401K Percent Allocation Recommendation Wealth Builders Strategy

Post on: 7 Апрель, 2015 No Comment

401k has become one of the most widely used retirement vehicles used by a vast majority of individuals in the country today — and yet, asset allocation. that is, the percent allocation within your 401k to various assets is a key decision towards having a successful nest egg when you retire. In fact, some studies have indicated that asset allocation within your 401k (or outside) is responsible for up to 90% of your returns.

Now, we are not huge believers in asset allocation for the wealth builders — instead we believe in identifying bull markets and riding it all the way to the top — at which time you sell it to willing buyers for top dollar, and then finding the next bull market and riding it to the top — and repeat — until one is satisfied with the level of one’s wealth portfolio. However, this implies that you have free and easy access to not only US stock markets, but worldwide — for the best companies for a new bull market may not be traded in the US markets. But the 401k plans are not helpful in this regard.

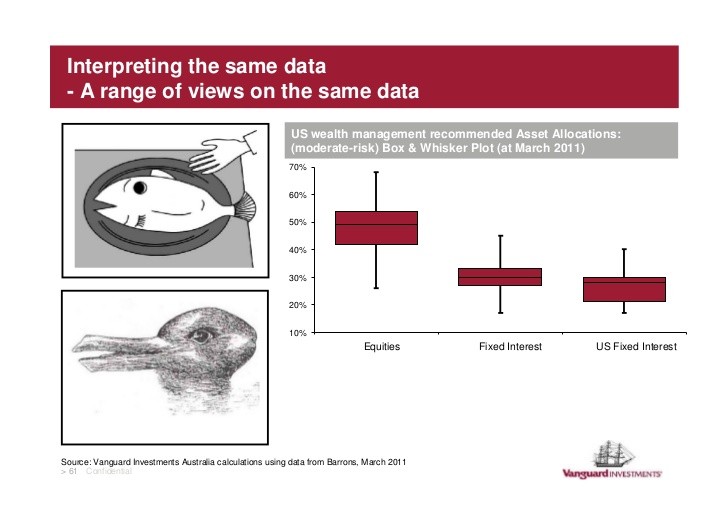

Most 401k plans are limited to a few mutual funds. some active and some indices, and provide some diversification through bond funds and some money-market equivalents. Under these conditions, you have to rely on the asset-allocation formula for your returns. This implies, you must seek out mutual funds that provide exposure to US based stocks, international stocks, some bonds, if possible some real-estate (through REITS and similar funds), and some cash equivalents. A reasonable number could be 25% in US stocks and 25% in international stocks, and putting 10% in cash equivalents, leaving 40% for bonds. You could get more aggressive on the stock side as well if you have good mutual fund options.

For example, when choosing stock mutual funds, look for small cap value. large cap value and a growth fund for your US and international stock portfolio. You don’t have to choose index funds if you find solid, long-running mutual funds — but choose the index funds (if available) if you do not know or understand the investing strategy of the mutual funds. For the bond funds, if you have the choice, again invest between US based and international bond funds, and pick intermediate bond funds as a safe hedge.

Once your asset allocation is complete, rebalance every 6 months or 12 months. You do not need to actually rebalance unless the allocation become significantly different from your chosen set (due to growth or decline in value of some funds over others), but checking every 6-12 months is important.

Of course, if you are among the lucky few who have access to stocks, do consider using some outstanding investment newsletters to help ride bull markets!