A Beginner s Guide To Portfolio Value After Rate Shocks At Annaly Capital Management Annaly

Post on: 16 Март, 2015 No Comment

Summary

- This article is designed for retirees and casual investors that want to understand interest rate shocks.

- I’ll explain the impact an interest rate shock has on portfolio value.

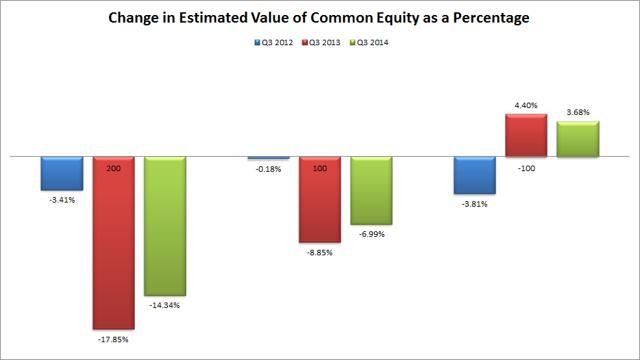

- We’ll walk through a chart that compares the changes in Annaly Capital Management’s portfolio value.

- I will explain how to interpret the chart when you see them in financial statements.

Annaly Capital Management (NYSE:NLY ) has dealt with a difficult environment over the last several years. Both the company and the environment have changed, so the risk profile of the company is quite different from what it was several years ago. My goal in this article is to explain these changes in a way that makes sense for retiring investors and casual readers. You won’t need a degree in Finance to understand the analysis, but I will break down some concepts that can be fairly complicated.

If you’re completely unfamiliar with interest rate shocks

I prepared an earlier article that goes over the basics of how interest rate shocks work. If the term interest rate shock leaves you feeling any doubt, that article is a good place to start. I will assume that everyone reading past here has already read the earlier article, which will allow me to get into a little more depth.

Portfolio Value

Different analysts may have different methods for evaluating any kind of company. In my opinion, one of the most reliable ways to look at an mREIT is by looking at the discount or premium to book value. However, the data is frequently out of date, so it is best to get an update on the movements in rates .

Portfolio Value

The company uses a large amount of leverage to create returns for shareholders. When investors are buying into an mREIT, a return of 2.8% simply wouldn’t be appealing. When mortgage backed securities are considered in the aggregate, rather than as individual securities, it is possible to make more accurate predictions about them. The banks make short-term loans to the mREIT using the MBS as collateral. Using those short-term loans the mREIT is able to finance a large portfolio of MBS. However, because the mREIT is using leverage, a slight decrease in the value of the assets can have a much more substantial impact on the value of the equity.

Leverage

New investors may not be familiar with the workings of preferred shares. They are technically equity on the balance sheet, but they have much more in common with debt securities than equity securities. Therefore, when I am looking at the leverage I want to remove the value of preferred shares from the value of equity and treat them as a liability instead.

The following chart shows the current level of leverage:

The chart makes the leverage very clear. Investing in an mREIT requires investors to accept a high degree of leverage, which can substantially increase the volatility of their investment.

Impact of Rate Shocks on Portfolio Value

The next image is pulled from the 10Q. It shows management’s estimates of the impact a rate shock would have on the company.

Since I covered the Net Interest Income in a previous article, we are focused on the changes in portfolio value and NAV.

Comparing the two, you should notice that the impact on NAV (Net Asset Value) is over 6 times the impact on portfolio value. It is important to understand that the company’s NAV is a large factor influencing the share price and the market capitalization of the company. The portfolio value matters because it creates an amplified impact on the NAV.

How does the impact now compare with the impact in prior periods?

I built another chart to compare the impact of rate shocks for NLY’s portfolio value. I choose to use portfolio value in this comparison because it strips out the impact of leverage isolates the exposure that is created by the portfolio. The chart may appear complicated, but I’ll explain how to read it.

The different colors each reflect a different moment in time. These values are based on the reported values from the 10Q statements for third quarter of 2008 (bright blue), 2009 (red), and 2014 (green).

Right in the middle of the chart we have numbers ranging from negative 75 to positive 75. These numbers represent the suggested interest rate shock in basis points. If you’re unfamiliar with basis points, you can use the article linked at the top. It provides a thorough explanation of how basis points work.

What do we learn from the chart?

When interest rates go down, the value of the portfolio held by an mREIT would usually go up. The left half of the chart contains the impact of the interest rate dropping by 75, 50, or 25 basis points. As you can see, the impact would have been fairly positive in 2008. In 2009 and 2014, the impact is still positive, but it isn’t as positive as it was before.

When we switch to the right side of the chart, we see that in 2008 the company would actually have a small benefit from interest rates rising by 25 or 50 basis points. A 75 basis point increase would still have caused the portfolio value to decline by a little over half of a percent.

However, in 2014 the risk from increasing rates is much more dramatic. An increase of even 25 basis points could cause almost the same decline that a 75 basis point increase would have caused in 2008. As the potential shocks get larger, the potential damage to the portfolio value gets larger. By the time we reach a 75 basis point shock, the damage would be 1.80% of the portfolio value.

We can tell from the table in the 10Q that the loss of 1.80% of the portfolio value would translate into having 12.3% of the equity value wiped out.

Conclusion

Looking at the impact on portfolio value from a rate shock indicates that the company’s position for handling the rate shocks is much less favorable now than it was 6 years ago. If interest rates are increased, there could be a very damaging effect to the portfolio. Of course, as investors we don’t actually know the way rates will move. If an investor actually knew the movements in rates before they happened, that investor would make a fortune. Therefore, rather than predicting movements in the rates, I prefer to focus on when the movements in rates and the movements in price indicate different scenarios.

The difficult part about being an investor in NLY is the fairly substantial exposure to loss if the interest rates increased. On the other hand, if the interest rates are steady, the company should provide a fairly strong return to investors.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.