5 LowRisk Investments That Offer High Returns

Post on: 29 Март, 2015 No Comment

Conservative investors have been frustrated in recent years because low interest rates have left guaranteed instruments yielding virtually nothing. And while rates will undoubtedly rise again at some point, guaranteed instruments will never outpace inflation .

This creates a dilemma for many investors who seek a decent return on their money, but dont want to risk losing their principal. However, there are several investment options paying higher rates of interest than CDs and treasury securities with a very reasonable amount of risk. Those who are willing to explore some of these options can significantly increase their investment income without having to lie awake at night worrying whether their money will still be there in the morning.

Understanding Investment Risk

Types of Risk

One common mistake that many investors make is assuming that a given investment is either safe or risky. But the myriad of investment offerings available today often cannot be classified so simply.

There are several types and levels of risk that a given investment can have:

- Market Risk: The risk that an investment can lose its value in the market (applies primarily to equities and secondarily to fixed-income investments)

- Interest Rate Risk: The risk that an investment will lose value due to a change in interest rates (applies to fixed-income investments)

- Reinvestment Risk: The risk that an investment will be reinvested at a lower rate of interest when it matures (applies to fixed-income investments)

- Political Risk: The risk that a foreign investment will lose value because of political action in that country (holdings located in developing countries are particularly susceptible to this)

- Legislative Risk: The risk that an investment will lose value or other advantages that it offers because of new legislation (all investments are subject to this risk)

- Liquidity Risk: The risk that an investment will not be available for liquidation when it is needed (applies to fixed-income investments and real estate and other property that may not be able to be quickly sold at an equitable price)

- Purchasing Power Risk: The risk that an investment will lose its purchasing power due to inflation (applies to fixed-income investments)

- Tax Risk: The risk that an investment will lose its value or return on capital because of taxation (most investments are subject to this risk)

Fixed income investments, such as bonds and CDs, are typically subject to interest rate, reinvestment, purchasing power, and liquidity risk, while stocks and other equity-based investments are more vulnerable to market risk. And while a few investments, such as municipal bonds and annuities. are at least partially shielded from tax risk, no investment is safe from political or legislative risk.

Of course, the specific types of risk that apply to an investment will vary according to its specific characteristics; for example, investments that are housed inside a Roth IRA are effectively shielded from taxation regardless of all other factors. The level of risk that a given security carries will also vary according to its type, as a small-cap stock in the technology sector will obviously have a great deal more market risk than a preferred stock or utility offering.

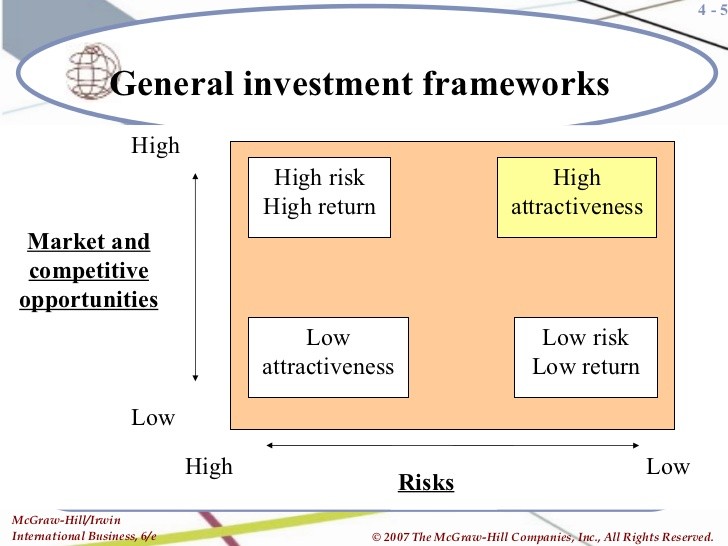

The Spectrum of Risk

In general, the level of risk that an investment carries corresponds directly with its potential rewards. With this in mind, the risk-to-reward investment spectrum can be broken down as follows:

