5 Steps To Increase Your Net Worth By $25 000 Money After Graduation

Post on: 26 Июнь, 2015 No Comment

Step 1. Earn $50,000+ per year. I know this seems obvious, but youd be surprised how many people think they can get rich on tragically small salaries. Saving 30%+ of your income is fantastic but it wont increase your net worth by $25K if youre only bringing home $2,000 per month.

*Im sorry if this is bad news for people that dont make large enough salaries to aggressively grow your net worth. I do not have a magic formula to grow your net worth by $25K when you make $30K a year and have $28K of expenses. However, this doesnt mean your savings efforts are for naught. You should always strive to save as much as you comfortably can, and if you feel like its not enough, you have to look for a way to increase your income to accomplish your goals.

Related Post: The Logistics of how to ACTUALLY Increase Your Net Worth By $25,000 Per Year (includes a peek at my old paycheque!)

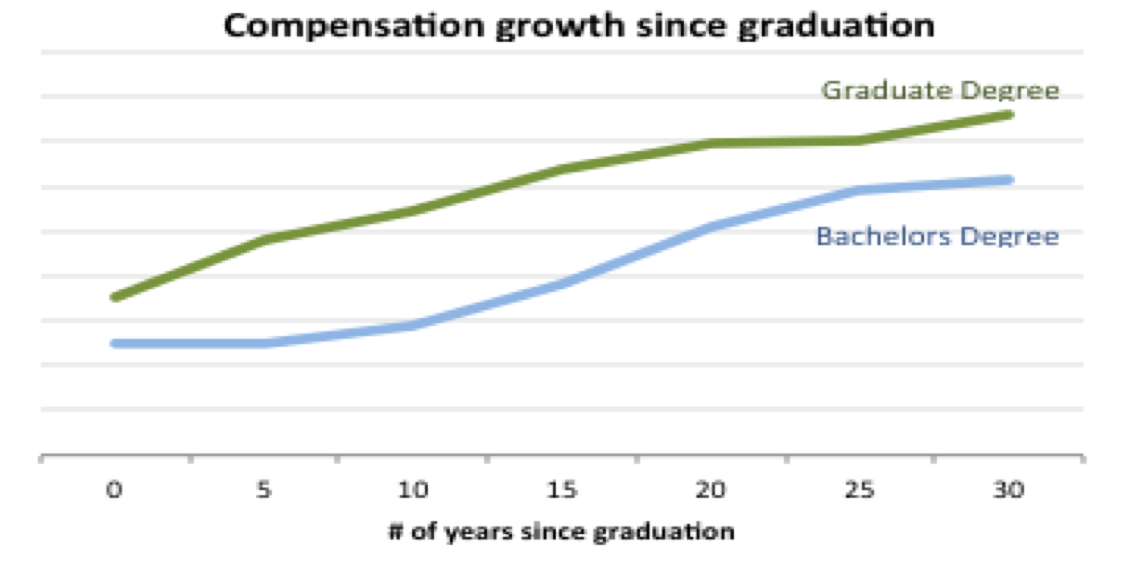

How I expect to achieve this: my starting salary at my first big girl job was $50,000 per year, and I received two raises in my time there before leaving to go back to school for my MBA. Im hoping my MBA warrants a higher starting salary, but in my mind my worst case scenario is going back to the salary I left. I also operate under the general assumption that I will make progressively more money every year of my career, making banking $25,000 in savings easier as time goes by.

Step 2. Aggressively kill debt. If youre carrying a balance on a credit card, their scary interest rates are eroding any wealth-building progress youre making. Not only does eliminating debt increase your net worth, it makes it easy to further increase your net worth by other means.

For example, for every $1,000 you owe at 15% interest, youre losing $150 per year. This means you actually have to pay $1,150 just to make your net worth budge $1,000. On the other hand, if you invest $1,000 at 3%, youre gaining $30 per year. The net worth difference between a -$150 drag and a +$30 boost is $180. Essentially this means that a debt-free person is already almost $200 ahead for every $1,000 in the net worth game than a person that has debt.*

*sidenote: this is super simplified math for the purpose of example only. Real numbers will different due to things like compounding and monthly payments, but the logic still stands.

