5 Funds to Fight Inflation FMD Capital Management

Post on: 1 Апрель, 2015 No Comment

Written by David Fabian, May 16th, 2014

Judging by the price action and performance of conventional inflation hedges over the last 12 months, it appears the investing public’s worries over inflation are nearly non-existent. After all, the Federal Reserve’s unprecedented transparency has already led every market participant to believe they will spring into action if and when inflation begins to rise above the 2% threshold.

However, if history has taught us anything, it’s that the market has a way of deceiving the vast majority of the investing public. With that in mind, it’s prudent to establish a watch list and then periodically review the best options to hedge inflationary pressures. Even if these hazards lay further out in the future than what the market is currently discounting.

There is no way to know which individual inflation-linked asset or hedges will perform best when the consumer-price or producer-price index begins to rise significantly. Luckily there a several mutual fund and ETF options that offer diversified baskets of assets such as: Treasury inflation-protected securities (TIPS), precious metals, soft commodities, stocks, and real estate investment trusts (REITs). Developing a game plan and then preparing to implement any one of these strategies within your portfolio could prove to be a valuable in protecting your purchasing power over the long term.

Fidelity Strategic Real Return

The Fidelity Strategic Real Return Fund (FSRRX) is a diversified strategy designed specifically to utilize a multi sector approach to targeting assets that will increase in value when inflation is on the rise. More specifically, the fund is made up of roughly 30% U.S. government issued TIPs and 25% floating rate notes which track the direction of LIBOR over time.

Furthermore, 25% of the fund is dedicated to commodity-linked notes whose performance is directly tied to the Dow Jones AIG Commodity index, which has been shown to positively correlate with CPI. Lastly, the final 20% is dedicated to preferred stocks and common stock issued by REITs, in addition to agency and non-agency mortgage backed securities.

The asset allocation of the fund is constructed to take advantage of the differing nature of many of these asset classes, which when combined offset each other to form a low volatility solution for inflation adjusted returns. The fund carries an expense ratio of 0.77%, and is sitting on unrealized gains of 5.87% year-to-date, outpacing the S&P 500 Index by a fair margin.

PIMCO Real Return Asset

The PIMCO Real Return Asset Fund (PRAIX) is a specialized portfolio dedicated to investments in inflation indexed securities globally. Although its portfolio is currently majority weighted to U.S. Inflation linked assets, it carries small positions in other sovereign issues from countries such as: Germany, Australia, New Zealand, Italy, and Brazil. Furthermore, it has modest holdings in other key areas such as agency and non-agency mortgage backed securities, floating rate notes, and asset backed securities.

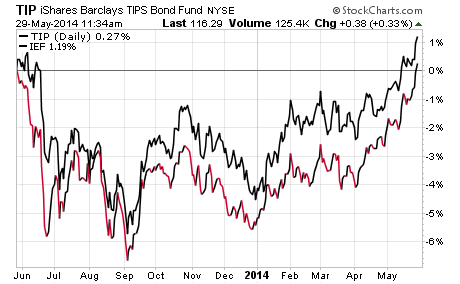

For individual investors, one of the single largest concerns with owning TIPs securities as a long-term inflation hedge is their high duration and therefore high volatility in relation to changes in interest rates. With the prospect of rising interest rates often labeled as an imminent threat, it’s important to note that the single largest differentiator PRAIX exhibits when compared to an index product such as the iShares TIPS Bond ETF (TIP) is its extensive use of interest rate swaps and futures to control duration and thereby subdue volatility.

This Morningstar five-star rated fund carries an expense ratio of 0.55%, and is currently up 8.72% so far this year, outpacing both its benchmark, and TIP by a considerable margin.

Permanent Portfolio Fund

When it comes to fighting inflation, one of the longest standing mutual funds dedicated to the cause is the Permanent Portfolio Fund (PRPFX). This fund has been focused on preserving purchasing power since 1982 by investing in a diversified portfolio of non-correlated assets that provide low volatility and international exposure.

The underlying sector allocation includes 25% in precious metals, 10% Swiss government bonds, 15% aggressive growth stocks, 15% REIT and natural resource stocks, and 35% short-term Treasury and investment grade bonds. PRPFX charges a net expense ratio of 0.69% and currently controls more than $8.6 billion in total assets.

As its name suggests, PRPFX is designed to be an “all weather” strategy that exists as a permanent core holding in the context of a diversified portfolio. The majority of the investments in the fund are geared towards traditional inflationary hedges that tend to perform well during periods of rising consumer prices.

Because of the non-correlated nature of the varying investment themes, this fund will often times go through periods of slow growth. This is particularly true when inflationary expectations are largely contained. However, that same diversification keeps volatility low and contributes to high profit potential during favorable economic cycles.

IQ Real Return ETF

If your goal is to beat inflation, the IQ Real Return ETF (CPI) may be just the right fit. This exchange-traded fund is based on a passive investment approach that selects its underlying securities according to a rules-based methodology developed by the ETF sponsor. The goal of CPI is to provide a “real return” above the rate of inflation as measured by the Consumer Price Index.

CPI is structured as a “fund of funds” that purchases other ETFs as its core portfolio holdings. The majority of the current asset allocation is geared towards short-term treasury bonds with some limited exposure to both domestic and international equities. The end result is a low volatility portfolio of conservative positions with intra-day liquidity and transparency.

Since the fund was released in 2010, the annual returns have been relatively tepid at just over 1% per year. However, during that time frame, consumer prices have been moderated by sluggish economic growth and aggressive quantitative easing efforts. In a true inflationary environment, this ETF has the ability to shift its underlying holdings to include commodities, real estate, and foreign currencies in addition to stocks and short-term bonds.

It is certainly one to watch when the inflationary pressures take hold once again.

iPath Dow Jones-UBS Commodity Index Total Return ETN

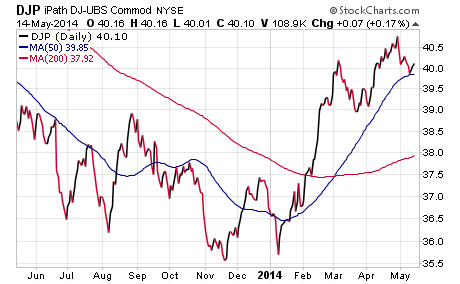

The last weapon in my inflationary arsenal is the iPath Dow Jones-UBS Commodity Index Total Return ETN (DJP). This broad-based commodity exchange-traded note tracks 19 liquid futures contracts that include energy, agriculture, precious metals, and livestock. DJP charges an annual expense ratio of 0.75% and has over $1.7 billion in total assets under management.

Rising commodity prices are often times a leading indicator of inflationary activity as these components make up the base materials for finished consumer goods. The performance of commodity prices can also be affected by seasonal consumption and weather patterns that result in a low correlation to traditional stock and bond investments.

While commodity prices have undergone several years of persistent declines, they have rebounded significantly in 2014 which may be a precursor to higher consumer prices. Investing in commodity prices is one way to retain purchasing power when inflationary pressures set in.

DJP is my preferred method of investing directly in commodities because you sidestep any adverse tax consequences of traditional ETF structures .

Each of these funds represents a unique and diversified way to play the inflationary theme in your investment portfolio. However, choosing the right fun will depend largely on your existing asset allocation, objectives, and risk tolerance. As always, having a disciplined strategy and implementing it decisively will produce superior results.

Looking for additional income ETFs and mutual fund strategies? Download our latest strategic income special report here .

This article originally appeared on Investorplace.com