- Safe/Low Return: CDs, treasury securities, savings bonds, life insurance (from highly rated carriers)

- Very Low Risk/Return: Fixed and indexed annuities. insured municipal bonds

- Low Risk/Return: Investment-grade corporate bonds (rated BBB or higher), uninsured municipal bonds

- Moderate Risk/Return: Preferred stocks, utility stocks, income mutual funds

- Medium Risk/Return: Equity mutual funds, blue-chip stocks. residential real estate

- High Risk/Return: Small and mid-cap stocks, small cap funds, and mutual funds that invest in certain sectors of the economy, such as technology and energy

- Speculative/Aggressive Return: Oil and gas investments. limited partnerships, financial derivatives. penny stocks. commodities

Understanding where different types of investments fall in the risk-to-reward spectrum can help investors identify opportunities to seek greater returns while still maintaining a modicum of safety. Moreover, by being aware of the particular type of risk an investment is exposed to, investors can make better decisions on what is appropriate for their situation and portfolio.

Very Low- to Moderate-Risk Investments

There is no such thing as a risk-free investment all investments, including those that are guaranteed to return principal, carry some sort of risk. But those who are willing to venture into the low- to moderate-risk category of investments can find substantially better yields than those offered in the safe category.

There are a number of good choices in these categories:

1. Preferred Stock

Preferred stock is a hybrid security that trades like a stock but acts like a bond in many respects. It has a stated dividend rate that is usually around 2% higher than what CDs or treasuries pay, and usually trades within a few dollars of the price at which it was issued (typically $25 per share).

Some of the other characteristics of preferred stock include:

- Preferred offerings usually pay monthly or quarterly, and their dividends can qualify for capital gains treatment in some cases.

- Preferred stock also has very little liquidity risk, as it can be sold at any time without penalty.

- The main types of risk that preferred stock carries are market risk and tax risk.

There are a few types of preferred stock:

- Cumulative Preferred. Accumulates any dividends that the issuing company cannot pay due to to financial problems. When the company is able to catch up on its obligations, then all past due dividends will be paid to shareholders.

- Participating Preferred. Allows shareholders to receive larger dividends if the company is doing well financially.

- Convertible Preferred. Can be converted into a certain number of shares of common stock.

Most preferred issues are also graded by credit ratings agencies. such as Moodys and Standard & Poors. and their default risk is evaluated in the same manner as for bonds. If the issuer of a preferred offering is very stable financially, then it will receive a higher rating, such as AA or A+. Lower rated issues will pay a higher rate in return for a higher risk of default.

Preferred shareholders can also count on getting their money back from the issuer before common stockholders if the company is liquidated, but they also do not have voting rights.

2. Utility Stock

Like preferred stock, utility stocks tend to remain relatively stable in price, and pay dividends of about 2% to 3% above treasury securities. The other major characteristics of utility stocks include:

- Utility stocks are common stocks and come with voting rights.

- Their share prices are generally not as stable as preferred offerings.

- They are noncyclical stocks, which means that their prices do not rise and fall with economic expansion and contraction like some sectors, such as technology or entertainment. Because people and businesses always need gas, water, and electricity regardless of economic conditions, utilities are one of the most defensive sectors in the economy.

- Utility stocks are also often graded by the ratings agencies in the same manner as bonds and preferred issues, are fully liquid like preferred stocks, and can be sold at any time without penalty.

- Utility stocks typically carry slightly higher market risk than preferred issues and are also subject to taxation on both dividends and any capital gains .

3. Fixed Annuities

Fixed annuities are designed for conservative retirement savers who seek higher yields with safety of principal. These instruments possess several unique features, including:

- They allow investors to put a virtually unlimited amount of money away and let it grow tax-deferred until retirement.