How I expect to achieve this: Frankly, ever since debt and I broke up for good in July, Im trying not to go running back to its warm and comforting embrace, but if I do Im getting the hell out of it the second I see an open door.

Step 3. Save like crazy. To save $25,000+ per year, youre going to need to be willing to part with about $2,000 per month in the beginning. If this seems insane, I promise it looks a lot less intimidating broken down into different accounts and goals.

For example, a few of the things Im working on right now include building a $10,000 emergency fund in my TFSA and saving $25,000 in my RRSPs. When I work full time, Ill probably contribute $500 per paycheque to my TFSA and $400 per paycheque to my RRSPs. Assuming I get paid twice per month, this translates to $1000/mo into my emergency fund and $800/mo into my retirement accounts, boosting my net worth by $1,800 per month or $21,600 per year. Regularly contributing to my brokerage account will bring this total to my $25,000 savings goal.

How I expect to achieve this: These were my savings rates before I left my full-time job to go back to school for my MBA, and even though my income has been reduced, I keep the same proportion. In other words, Im used to 40% of my paycheque going towards my savings goals and as long as I keep this percentage with a bigger salary, my net worth will grow accordingly.

Step 4. Dont buy cars and houses. If you think my savings plan above looks crazy, its probably because youre carrying a ridiculously huge car payment or a mortgage. Im not surprised if youre balking at saving the required $2,000 per month for a $25K net worth increase when you spend $600 per month on car expenses. Im not saying dont have a car, especially if you actually cant be without one (and I mean ACTUALLY CANT BE WITHOUT ONE, not would-just-find-it-inconvenient-to-be-without-one), but I am saying dont have a car if its going to keep you from building wealth. A car is not an asset, a car is a money-hungry black hole much like a child except quieter and can be left unattended for long periods of time without consequence. As for a mortgage, I dont even want to touch this because I will want to go into super rant mode but I would STRONGLY discourage you from counting your home in monthly net worth calculations (annually or every 2-5 years makes more sense). I dont really care if your house is worth $450,000 now and 6 months ago it was valued at $400,000. Thats unrealized gains, its not money in the bank. Furthermore, its subject to the market, and Im not sure if youve noticed but the Canadian housing bubble is a real thing and were on the verge of getting f#$%ed. Sorry, guys. Lastly, making your monthly mortgage payment is doing very, very little for your net worth in the early years of home ownership since the bulk of it is going towards interest. You are running on a hamster wheel of a false sense of progress chasing a dangling carrot that is probably laced with cyanide. If you dont believe me, ask an American what it was like.

Full disclosure: I was born without the gene that makes all bright-eyed and bushy-tailed millennials reach for the holy grail of owning a home. I know that eventually I will grudgingly take on the burden of a mortgage, but it will be in my thirties and because its the only way I will be allowed to own a dog since renting with pets is basically impossible in my city.

How I expect to achieve this: I have no plans to purchase a car or home anytime in the next 5 years, because those are just things I dont want. Over the long term, even if I subscribe to car and home ownership, I will never count these items in my goal of increasing my net worth by $25K+ year over year. I will count them in my overall net worth calculations (in a seriously underestimated way) but they will have no bearing on the actual progress of increasing my net worth each year.

Step 5. Invest in income-generating assets. This means use your money to buy things that make you more money. I try to keep a relatively balanced portfolio, and Im partial to dividend stocks. More often than not, when I purchase a new investment, it will generate a monthly or quarterly payout (with the exception GICs and some mutual funds, which pay out annually). I always reinvest this income into more income-generating assets. The goal is to maximize passive income to relieve some of the net worth boosting duties of your salary. In my mind, the more money you can get without working, the better.

How I expect to achieve this: I started investing in stocks a few years ago, so my portfolio has had some time to start to pull its own weight. My current annual dividend income is a few hundred dollars per year, and it keeps growing. The more passive income I earn, the less Im required to save from my salary in order to meet my goal. For example, in Step 3 I outlined a plan to save $25,000 per year, but if Im earning $1,000 in dividends per year, I only have to save $24,000 per year and my net worth will still be increasing by $25,000 annually.

And there you go! Thats how Im doing it.