A Dividend Reinvestment Calculator for EVERY Stock (Including DCA! ) Don t Quit Your Day Job

Post on: 5 Май, 2015 No Comment

Share the post A Dividend Reinvestment Calculator for EVERY Stock (Including DCA!)

This calculator automatically grabs stock data from our friends at Quandl and automatically calculates how much a position would be worth if the stock was held and all dividends were reinvested between two dates. As a bonus, it also can calculate historical returns for dollar cost averaging. At launch, that means we support around 15,000 unique tickers for as far back as there is data. See the full list here. but if its on the NYSE, NASDAQ, or AMEX theres a very good chance this will work.

Yes its finally possible to automatically make a fair comparison with actual realized stock returns without a huge amount of outside. The returns we estimate are annualized for easy comparison to our other reinvestment calculators, such as the S&P 500 Calculator. the Wilshire 5000 Calculator. and the 10-Year Treasury Calculator . (Please turn off inflation on those calculators to be comparable this calculator uses XIRR to produce return estimates.)

This calculator automatically updates on the fly- but please see the notes below the calculator. (Editor: for Canadian listed stocks, please check carefully. Quandl isnt calculating splits, so it is best to stick to American listed stocks.)

The (Any) Stock Reinvestment and Dollar Cost Averaging Calculator!

How To Use the Reinvestment Calculator

Note: a date in the future doesnt mean this calculator can see the future. It is just rounding to the closest snap-point.

- Stock Ticker: Enter a valid ticker (case doesnt matter, just dont add spaces).

- Starting Amount ($): Enter the amount of the initial investment.

- Starting Date: Enter when the investment was first made.

- Ending Date: Enter when the investment was sold (or date to check the accumulated value).

Advanced Options

- Reinvestment ($). The amount invested in every period selected from the pull-down below it.

- Frequency. How often the dollar cost averaging/paycheck contribution went into the stock.

- Total Amount: The value of the investment on the ending date.

- Annualized Investment: Our estimate to the amount returned annually by the investment, including the dollar cost averaging.

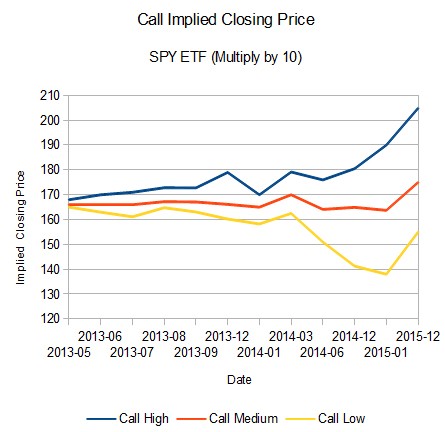

- Graph: The value of the account over time drag your cursor over points to see value on a date (sorry mobile users)

- Dividends: All of the dividends in the time in question, along with their amounts.

Notes About the Calculator (Read Before Emailing)

- Give it a second, its going to (three) space(s). Thats what the spinner represents it shouldnt take more than 15-25 seconds.

- This information is for informational purposes only . Please verify all information produced by the tool independently.

- Stocks will not update more than once a day, and they snap to the closest week and trading day . So, no calculations for days that the markets closed, and you get 52 data points per year.

- Let me know by email or in the comments if you find a bug. If the ticker is missing, check this spreadsheet first — I will eventually figure out a better way to look up the stocks, but for now this is our limitation.

- The full list of available tickers is available at Quandl it is not a bug if it doesnt work for a ticker not on that list.

- Ill do my best to accommodate future feature recommendations, but remember this is unpaid work. If you want something better, Im available to freelance .

Why Bother?

For the same reason I wrote our until-today-most-ambitious-web-calculator, our any house real estate return calculator. to make it possible, at a glance, to compare various forms of investment in a fair way. Just as people who quote housing returns leave out roughly every single housing expense other than the purchase price, people who quote stock returns usually do so sans-dividends. That isnt necessary anymore this calculator will give you the power to actually determine what an investment would be worth over a long time frame, even with the dividends included. And, further even with re-investments included .

To our knowledge there is nothing approaching the utility of this calculator on the internet.

But even so, there was a deeper reason why we wanted to create our most epic calculator yet this article (our 749th published piece) marks our five year anniversary at Dont Quit Your Day Job ! Happy birthday to us and heres our gift to you.

Use it in good health, and may all of your investments move up and to the right.