6 Mutual Funds To Hedge Against Recession

Post on: 4 Апрель, 2015 No Comment

By Jon the Saver 2 Comments

The word recession has investors searching for safe investments until the market rebounds. Just take a look at how the market has reacted recently. Investors want the maximum yield with the least risk involved. Luckily, options are available for investors to weather the storm until the economy improves.

Mutual or index funds are a collection of bonds, stocks or money market securities. These funds are popular choices for safer investments because they offer diversification. If one bond or stock performs poorly, another security’s stellar performance may balance the losses. Investing in a collection of securities creates a safety net for investors. In fact, a well-diversified portfolio can help you make money even while stocks are losing value .

Historically, investors can expect a typical total return of 8 percent to 9 percent over a year as a long-term average. Stocks, on the other hand, can yield 10% to 11%. Mutual and index funds are typically long term investments. Six of the best types of funds will be reviewed to help safeguard your finances.

Safest Investments

Federal Government Bond Funds

The most risk-averse investments are probably the federal government bond funds. U.S. Treasury bonds are considered safe because it is based on the government’s ability to print money and collect taxes. This eliminates most risk on behalf of a company and provides optimal protection. Even with the recent debt downgrade on the U.S. countries flooded into the Treasury market buying these securities for their safety.

Ginnie Mae mortgage-backed securities (MBS) are also considered safe investments because the securities are guaranteed by the Federal Housing Administration (FHA). Since they are securitized by the Government National Mortgage Association, they are considered safer than most investments. Including some mortgage-backed securities or federal government bonds in your mutual fund will provide more security.

Municipal Bond Funds

Municipal bond funds have a slightly higher risk than Federal Government Bond Funds. These bonds are listed by state and local governments and provide a high degree of safety to investors, because they are backed by the revenue-generating power of the issuing government. Include some municipal bonds in your mutual funds to increase your return, but maintain safety as well.

Taxable Corporate Bond Funds

If you are seeking a higher yield than federal government bonds, but less risk than stocks, taxable bond funds may be a good alternative. They do carry higher risk. However, with higher risk comes with higher yields. Investors should ask their financial advisors to recommend some high quality bonds to lower the risk associated with this type of investment. Corporate bondholders are ahead of stockholders when it comes to getting repaid due to bankruptcy.

Money Market Mutual Funds

Money market mutual funds are recommended for short term investments and provide a significant amount of security for investors. Money market mutual funds are recommended for investors that are not experienced and need a significant safety net to minimize losses. Consider money market mutual funds for diversification of your investment portfolio. But consider these basically a cash equivalent, because yields are very low, but the trade-off is the money is liquid.

Higher Risk Investments

These final securities are higher risk investments, but still considered generally considered safer than investing in just a few single stocks. Consider these investments for more aggressive returns with the benefit of diversification.

Dividends Funds and Large Cap Funds

Dividend funds are a safer way to make money while investing in the stock market. Investors experience less volatility while they focus on a steady growth by providing regular income in the form of dividends on top of capital appreciation. Consider dividends funds for a safer, but somewhat aggressive investment. Focusing on blue chip stocks is also safer than investing in smaller companies that may be slightly more volatile. Large cap stocks are typically less vulnerable to disastrous effects of an economic downturn. This will help to protect your portfolio in more difficult times in the stock market.

Hedge Funds

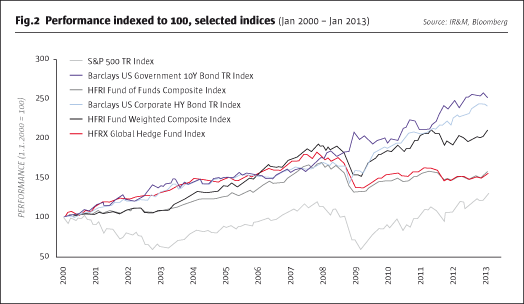

While not for everyone, hedge funds are designed to for people who want to make money no matter what the market is doing. Wealthy investors are often advised to invest a portion of their portfolio in hedge funds. These funds try to protect investors regardless of the market conditions. Consider hedge funds to diversify your portfolio, but only if you are very comfortable with the added risk and alternative investment types.

Investing during a recession is akin to building your portfolio at a discount. When the market rebounds, your investments will increase, and the foundation of your portfolio will be built on sound investments. Recession is not the only time that people consider more conservative investments. They are also considered when a person is nearing retirement. Diversification often provides the safe haven that retirees need. With a safe haven, they can enjoy their retirement.

Invest Like a Pro

For even more information, be sure to check out Jeremys free Invest Like a Pro eBook. It has a ton of great information to help you research investments, track your portfolio, and invest like a pro.