A brief history of the hedge fund

Post on: 5 Апрель, 2015 No Comment

a brief history of the hedge fund

In light of the wildly escalating debt ceiling brinksmanship, particularly Obamas desire to raise revenue by closing tax loopholes for hedge fund managers, check out this brief history of the hedge fund itself, and the cause behind the historically low tax burden of their managers.

From John Cassidys recent New Yorker profile of Bridgewater Associates CEO Ray Dalio:

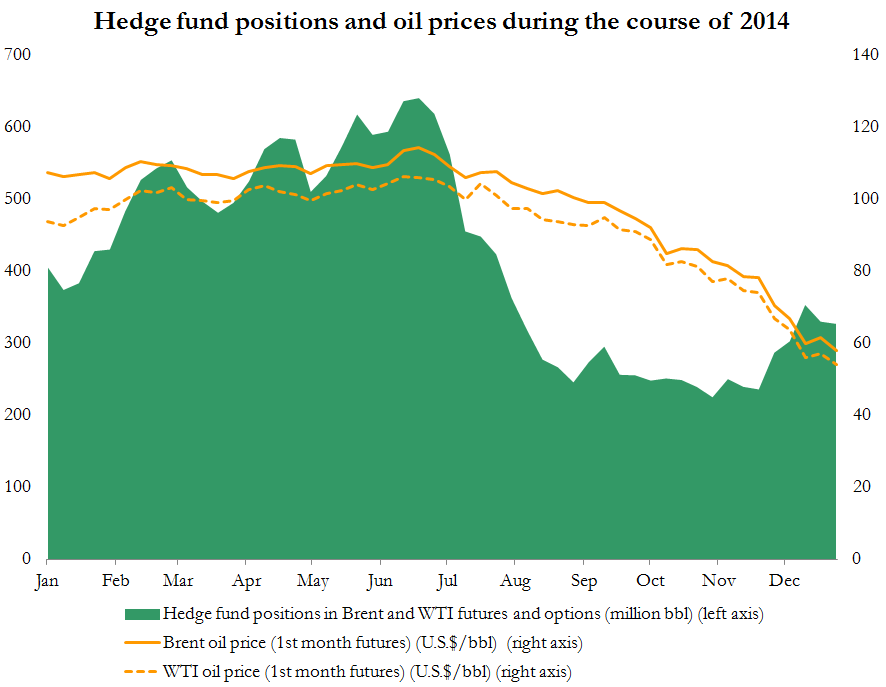

Hedge funds date to 1949, when Alfred Winslow Jones, a writer at Fortune. opened a private investment firm using sixty thousand dollars he had raised from friends and forty thousand he had saved. To boost his returns, Jones borrowed heavily and bought stocks he liked on margin a practice that had been discredited in the late nineteen-twenties. As a hedge against the market failing, Jones also picked ut some stocks he believed to be overvalued and bet against them a practice known as selling short. Jones fund regularly beat the Dow, and by the late nineteen-sixties it had attracted many imitators.

Worldwide, there are now some ten thousand hedge funds, which the government regulates only loosely. Together, they have about two trillion dollars under management. Even today, they employ the two basic tools that Jones used borrowing (leverage) and selling short and they charge their clients hefty fees, as Jones did. On top of a two-percent management fee, they deduct twenty percent of any investment gains they generate. Jones claimed that this remuneration scheme, which is known as two and twenty, was inspired by the way ancient Phoenician merchants financed their trading expeditions. But the practice is also tax-driven. It allows hedge-fund managers to classify much of their income as capital gains, which are taxed at a far lower rate than regular income. While cops and schoolteachers face a marginal tax rate of twenty-five percent, hedge-fund managers like Dalio have for years paid fifteen percent on the lions share of their income.

Tech sector growth wasnt the only cause for our robust economy in the nineties. Some of the credit there must go to Clinton too, who kept capital gains taxes high until the end of the decade.

When Obama states that tax rates are lower now than theyve been since the fifties, hes more or less right. which suggests that his advocacy for revenue increases as part of a debt ceiling compromise isnt some leftist agenda; its really just sound compromise.