A Basic Introduction to Spread Betting and CFDs

Post on: 10 Апрель, 2015 No Comment

A Basic Introduction to Spread Betting and CFDs

or copy the link

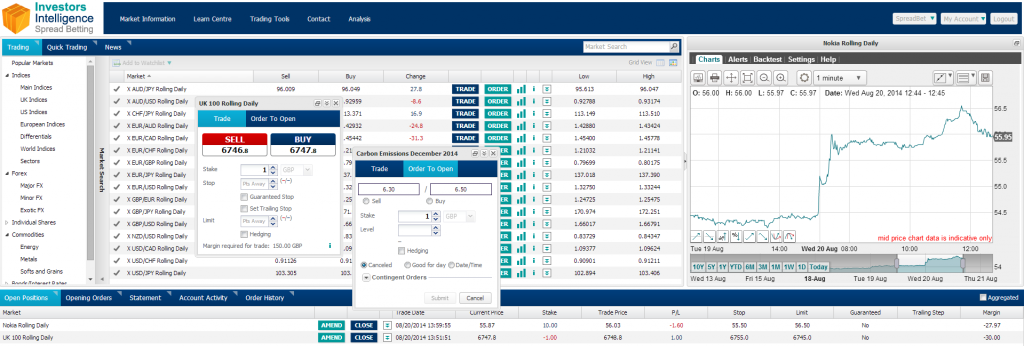

Two of the more popular forms of investment that have slowly been gaining steam in the last few years are spread betting and CFDs. Unlike traditional investments into stocks, spread betting and CFDs allow you to invest on the movement of the market without having to buy the actual stock that is being traded. This raises a few significant advantages for investors who are confident in their ability to read market movements and in the process derive profits from it without necessarily owning the stock and locking it up until the market becomes favorable.

If all of these may seem confusing, then consider spread betting and CFDs as you would any betting game. You can pick the movement of a specific index and will profit if your pick is correct. Conversely, you lose money if your pick is wrong. Put simply, if you pick the price of certain shares to go up and this happens, you profit from the venture. The opposite is true if you picked the price to go up but instead it went down.

While spread betting and CFDs may sound the same, there are a few critical differences.

- Spread betting profits and losses are determined by whether you are correct in your choice of price movement and by how much the price moved. Say, a stock has a 100/101 spread and you picked that the price will go up. To spread bet, you say you will “go long” – or buy at 101 – at £1 per point increase. If the price indeed goes up from 101 to 111, and you then decide to sell, you end up profiting 10 points x £1 (£11) for the transaction.

- In CFDs, or Contracts for Difference, you bet on the difference between the contract opening and closing. For example, you picked to go long on a stock at £100 per share and you buy 100 CFD options for it. If indeed the price increases to £120 and you exercise your CFD options, your total profit is the difference of the opening contract and the closing contract (£120 x 100 minus 100 x £100) which is equivalent to £2000.

Perhaps the best thing about spread betting and CFDs is that these allow you to continue being active in the market even if the prices go up or down without you having to lock up your money on an underperforming stock. And with so many indices, currencies, shares, and commodities to bet on, you are sure to find something that you can be confident with on any given day.

So if you are looking to explore new forms of investment, check out spread betting and CFDs and give yourself the chance to test your market analysis skills in predicting the movement of prices as you set yourself up for getting it right by putting your money on the correct movement of the price