7 Roth IRA Mistakes To Avoid

Post on: 25 Апрель, 2016 No Comment

W hen it comes to saving for your retirement, a Roth IRA offers you a simple and understandable vehicle for planning ahead.

But while investing in your Roth IRA isnt rocket science, investors from all walks of life tend to encounter the same potential pitfalls over and over. So make sure you know the rules of the game as well as the hidden dangers which threaten to throw a wrench in even the best laid retirement plan .

Continues after Advertisement

Here are seven Roth IRA mistakes you need to avoid:

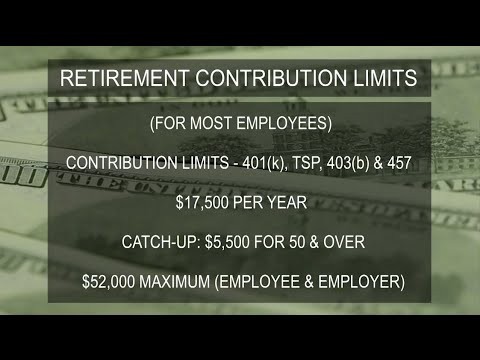

1) Not Making The Maximum Contribution (or Any At All)

One of the worst mistakes you can make is to not make any contribution at all to your Roth IRA. If doing so is part of a well thought out financial plan, thats fine. But if its due to a failure to plan, youre making a big mistake. Investing just $5,000 per year at 10% for 35 years is $1,495,634.03.

Likewise, a failure to contribute the maximum amount to your Roth IRA each year is also a big mistake. Lets say you contribute $1,000 per year less than the annual minimum. At 10% a year over 35 years, that $1,000 per year adds up to $299,126.81!

2) Not Understanding The Ordering Rules For Withdrawals

Few people know that the IRS has a specific set of rules regarding the order in which you withdraw funds from your Roth IRA. Under these rules, you must withdraw funds in the following order:

- Your original contribution amounts

- Conversion and rollover amounts

- Earnings on your original contributions

When it comes to Roth IRA withdrawals. you can always withdraw your original Roth IRA contributions tax-free and penalty-free. However, in most cases, you need to wait until age 59 ½ (as well as meet the provisions of the five year waiting period ) before you can withdraw earnings or conversion amounts. Furthermore, each Roth IRA conversion you perform is independently subject to the Roth IRA five year rule, and this tends to be a major stumbling block for some people.

For instance, lets say youre 62 years old, and youve had a Roth IRA for ten years. Three years ago, you performed a Roth IRA conversion, and youve currently withdrawn every penny of your original contributions tax-free and penalty-free. Since your Roth IRA meets the provisions of the five year waiting period, and youre older than age 59 ½, you can withdraw your remaining funds tax-free and penalty-free, right?

Wrong. Under the IRS ordering rules, you need to withdraw your conversion amounts after youve exhausted your original contributions. But since you performed a conversion three years ago, the conversion does not yet meet the provisions of the five year waiting period, so you need to wait another two years to avoid the 10% early withdrawal penalty.

3) Making An Excess Contribution

Believe it or not, its relatively easy to make an excess contribution. For instance, lets say you max out your Roth IRA contribution for the year, but then experience a significant rise in income. Thats great news! But if your income increases beyond the IRS limits, youll end up with an excess contribution.

Fortunately, its easy to correct. As long as you remove the excess contribution prior to filing your taxes, you dont have to worry about any penalties. Otherwise, youll incur a 6% annual penalty on the amount of your excess contribution until its removed.

4) Paying Too Many Fees

One of the most common Roth IRA mistakes involves paying too many of your hard-earned dollars in unnecessary fees.

Some financial institutions charge an annual fee for hosting a Roth IRA account. Make sure yours isnt one of them. Any number of discount brokers will offer you a no-fee Roth IRA. So save your money.

Also, the majority of account holders use their Roth IRA to invest in the stock market. usually through mutual funds, index funds, and/or exchange traded funds (ETFs). Each of these funds comes with an expense ratio an annual fee which covers the cost of operating, managing, and marketing the fund.

Some expense ratios can run well in excess of 1.5% annually, but a good S&P 500 index fund (or other widely held benchmark fund) will have an expense ratio of 0.10% or less. Unless youre absolutely in love with your mutual fund manager (and the market-beating returns make the added expense worth it), you should shop around for the lowest expense ratio possible.

Why? Because just 1% annually can add up to a lot of money. For example, lets assume you invest $5,000 per year at 11% for 35 years, but I invest the same $5,000 per year at 10% over the same time period a mere 1% difference. How much more money do you end up with? $1,900,822.03 vs. $1,495,634.03 a difference of $405,188 or 27% more money!

5) Overdiversification

You hear a lot about the need for diversification in the financial media, and the wisdom of diversification is well documented. Nevertheless, its possible to be too diversified . How?

Lets say in an effort to be truly diversified, you own multiple mutual funds and ETFs. You may be diversified in terms of owning multiple funds, but does that make you anymore diversified in terms of what stocks you own? You may be surprised to learn those multiple diversified funds own pretty much the same stocks. If so, your effort toward diversification efforts is sticking you with several unnecessary costs. It might be best to go with a broad market index fund such as the Vanguard Total Market Index (VTI) which sports a 0.07% expense ratio and provides you with all the diversification you need.

6) Not Contributing Because You Earn Too much

Another common Roth IRA mistake is thinking you earn too much to make a contribution. IRS regulations prohibit you from making a Roth IRA contribution if youre married filing jointly and earn over $183,000 or if youre single or head of household and earn over $125,000.

But that doesnt mean you should give up on making a contribution! If you earn too much to make a direct contribution to your Roth IRA, you can always make non-deductible contributions to a Traditional IRA, then convert your Traditional IRA to a Roth IRA. Since your Traditional IRA is funded with non-deductible contributions (meaning you already paid income taxes on those contribution dollars), performing a Roth IRA conversion wont trigger an income tax liability.

So even though you technically earned too much to make a Roth IRA contribution, for all intents and purposes, you just made one!

7) Thinking December 31st Is The Contribution Deadline

Many people make the mistake of thinking the end of the calendar year is also the Roth IRA contribution deadline. But the actual deadline is the same as the tax filing deadline April 15th in most years.

So if January comes around, and you only managed to contribute $4,000 of your $5,000 maximum annual Roth IRA contribution, its not too late. You still have until April 15th to contribute the remaining $1,000.

Conclusion

Avoid these seven common mistakes, and youll thank yourself in your retirement years. Why? Because youll have more money. Just a few pennies here and a few dollars there can add up to a substantial sum of money over long periods of time, so make sure you dont commit any of these mistakes when it comes to your Roth IRA.

www.your-roth-ira.com. the Web’s #1 resource for Roth IRA information. You can follow him on Twitter .

Last Edited: 14th November 2013