90% Of fund managers beat the market

Post on: 25 Апрель, 2015 No Comment

ChuckJaffe

Here’s a sentence I never expected to hear from a respected mutual fund source: “Ninety percent of funds are superior stock pickers.”

C. Thomas Howard, director of research at AthenaInvest, a Denver-based research/investment company not only believes that, but says 80% of funds are so good at picking stocks that they cover the fees they charge investors.

If you suspend your disbelief — and stop thinking that Howard must be taking psychotropic drugs — the way you choose and invest in funds may be changed forever.

To see why, however, you first must understand Howard’s thinking and the common knowledge that makes it seem implausible.

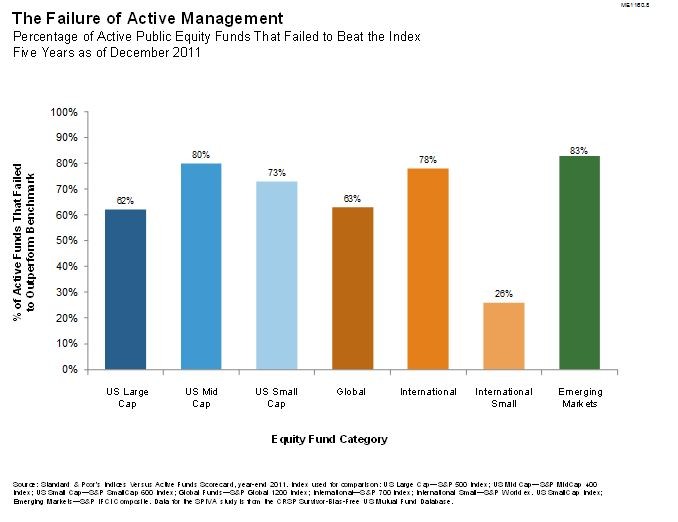

Countless studies of performance show that active funds routinely deliver below-average results and fail to outperform comparable index funds.

If the performance numbers don’t lie — and they don’t — it seems far-fetched for Howard to suggest that money managers have real expertise that trumps the market.

But Howard is relying on a wide range of research, some of it his own but also several studies from 2013, showing that 80% or more of equity-fund managers beat their benchmark until the burden of fees and costs come into play.

Indeed, widely available numbers play this tune.

In industry jargon, a fund’s “alpha” is the “excess return” — above and beyond the index, and adjusted for risk — that can be attributed to the skill of the manager. If the typical equity fund’s alpha is roughly zero after expenses — and it is — that means average managers outperform the index in the raw, but are doomed by cost structures to lag the benchmark in the end.

“If you can get a couple of decent years together and a decent story and then slide quietly into mediocrity, it’s a recipe for success for your fund company, and a recipe for disappointment for investors.” David Snowball, founder of MutualFundObserver.com

But if 90% of all managers are good stock pickers, as Howard insists, expense ratios alone don’t explain why so many funds are mediocre.

That, according to Howard, is the result of what he calls “the portfolio tax,” a drag on performance created by three significant burdens:

1) Asset bloat. When funds get big, the chances for superior performance shrink. That’s why, Howard explained, so many small funds get off to a great start, attract assets because of their success and then regress when the manager struggles to extract market-beating returns from a larger portfolio.