5 Ways Roboadvisors Will Change the Way Advisors Work SEI s Practically Speaking SEI s

Post on: 16 Март, 2015 No Comment

The following is a guest blog post by Raef Lee, Managing Director for the SEI Advisor Network. In addition to writing tips for advisors on technology, Raef is responsible for exploring new services and markets for the SEI Advisor Network. Connect with him on LinkedIn now or follow him on Twitter: @SEIRaefL .

Even the name robo-advisor is derisive. It creates an image of uncaring, lack of humanity and inflexibility. It is the term that is now being broadly used by advisors to describe the new breed of technical startups (upstarts) that directly connect a technical-savvy investor with a suite of analytic tools that allow them to create their own financial plan or investment portfolio. A name this disparaging shows that advisors have some fear of this new model of financial advice.

There are three main types of robo-advisor:

- A pure technology website, devoid of advisors, that allows investors to do everything themselves (examples include Motif Investing and Jemstep)

- Companies that include advisors who use technology only (the internet) to communicate with their clients (such as Personal Capital and Learnvest)

- Established financial service companies that have recently expanded their online advice offering (such as Vanguard and Edelman Online)

The fear, uncertainty and doubt (FUD) has been fanned by all that has been written recently about these companies. The Wall Street Journal did a detailed piece focusing on the cost of robo-advisor services. Finovate has highlighted the venture funding behind these companies.

Whether you think that robo-advisors are the latest fad that will go away, or a vision of how financial advice will be given in the future, they will definitely disrupt and change the way that advisors interact with their clients.

What it means to you

In our research and discussions with advisors, these are the ways that robo-advisors are most likely to impact you:

- Increased fee pressure. Robo-advisors offer lower fees for technology-centric services. The feeling goes that this could set an expectation for lower fee expectations for younger investors.

- A call for transparency. Investors will want more transparent and appropriate fee structures. The emerging robo-advisor model is for a fixed fee for lower assets (say, under $100,000) and a basis point fee for larger assets (where the services provided are broader).

- Pressure to accommodate a younger generation. Robo-advisors will reach a younger, technically savvy, growth accumulating generation who may continue taking advice from the same source as they grow wealthier.

