes and interest. ARR is an accounting method used for purposes of comparison. The major drawbacks of ARR are that it uses profit rather than cash flows.

Internal Rate of Return Meaning of Capital Budgeting Capital budgeting can be defined as the process of analyzing, evaluating, and deciding whether resources should be allocated to a project or not. Capital budgeting addresses the issue of strategic long-term investment decisions. .

Internal Rate of Return In investment decision analysis you may need to calculate internal rate of return . “Internal rate of return (IRR) is the discount rate that gives the project a zero NPV” (McLaney, 2006). It is a good choice to use for investment projects. There is a formula for the internal.

Internal Rate of Return Internal Rate of Return (IRR) Calculation of the true interest yield expected from an investment. Explanation of Internal Rate of Return . What is Internal Rate of Return . Definition The Internal Rate of Return (IRR) is the discount rate that delivers a net present value of.

LECTURE OUTLINE – DRAFT 2 [pp. 3 -4 are new] NB MIDTERM EXAM SUNDAY, OCTOBER 20, 2013 CONCLUDE LECTURE 4 THE SHARPE SINGLE INDEX MODEL SHARPE MODEL’S APPLICATION TO PORTFOLIO MANAGEMENT THE MODEL’S ASSUMPTIONS [ARE THEY REALISTIC?] ESTIMATING THE MODEL PARAMETERS RELIABILITY OF THE ESTIMATES.

Chapter 8: Risk and Rates of Return 1 . The tighter the probability distribution of its expected future returns . the greater the risk of a given investment as measured by its standard deviation. a. True b . False ANSWER: False 2. The coefficient of variation, calculated as the standard deviation.

Chapter 8: Risk and Rates of Return 1 . The tighter the probability distribution of its expected future returns . the greater the risk of a given investment as measured by its standard deviation. a. True b . False ANSWER: False 2. The coefficient of variation, calculated as the standard deviation.

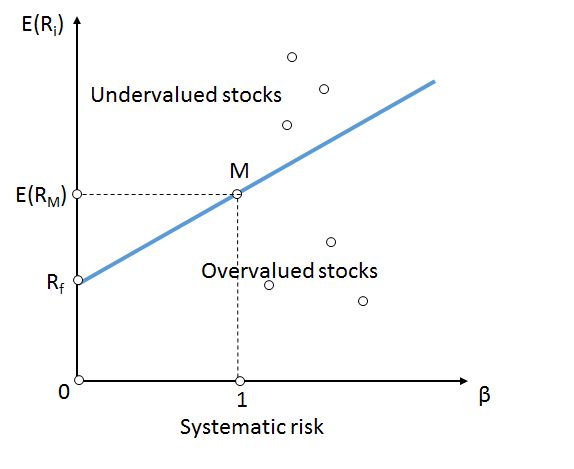

CHAPTER 10 Return and Risk . The Capital Asset Pricing Model (CAPM) Multiple Choice Questions I . DEFINITIONS PORTFOLIOS a 1 . A portfolio is: a. a group of assets . such as stocks and bonds, held as a collective unit by an investor. b . the expected return on a risky asset . c. the expected return.

prices may react to market forces such as risk and interest rates . You will use both the CAPM (Capital Asset Pricing Model) and the Constant Growth Model (CGM) to arrive at IBM’s stock price. To get started, complete the following steps. Find an estimate of the risk -free rate of interest, krf. To.