5 Dividend Growers With A Low PEG Ratio

Post on: 9 Июль, 2015 No Comment

I have searched for highly profitable stocks that pay rich dividends, and their last dividend declared is greater than the last dividend paid. Those stocks would also have to show a very low P/E ratio and a very low PEG ratio.

I used the Portfolio123’s powerful screener to perform the search. The screen’s formula requires all stocks to comply with all following demands:

- The stock does not trade over-the-counter (OTC).

- Price is greater than 1.00.

- Market cap is greater than $100 million.

- Dividend yield is greater than 3%.

- Last dividend declared is greater than the last dividend paid.

- Total debt to equity is less than 1.00.

- Trailing P/E is less than 15.

- Forward P/E is less than 15.

- PEG ratio is less than 1.10.

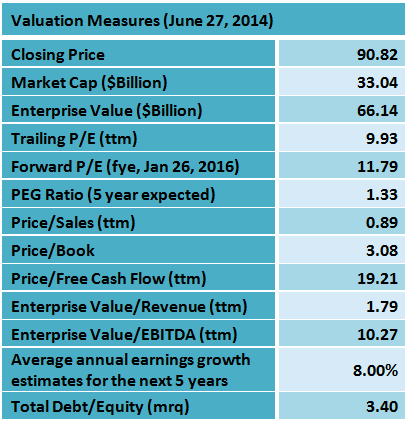

After running this screen on December 22, 2013, only five stocks came out, as shown in the charts below. In my opinion, these stocks can reward an investor a significant capital gain along with a nice income. I recommend readers to use this list of stocks as a basis for further research. All the data for this article were taken from Yahoo Finance, Portfolio123 and finviz.com.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

Ensco plc (NYSE:ESV )

Ensco plc provides offshore contract drilling services to the oil and gas industry worldwide.

See my article from December 19, 2013.

(Click to enlarge)

Chart: finviz.com

HSBC Holdings plc (NYSE:HSBC )

HSBC Holdings plc provides various banking and financial products and services. HSBC Holdings plc was founded in 1865 and is headquartered in London, United Kingdom.

HSBC Holdings has a very low trailing P/E of 12.48 and a very low forward P/E of 12.92. The price to book value is at 1.20, and the price-to-cash ratio is extremely low at 0.35. The PEG ratio is very low at 0.82, and the average annual earnings growth estimates for the next five years is quite high at 13.90%. The forward annual dividend yield is quite high at 3.74%, and the payout ratio is only 42%.

HSBC Holdings has recorded strong EPS and negative revenue growth during the last three years, as shown in the table below.

On November 04, HSBC Holdings reported its third-quarter financial results.

Third-Quarter Highlights

Reported profit before tax up 30% in the third quarter of 2013 at US$4,530m compared with US$3,481m in the same period in 2012

Underlying profit before tax was US$5,056m, up 10% in 3Q13, compared with US$4,603m in 3Q12.

Reported PBT for nine months to 30 September 2013 up 15% at US$18,601m, US$2,383m higher than in the same period in 2012.

Underlying PBT for the nine months to 30 September 2013 up 34% at US$18,145m, US$4,640m higher than the prior year period.

Earnings per share and dividends per share for the nine months to 30 September 2013 were US$0.71 and US$0.30, respectively, compared with US$0.58 and US$0.27 for the equivalent period in 2012.

Annualised return on equity 1.5 ppt higher — nine months to 30 September 2013 annualised return on average ordinary shareholders’ equity (‘RoE’) was 10.4% compared with 8.9% in the equivalent period in 2012.

Our home markets of UK and Hong Kong contributed more than half of the Group’s underlying PBT in the quarter and year to date. We expect both to see GDP growth in 2014 over 2013.

Stable revenue — 3Q13 underlying revenue of US$15,588m was broadly unchanged compared with US$15,661m in 3Q12. Notwithstanding this, we achieved broad-based revenue growth in Hong Kong.

Lower 3Q13 underlying operating expenses — 3Q13 underlying operating expenses were US$9,572m, down 4% from US$9,952m in 3Q12. Excluding notable items, operating expenses increased reflecting higher investment expenditure, wage inflation and litigation and regulatory-related costs.

Maintained momentum in sustainable savings — during 3Q13 we achieved US$0.4bn of additional sustainable cost savings across all regions, taking the annualised total to US$4.5bn since the start of 2011. This exceeds our target for the end of 2013.

Further progress on capital generation but regulatory uncertainty remains — our core tier 1 ratio was 13.3% and our common equity tier 1 ratio was 10.6% in 3Q13.

HSBC Holdings has compelling valuation metrics and strong earnings growth prospects. In my opinion, HSBC stock can move higher. Furthermore, the rich dividend represents a nice income.

(Click to enlarge)

Chart: finviz.com

Maiden Holdings, Ltd. (NASDAQ:MHLD )

Maiden Holdings, Ltd. through its subsidiaries, provides reinsurance solutions to regional and specialty insurers primarily in the United States and Europe.

See my article from December 19, 2013.

(Click to enlarge)

Chart: finviz.com

LyondellBasell Industries NV (NYSE:LYB )

LyondellBasell Industries N.V. manufactures and sells chemicals and polymers; refines crude oil; produces gasoline blending components; and develops and licenses technologies for the production of polymers. The company was founded in 2005 and is based in Rotterdam, the Netherlands.

(Click to enlarge)

LyondellBasell Industries has a very low trailing P/E of 13.55 and a very low forward P/E of 10.98. The PEG ratio is low at 1.05, and the average annual earnings growth estimates for the next five years is quite high at 9.73%. The forward annual dividend yield is quite high at 3.05%, and the payout ratio is only 31%.

The LYB stock price is 2.03% above its 20-day simple moving average, 3.02% above its 50-day simple moving average and 15.34% above its 200-day simple moving average. That indicates a short-term, a mid-term and a long-term uptrend.

Analysts recommend the stock. Among the 19 analysts covering the stock, four rate it as a strong buy, eleven rate it as a buy, and four rate it as a hold.

LyondellBasell Industries has recorded strong EPS and revenue growth during the last three years, as shown in the table below.

LyondellBasell returns value to its shareholders by stock buyback and by increasing dividend payments, as shown in the chart below.

(Click to enlarge)

Source: company presentation December 11, 2013

On October 29, LyondellBasell reported its third-quarter financial results.

Third-Quarter 2013 Highlights

- Diluted earnings per share of $1.51; $854 million income from continuing operations

- EBITDA of $1,531 million

- Solid earnings and cash flow continued, supported by reliable operations and favorable crude oil and natural gas environment

- Completed scheduled maintenance turnaround at Clinton ethylene and polyethylene facility

- 13.5 million shares repurchased during the quarter

LyondellBasell Industries has recorded strong revenue and EPS growth, and considering its cheap valuation metrics, its good earnings growth prospects, and the fact that the stock is in an uptrend, LYB stock can move higher. Furthermore, the rich growing dividend represents a nice income.

Gladstone Investment Corporation (NASDAQ:GAIN )

Gladstone Investment Corporation is a business development company specializing in buyouts recapitalizations, and changes in control investments.

See my article from December 19, 2013.