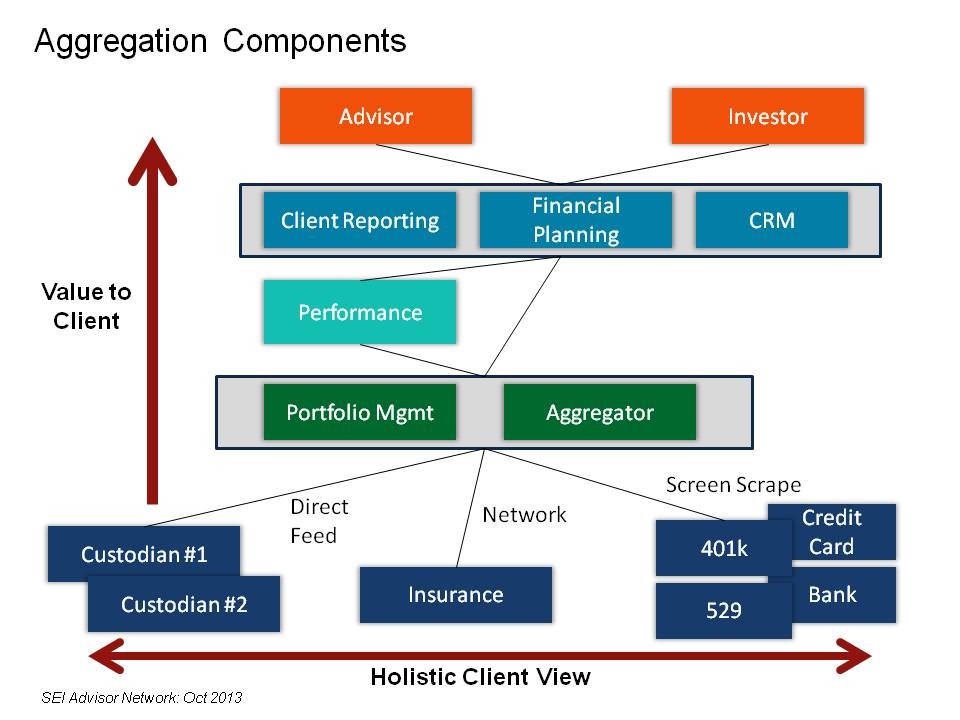

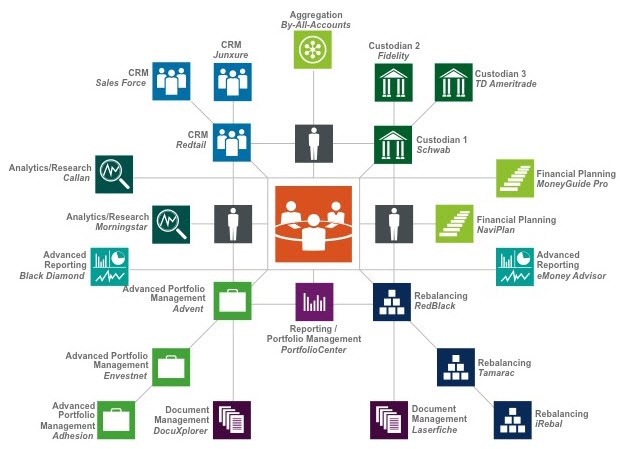

- More technology. Investors may increasingly demand that they interact with the advisor in the way they choose. This will include web conferencing, the ability to schedule time with an advisor online, and intuitive ways of working on documents together.

- Access to comparative data. Investors want information about how they are doing compared to their peers, and for their advisor to present other views (both expert and non-expert). This allows the investor to be better informed in the decision making of their financial plan.

Robo-advisor overview

These are early days for robo-advisors; the market is new, there are many entrants and several business models are being tried. Here’s an example of the current landscape:

Note that:

• As more advisor time is used and there is more investment management (bottom left quadrant), the fees rise. When more technology is used (top two quadrants), the fees decrease.

• Nearly all these companies are private; most are venture-funded and were founded less than five years ago.

• The cost of the service ranges from 200 bps (Edelman Online for assets under $150K) to zero (SigFig). However, very different services are included in the costs. One of the most interesting aspects of these companies is that their fees are transparent and clearly identified on their websites.

Across the pond

I talked to Ian McKenna who is the Lead Futurologist (I see a new title in my future) at the Finance & Technology Research Center (F&TRC) and writes for the influential British MoneyMarketing publication. He has researched the new companies in both the UK and the US. McKenna commented, “Only a handful of advice firms in the UK are embracing digital as a device delivery mechanism, due to the more restrictive regulatory environment. However, we are now tracking over 20 highly innovative next-generation advice services across America, which look destined to make high quality advice and guidance accessible to vast numbers of Americans who would previously have found such services unaffordable. ”

All this concern about robo-advisors brought me back to my favorite way of scaring myself growing up: watching Dr Who. I would hide behind the couch as the good doctor and his faithful sidekick would do battle with the latest threat to civilization. My most scary villain? The Cybermen. It looks like I haven’t progressed much…

So, should advisors be afraid? Robo-advisors will probably succeed in a new market, which has largely been ignored by advisors – young, high income, portfolio accumulators. Advisor sentiment to date has been: why go after someone with no money? Technology-centric solutions may make this client segment profitable.

Otherwise, advisors need not be nervous as long as they:

- Embrace the increased use of technology and social media that clients will increasingly expect in their advisor communication.

- Include younger advisors in succession planning who look like and connect with the next client generation.

Raef Lee

Raef Lee is the technology contributor for Practically Speaking and also serves as a managing director for the SEI Advisor Network.