5 Reasons to Buy Oil Stocks Now

Post on: 16 Март, 2015 No Comment

Recent Posts:

5 Reasons to Buy Oil Stocks Now

After hitting a high of about $115 a barrel just a few months ago, crude oil is trading near one-year lows. Oil is down around $80 a barrel as a weakened global economy has put a damper on demand the 2010 low for crude was around $77 a barrel.

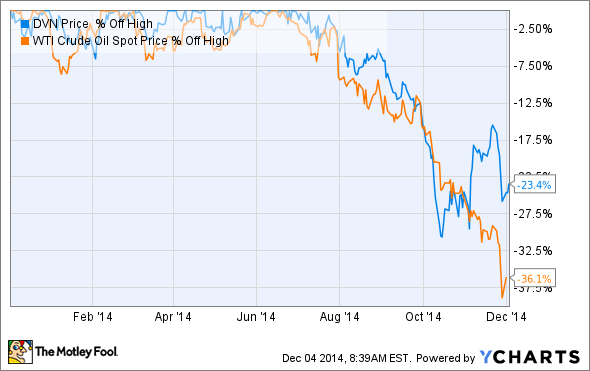

As a result, energy stocks have been held back this year. The broad-based iShares Dow Jones US Energy Sector ETF (NYSE:IYE ) is off over 12% year to date, more than twice as bad as the Dow Jones Industrial Average’s nearly 6% decline. While major oil stock Exxon Mobil (NYSE:XOM ) has “outperformed” its peers, XOM stock still is in the red since January 2011.

Despite these headwinds, investors with an eye for the long term should seriously consider jumping into the oil sector right now. Macroeconomic trends across the next few years really favor oil stocks as a long-term buy.

Here are five reasons to drill for profits in oil and energy stocks now:

Dividends, Dividends, Dividends

I have been harping on the power of dividend investing for a while as Treasuries offer meager yields and stable income investments continue to outperform the market. The power of a 3%-plus dividend cannot be understated and such a yield is the norm for many oil stocks. From Big Oil companies like Chevron (NYSE:CVX ) that offer 3.5% dividend yields to dividend-rich depletion trusts like the BP Prudhoe Bay Royalty Trust (NYSE:BPT ) or the Whiting USA Trust (NYSE:WHX ) that offer mammoth but wildly fluctuating dividends, there are a host of great income plays in the energy sector now. And as oil prices climb, those dividends will only get juicer.

Baseline Demand, With Future Growth

Yes, we haven’t seen surging demand for crude. But don’t confuse downward estimate revisions for a falling thirst for oil. The International Energy Agency reports that worldwide demand will rise by 1.2% (to 89.3 million barrels a day) this year and 1.6% (to 90.7 million barrels a day) next year. Yes, a global recession continues to take its toll. But even now demand is increasing. Just imagine what will happen once the economy turns a corner. Even if you believe that’s a year (or two or three) down the road, the baseline demand should give you incentive to buy in now before crude oil consumption jumps.