60Second Guide to Maximizing Your 401(k)

Post on: 23 Май, 2015 No Comment

You work hard — your employer-sponsored retirement plan should work hard, too. Over the next 60 seconds, we’ll show you how to get the most out of your 401(k).

0:60: Start Contributing

Let’s begin with the basics: The first step to maximizing your 401(k) is to actually contribute to it. Sounds obvious, yet studies show that millions of eligible employees do not participate in their 401(k) plans. So get that application from the folks in Human Resources, fill out the forms, and turn ‘em in.

0:52: Start Contributing. Even More!

If you’re already contributing, try to increase the amount you’re socking away. Since the money comes out of your paycheck before you pay taxes on it, the bite won’t be nearly as noticeable as you may fear.

0:44: Get the Full Benefit of Your Employer Match

Does your employer match a portion of your 401(k) contributions? If so, contribute at least as much as necessary to take full advantage of that benefit. This is free money, folks — F-R-E-E. Plus, the hundreds of dollars your employer contributes today will be worth thousands after a decade or two of growth. How can you pass that up?

0:36: Stock Up on Stock

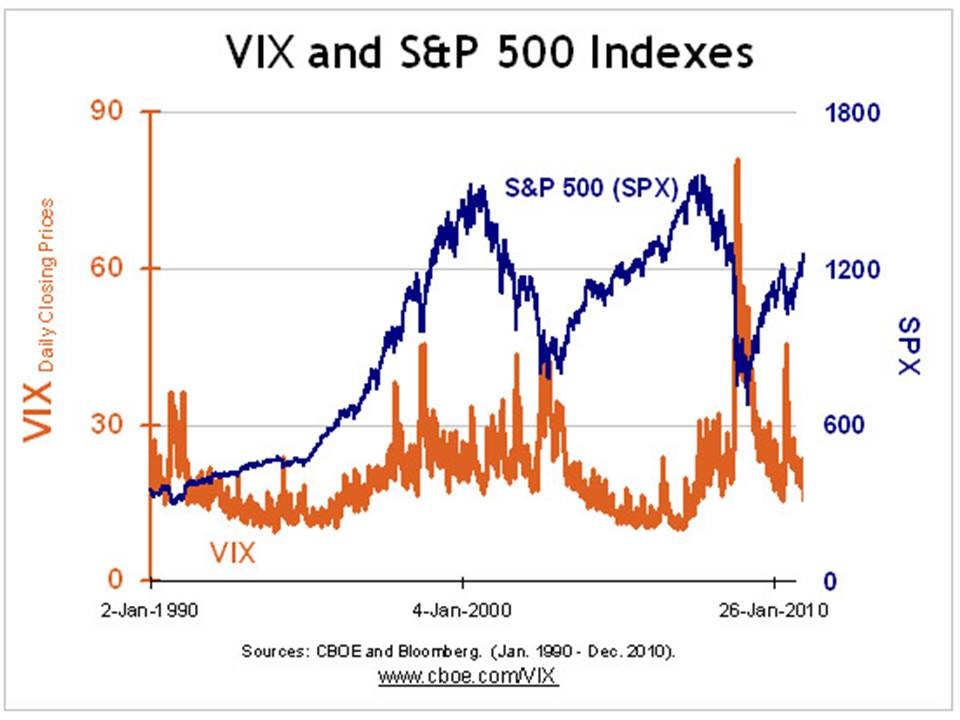

Most 401(k) plans offer investments in money market, bond, and stock mutual funds. According to Ibbotson Associates, from 1926-2000 the annual returns on those investments were 3.8%, 5.2%, and 11.2%, respectively. Historically, the stock market has been the biggest wealth-creating machine going. In the short term, however, the stock market can make a nest egg look like an omelet. That’s why stocks are only suitable for money that will be invested (and left alone!) for at least five years.

0:26: Pick the Right Mutual Fund

If you’re going to invest in the stock market, then probably your best bet is a whole-market (sometimes called total market) index fund or S&P 500 index fund. Index mutual funds simply attempt to match the performance of the overall market by buying the stocks in a specified index. That doesn’t sound too exciting, but matching the index is a thrill when you consider that 80% of actively managed mutual funds (i.e. mutual funds that pay a team of analysts to pick stocks) have historically underperformed the index.

0:18: Keep Sockin’ It Away

You’re going to get statements every quarter telling you how your 401(k) investments are doing. (Heck, you may even be able to check your account nine times daily online from your cubicle.) That’s great that you’re into it. just make sure that you don’t dip into it. This is money earmarked for your fabulous future. Consider it your nest egg and tend to it accordingly.

0:10: Take It With You

When you leave your job, this is one time when you can (and should) touch the money — but don’t cash out your account! You’ll end up paying a king’s ransom in taxes and penalties. Transfer it over into an IRA. (Hey! We have a 60-Second Guide on IRAs. too!) Your future self will thank you.

The secret to a toe-ticklin’ retirement is to save early and save often. Don’t delay! Use that 401(k) to full advantage. As the old saying goes, the key to financial success is not timing the market, it’s time IN the market.

Got a few extra minutes?

- Visit our 401(k) area for even more information.

- If you are about to change jobs — or still have a 401(k) with a former employer — consider transferring your 401(k) to a self-directed IRA. Here are the ins and outs of transferring or rolling over your 401(k).

- Visit the Broker Center to open an IRA account.