- The principal and interest in fixed contracts is backed by both the financial strength of the life insurance companies that issue them, as well as by state guaranty funds that reimburse investors who purchased an annuity contract from an insolvent carrier. Although there have been instances of investors who lost money in fixed annuities because the issuing company went bankrupt, the odds of this happening today are extremely low, especially if the contract is purchased from a financially sound carrier.

- In return for their relative safety, fixed annuities also pay a lower rate than utility or preferred stocks; their rates are generally about 0.5% to 1% higher than CDs or treasury securities. However, some fixed annuity carriers will also offer a higher initial rate, or teaser rate, as a means of enticing investors.

- There are also indexed annuities that can give investors a portion of the returns in the debt or equity markets while guaranteeing principal. These contracts can provide an excellent return on capital if the markets perform well, while they may only offer a small consolation gain under bearish conditions.

- Annuities resemble IRAs and qualified plans in that they grow tax-deferred with a 10% penalty for withdrawals taken before age 59 1/2. And like IRAs and other retirement plans, all types of annuity contracts are unconditionally exempt from probate and also protected from creditors in many cases.

- The major risks that come with annuities are liquidity risk (due to the early withdrawal penalty, and also any surrender charges levied by the insurance carrier), interest rate risk, and purchasing power risk.

4. Brokered CDs

This type of CD can be an attractive option for ultraconservative investors who cannot afford to lose any of their principal. These instruments have the following features:

- Although they do not pay rates as high as preferred or utility stocks, brokered CDs can pay significantly more than their counterparts that are sold by personal bankers.

- Brokered CDs are issued like bonds and trade in a secondary market, but are still insured by the FDIC provided that they are held until maturity. If the CDs are sold before then, then the investor may get less than their face value in the secondary market.

- Many brokerage firms sell this type of CD. For example, Edward Jones has used brokered CDs to attract customers from banks who were seeking higher yields.

- Brokered CDs carry the liquidity risk that comes with any other type of bond and are subject to taxation.

5. Bond and Income Mutual Funds and Unit Investment Trusts (UITs)

Investors seeking higher yields would be wise to consider many of the bond mutual funds or other income-oriented mutual funds or UITs that are now available. These vehicles have a different set of advantages and disadvantages from the individual offerings listed above:

- Income funds invest in a wide range of income-producing instruments, such as bonds, mortgages, senior secured loans, and preferred and utility stocks. The diversification and professional management they offer lessens the market and reinvestment risks found in individual securities. The combination of different classes of securities, such as bonds and preferred stocks, can also combine to provide a superior payout with less risk than individual offerings.

- Investors have a wide range of choices when it comes to income funds. There are hundreds, if not thousands, of income funds available today investors should know exactly what they are looking for and do their homework before investing in one. Some funds are very conservative, investing only in things like cash instruments and treasury securities, while others are much more aggressive and look to junk bonds and mortgage-backed securities to provide a high level of income. Funds that invest solely in utility stocks can also be considered income funds, although they may have growth as a secondary objective. But those who are considering utility stocks can also diversify with a utility fund or UIT.

- Exchange-traded funds are the newest player on the block. These instruments resemble UITs in that they are a packaged group of preselected securities, but unlike traditional UITs they trade daily in the markets like stocks and can be bought and sold in intraday trading. Many ETFs are also geared to produce income using the strategies described above.

- Income funds offer market risk, reinvestment risk, and tax risk in most cases. They can also have political risk for international funds, and purchasing power risk from conservative funds.

Morningstar.com can provide objective information on the characteristics, risks, management style, and performance history of most funds as well as compare each one to its peers.

Final Word

Investors who seek income have several alternatives to choose from that can offer superior payouts with minimal risk. It is important to understand that there is no such thing as a truly risk-free investment but that different investments carry different types of risk. However, those who are willing to consider conservative to moderate income-producing alternatives that are not guaranteed for principal can receive a higher payout than what traditional banks can offer. For more information on income-producing investments, consult your financial advisor .

What are your favorite investment options with low to moderate risk?