5 Blue Chip Stocks To Buy For The Next 5 Years

Post on: 12 Апрель, 2015 No Comment

The Gist

The stocks covered in this article are the top five Dow Jones Industrial Average (NYSEARCA:DIA ) large cap or better stocks according to five year EPS growth projections. The Home Depot, Inc. (NYSE:HD ) has the highest with an expected increase of 14.19% over the next five years while Intel Corporation (NASDAQ:INTC ) has the least, yet still substantial, at 11.75%. See chart below.

Furthermore, these stocks are considered blue chips. A blue chip is a stock in a corporation with a national reputation for quality, reliability and the ability to operate profitably in good times and bad. Typically they pay dividends and are less volatile than the market.

There may be an uptick in volatility in front of us with the markets at all-time highs and another Washington debt ceiling showdown on the horizon in May. This may be an ideal time to rotate out of more speculative names and into these blue chip opportunities.

The Goods

In the following sections, we will perform a review of the fundamental and technical state of each company to determine if this is the right time to start a position. The following table depicts summary statistics and Tuesday’s performance for the stocks.

The company is trading 4% below its 52-week high and has 3% potential upside based on a consensus mean target price of $12.42 for the company. BAC was trading Tuesday at $12.03, down almost 1% for the day.

Fundamental Review

Fundamentally, BAC has several positives. The company has a forward P/E of 9.35. BAC has a net profit margin of 5.03%. BAC is trading for approximately 55% of book value. Insider ownership is up by 33% over the last six months. EPS next year is expected to rise by 30% and the company pays a dividend with a yield of .33%.

Technical Review

Technically, BAC is in a solid uptrend. The coveted golden cross was fulfilled earlier this year. The stock has been in a solid uptrend since mid-July. The stock is currently trading above all three major support levels. The stock is technically solid here.

My Take

Bank of America has a fortress balance sheet. BAC’s success at cutting costs, improved capital position and the likelihood of higher capital returns are all huge positives going forward. The revived housing market should underpin the stock as well. BAC just passed the Fed stress test. On Thursday BAC will announce its capital return plans. The news should boost the stock to new heights.

The company is trading 20% below its 52-week high and has 24% potential upside based on a consensus mean target price of $111 for the company. CAT was trading Tuesday at $89.66, down almost 2% for the day.

Fundamental Review

Fundamentally, CAT has several positives. The company has a forward P/E of 9.69. CAT has a net profit margin of 8.66%. CAT has a PEG ratio of .77. EPS next year is expected to rise by 17% and the company pays a dividend with a yield of 2.28%.

Technical Review

Technically, CAT is currently trading at the bottom of the uptrend channel. The coveted golden cross was fulfilled earlier this year. The stock has been in a solid uptrend since mid-July. The stock has pulled back recently and is close to being oversold with an RSI of 37.

My Take

I feel the recent weakness in CAT has been overdone. China will drive CAT higher as global growth improves. The stock is fundamentally sound and I see this as a buy the dip opportunity. The 2% dividend yield doesn’t hurt either.

The company is trading 1% below its 52-week high and has 7% potential upside based on a consensus mean target price of $60.79 for the company. DIS was trading Tuesday at $57.10, down almost 1% for the day.

Fundamental Review

Fundamentally, DIS has several positives. The company has a forward P/E of 14.86. DIS has a net profit margin of 14.22%. DIS has a PEG ratio of 1.52. EPS next year is expected to rise by 12% and the company pays a dividend with a yield of 1.30%.

Technical Review

Technically, DIS is currently trading at the top of the uptrend channel. The stock has been in a solid uptrend since taking a precipitous drop in mid-November. The stock is near the overbought range with an RSI of 69.

My Take

I posit Disney’s purchase of Lucasfilm was a smart move. The last three Star Wars movies brought in $2.5 billion. With the upcoming three new movies being shown at higher ticket prices, they could bring in even more revenue. This bodes well for the stock. The fundamentals look solid, yet I would wait for the stock to cool off some prior to starting a position.

The Home Depot, Inc.

The company is trading 1% below its 52-week high and has 3% potential upside based on a consensus mean target price of $72.90 for the company. HD was trading Tuesday at $70.75, down almost 1% for the day.

Fundamental Review

Fundamentally, HD has several positives. The company has a forward P/E of 17. HD has a net profit margin of 6.22%. HD has a PEG ratio of 1.68. EPS next year is expected to rise by 16% and the company pays a dividend with a yield of 1.63%.

Technical Review

Technically, HD is currently trading at the top of the uptrend channel. The stock has been in a solid uptrend since June of last year. The stock is near the overbought range with an RSI of 65.

My Take

HD is a gold mine. The resurgence of the housing market will continue to propel the stock higher. Nevertheless, wait for a pullback to start a position. The stock is trading at the top of the uptrend channel and is showing signs of being overbought with an RSI of 65.

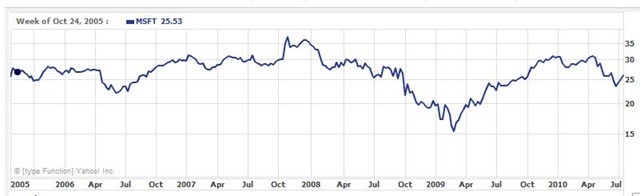

Intel Corporation

The company is trading 24% below its 52-week high and has 6% upside potential based on the consensus mean target price of $22.96 for the company. Intel was trading Tuesday for $21.62, down slightly for the day.

Fundamental Review

Fundamentally, Intel has some positives. The company has a forward P/E of 10.28. Intel pays a dividend with a yield of 4.15%. The company has a net profit margin of 20.63%. The company is trading for slightly over two times book value and has a PEG ratio of .87.

Technical Review

Technically, the stock is in a long-term downtrend, yet has rallied back recently after missing earnings on January 17th. The stock has reversed direction but still needs to break through $23 to confirm a full reversal.

My Take

Intel has taken a beating recently due to the waning demand for PCs. Nevertheless, I wouldn’t count them out. Intel has the wherewithal to transition into the new age of tech. According to a recent Reuters article ,

Intel’s next CEO is likely to shepherd the top chipmaker into a growing contract-manufacturing business, a strategic shift that could lead to a deal with Apple Inc. (NASDAQ:AAPL ) and give it a fighting chance to make inroads in the mobile arena.

I posit the stock is a solid buy at this point as the weak hands were shaken out after earnings. The risk/reward ratio favors longs.

The Bottom Line

These blue chip stocks have the potential for both significant upside over the next five years. These stocks have solid long-term growth stories. These facts coupled with the Fed’s announcement that the QE program will continue leads me to believe these stocks are set for more upside.

We are talking about buying and holding these stocks for the long haul. Since these will be long-term core portfolio holdings, take your time and build your full position slowly. If you choose to start a position in any stock, I suggest layering in a quarter at a time at a minimum to reduce risk. Furthermore, always remember to have a well-balance diversified portfolio containing several different asset classes to reduce risk.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in BAC. CAT. HD. DIS. INTC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not an endorsement to buy or sell securities. Investing in securities carries with it very high risks. The information contained within this article is for informational purposes only and is subject to change at any time. Do your own due diligence and consult with a licensed professional before making any investment.