5 Ways to Protect Your Portfolio From a Correction (AFOP CLX GLD KRFT NFLX PG)

Post on: 28 Апрель, 2015 No Comment

It’s been nearly six months since the S&P 500 began its precipitous rise, and we have yet to even endure a 5% correction in that time. It might seem as if I’m regularly jumping on the bearish bandwagon, crying wolf when nothing seems wrong. But the stock market won’t rise forever, and a correction looks inevitable. Therefore, it pays to think ahead. Consider putting a few strategies in motion to protect your portfolio when a market downturn does occur.

Below, I’ve outlined five approaches that might help you weather the storm. Not every situation works for every individual, but chances are good that at least one of these strategies may make sense to you.

1. Consider gold

Uncertainty is a common cause for a stock market drop, and no commodity tends to respond more positively to the resulting flight to safety than gold. Gold represents a tangible investment that doesn’t evaporate during recessionary times — unlike corporate earnings. Unfortunately, finding investing success within the gold sector can be harder than winning at whack-a-mole, since many of these companies are still in the exploration stages of their existence.

One solution is the SPDR Gold Trust ( NYSE: GLD ). This exchange-traded vehicle holds physical gold, giving you the opportunity to profit from a rally in the underlying commodity without exposing yourself to the potentially fluctuating costs of individual mining companies.

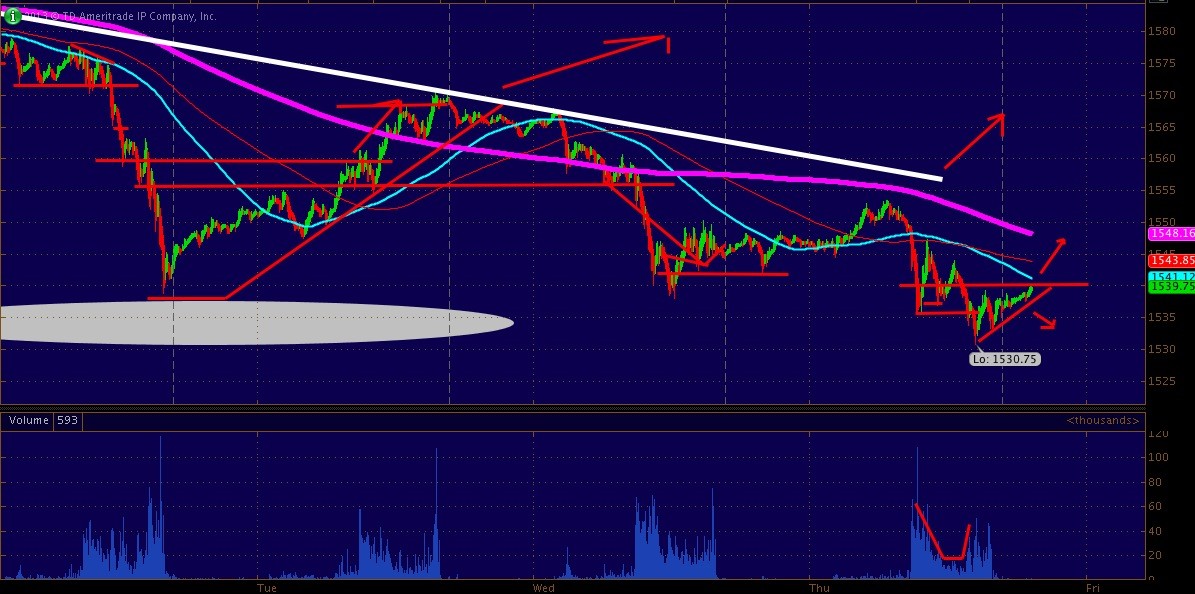

2. Make puts your friend

You might think that the best way to prepare for a market correction would be to sell stocks short. But as even I’ve learned, the market can stay irrational longer than you can stay solvent. Shorting a stock leaves you exposed to losses greater than your initial investment, yet offers a maximum return of only 100%. Instead, put options could be your best avenue to downside success. Buying put options risks only your initial investment, and gives you a return potential greater than 100%.

Put options can also provide a hedge against current long positions. Netflix ( Nasdaq: NFLX ) comes to mind as a possible put candidate, after its strong rally following better-than-expected earnings. Shareholders could hedge their bets by purchasing puts to offset losses in a general profit-taking pullback. Puts aren’t for novice investors, but those who feel comfortable with options may find this strategy very lucrative.

3. Use your easy button

History has proven that you have a greater return potential if you hold for the long term, as opposed to trying to time the market. Having a well-balanced portfolio could make the difference between enduring a portfolio hiccup or a monetary freefall. To help curb those freefalls, consider investing in low-beta consumer staples stocks.

Consumer staples usually have considerably smaller daily fluctuations, and their businesses often remain consistent even during weak economic times. Two companies that fit this description are Procter & Gamble ( NYSE: PG ) and Kraft ( NYSE: KFT ). Both companies have strong brand names with household appeal, and both have delivered healthy and growing dividends to shareholders. These companies’ products find their way off the shelves and into consumers’ homes regardless of market conditions.

4. Follow the money

Although I’d never advocate herd mentality, it does pay to keep an eye on what the most prominent investors are buying. Big investors Warren Buffett, George Soros, and Carl Icahn didn’t become billionaires overnight. Time after time, their impeccable ability to analyze businesses has often allowed them to spot trends before many other investors do.

Carl Icahn, for example, recently reported taking a 9% stake in Clorox ( NYSE: CLX ). citing what he believed was an undervalued business. Icahn is known for his active role as a venture capitalist; he’s made a habit of buying into troubled or stagnant companies that need potentially rigorous changes to turn them around. Clorox’s business has struggled under the weight of weakened consumer spending. but its dividend remains healthy. Perhaps Carl Icahn believes that Clorox’s brands can be reinvigorated, or possibly pieced out to a potential bidder. Either way, big money is flowing into Clorox, and investors should take notice.

5. Be patient

Finally, we come to what may be the most important thing you can do when preparing for a correction: Don’t panic when one actually does occur. Your financial hopes and dreams almost certainly won’t come crashing down, just because the indexes moved down 10%. Using sound judgment is paramount to your success as an investor.

To reduce your downside exposure, consider using trailing stops. These allow you to determine the level at which your stock will automatically be sold if it begins to head lower. Likewise, in a rising market environment like we’re in now, don’t be afraid to use limit buy orders, which are well below current prices.

Right now, I have my eye on Alliance Fiber Optic ( Nasdaq: AFOP ). which dove after reporting quarterly results that apparently fell short of some expectations. Its forecast appears strong, and strength in the fiber optic sector is unparalleled at present. But even after Alliance’s drop, its shares aren’t quite cheap enough for me. The level that I feel would make the stock a buy is just a bit lower.

My point? Don’t chase a stock higher. Make the values come to you.

Do you have a particular strategy you employ to protect your profits from corrections that I haven’t mentioned? Share your thoughts in the comments section below.

Fool contributor Sean Williams does not own shares in any companies mentioned in this article. You can follow him on CAPS under the screen name TMFUltraLong. Netflix is a Motley Fool Stock Advisor pick. Clorox and Procter & Gamble are Motley Fool Income Investor selections. Try any of our Foolish newsletter services free for 30 days . We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy .