7 Invaluble Investing Principles from an Investing Legend

Post on: 22 Август, 2015 No Comment

7 Invaluble Investing Principles from an Investing Legend

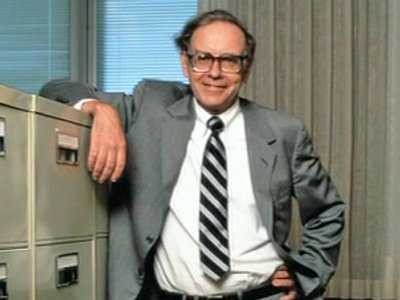

The late Walter Schloss might not be very well-known to the general public, but he is actually one of my favourite investors.

He was a colleague of Warren Buffett (the two became close friends over time) when they were both working for Benjamin Graham’s hedge fund, the Graham-Newman Partnership.

After Graham retired in the 1950s, Walter Schloss started his own fund and went on to amass an incredible track record over the next five decades.

When all was said and done, Schloss’ fund achieved a return of 16% a year (net of fees!) from 1955 to 2002 for its investors. To put that record into perspective, a $10,000 investment in his fund back in 1955 would have become more than $10 million in 2002.

I recently found an old document Schloss had written titled “Factors needed to make money in the stock market .” It contains 16 invaluable investing principles which Schloss had lived by. I had previously shared four of them – check them out here .

Here’re three other pieces of timeless advice from the same document by the legendary investor.

“Have the courage of your convictions once you have made a decision”

Often in investing, we might miss out on a great investment due to a lack of courage to act on our opinions.

The way around this problem is to have a strong process for analysing potential investments. A well-structured process will give us confidence in our analysis and thus allow us to be more comfortable in taking those much-needed leaps of faith to actually invest in our ideas.

“Try not to let your emotions affect your judgment. Fear and greed are probably the worst emotions to have in connection with the purchase and sale of stocks.”

As humans, it’s only natural for us to feel greed and fear.

During a bull market, it is not a good experience to see others making lots of money because of soaring stock prices that have deviated far from real business values while you’re just sitting there doing nothing.

But when it comes to investing, it is better to remind ourselves that it is a marathon and not a sprint. Sure, we might lose out over the short term, but if we are patient enough, we will likely do well over the long term if we have a good investment process that emphasizes the study of a share’s real business value and only investing when a share’s price is lower than that value.

It’s also not a good experience to be buying shares during a crash when everyone else is fleeing. But, it’s worth pointing out that market crashes are great times to get bargains because all that fear in the market tends to drive the prices of shares to levels lower than their business values. Land transport operator SMRT Corporation Ltd (SGX: S53) is a great example of how investors can profit when there’s fear surrounding a firm.

“Be careful of leverage. It can go against you.”

I have been talking about the dangers of leverage. So have my colleagues at the Motley Fool Singapore.

Thing is, leverage is a real double-edged sword. It can magnify your gains, or it can absolutely crush you. Through leverage, hedge funds with hundreds of millions of dollars at their disposal have also lost it all overnight .

James Montier once said, “Leverage can’t ever turn a bad investment good, but it can turn a good investment bad. When you are leveraged you can run into volatility, that impairs your ability to stay in an investment which can result in a permanent loss of capital.” Investing with excessive leverage is almost like swimming with a group of hungry sharks. Sure, it makes a great tale if you live through it. But what are the odds?

Foolish Summary

There are many great investors for us to learn from and Walter Schloss belongs to that group, in my opinion. Here’s the list of his 16 investing principles again. Go on, take a look. It’s fantastic.

For more investing analyses and important updates about the stock market, sign up to The Motley Fool Singapore’s free weekly investing newsletter, Take Stock Singapore. Written by David Kuo, it can help you grow your wealth in the years ahead.

Like us on Facebook to follow our latest hot articles.

The Motley Fool’s purpose is to help the world invest, better .

Get FREE Issues of TAKE STOCK

By submitting your email address, you consent to us keeping you informed about updates to our website and about other products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms of Service .

The information provided is for general information purposes only and is not intended to be personalised investment or financial advice. Motley Fool Singapore writer Stanley Lim doesn’t own shares in companies mentioned.

The late Walter Schloss might not be very well-known to the general public, but he is actually one of my favourite investors.

He was a colleague of Warren Buffett (the two became close friends over time) when they were both working for Benjamin Grahams hedge fund, the Graham-Newman Partnership.

After Graham retired in the 1950s, Walter Schloss started his own fund and went on to amass an incredible track record over the next five decades.