5 Simple Ways To Beat The Market Part 2 Of 5 Guggenheim S&P 500 Pure Value ETF (NYSEARCA RPV)

Post on: 16 Май, 2015 No Comment

Summary

- Investors should understand simple and easy to implement strategies that have been shown to outperform the market over long time intervals.

- The second of five strategies I will describe in a series of articles is the value factor that has seen high book-to-market stocks outperform over time.

- Investors reduced their equity exposure after the drawdown in 2008 and missed tremendous returns in value stocks.

- A rules-based index approach to value investing may help investors overcome these biases and capture the alpha inherent in value investing.

With yesterday’s article. this article, and three articles to follow over the next three business days, I will be showing readers five buy-and-hold approaches that have historically beat the market, providing absolute and risk-adjusted returns in excess of the most commonly used domestic equity benchmark — the S&P 500. All of these articles have already been penned, and I will be asking Seeking Alpha editors to release the remaining articles over the next several mornings (east coast U.S. time).

My first article in this series began by describing the tremendous improvement in access to financial markets for the average investor over time. Despite this reduction in barriers to stock market entry for the average investor, stock ownership is much less common among U.S. households than pet or gun ownership, and even less common than a Netflix or Hulu subscription.

From the very low levels of direct stock ownership (13.8% of U.S. families), I believe that some households should simply be looking to replicate the broad stock market gauge through low cost index funds. Novice individual investors can essentially tie the returns of the broad market less a very modest trading commission and an expense ration of 0.095%, or $0.95 on $1000.

Of course, the audience at Seeking Alpha is typically looking for strategies that not just approximate market returns, but those that outperform or achieve alpha. This series of articles describes five buy-and-hold strategies that have outperformed the market over the trailing twenty years. These strategies are factor tilts from the broader market, and I will describe, supported by academic research, why I believe these strategies have generated long-run alpha.

Value

In the first article in this series, I described the size factor, or why small-cap stocks tend to outperform large-cap stocks over long time intervals. The size factor is captured in the Fama-French Three Factor Model that helped earn Eugene Fama the Nobel Prize in Economics in 2013. Another of these factors is the value factor. The researchers noted that low market-to-book stocks tended to outperform high market-book stocks. Adding the size factor and value factor to the Capital Asset Pricing Model better describes the stock market performance than beta alone. Since we are trying to beat the general market, it makes intuitive sense that alpha would be found in a value factor that was used as a supplement to better describe overall returns.

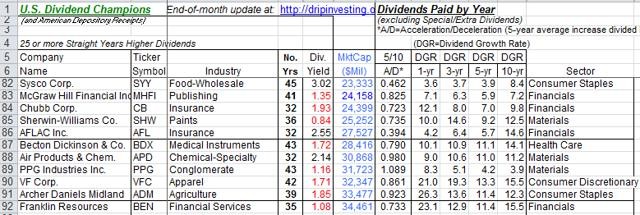

Our second way to beat the market, as proxied by the S&P 500, is then to simply buy value stocks. Below I have tabled the average returns of the S&P 500 Pure Value Index, and show the returns of this index graphed against the S&P 500. For more information on this style-concentrated index, please see the linked microsite. This index is replicated through the Guggenheim S&P 500 Pure Value ETF (NYSEARCA:RPV ) with an expense ratio of 0.35%. The S&P 500 Pure Value Index identifies constituents by measures of high levels of book value, earnings, and sales to the share price. In the five strategies I am detailing to beat the market, I will be using trailing 20 years of data, which is the longest time interval that encapsulated all of the relevant indices used in the analysis.

(click to enlarge)

Why does value investing work? Why has the S&P 500 Pure Value Index outperformed over this long sample period? Value investing has been extolled since the days of Benjamin Graham, and put into most visible practice by his pupil, Warren Buffett. Value investing necessitates understanding the difference between a stock that is valued too low by the market, and a stock that is a value trap because changes in the business or its industry have created a structural headwind. Value investors then need to have the fortitude to hold their investment when investor sentiment runs counter to their investment themes. On average, individual investors do not have these attributes.

In data from How America Saves, the fund giant Vanguard has published a wealth of data on defined contribution plans under its management. The table below shows participant contributions in Vanguard’s defined contribution plans over the trailing ten years. Investors should on average be taking a long-term view towards their retirement assets; however, investors owned their lowest percentage of equities in 2009 as markets rebounded from the 2008 downturn, missing a 26.5% total return for the S&P 500 and a tremendous 55.2% return for the S&P 500 Pure Value Index.

Source: Vanguard

In the four years that the S&P 500 produced a negative return in our twenty-year dataset, the value index produced a higher return in the following year. In the Vanguard data, retirement plan participants, who should be taking a long-term view towards their investments, were less likely to own equities after 2008. Value investing is a discipline, and the average investor is not suited to follow this approach, which may be why a low-cost, rules-based exchange-traded fund with a value bent like may be a good solution for some investors.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.