401K Calculator

Post on: 16 Март, 2015 No Comment

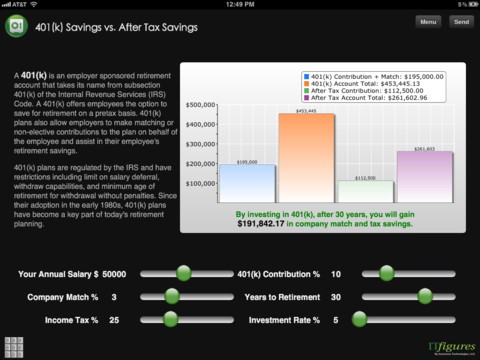

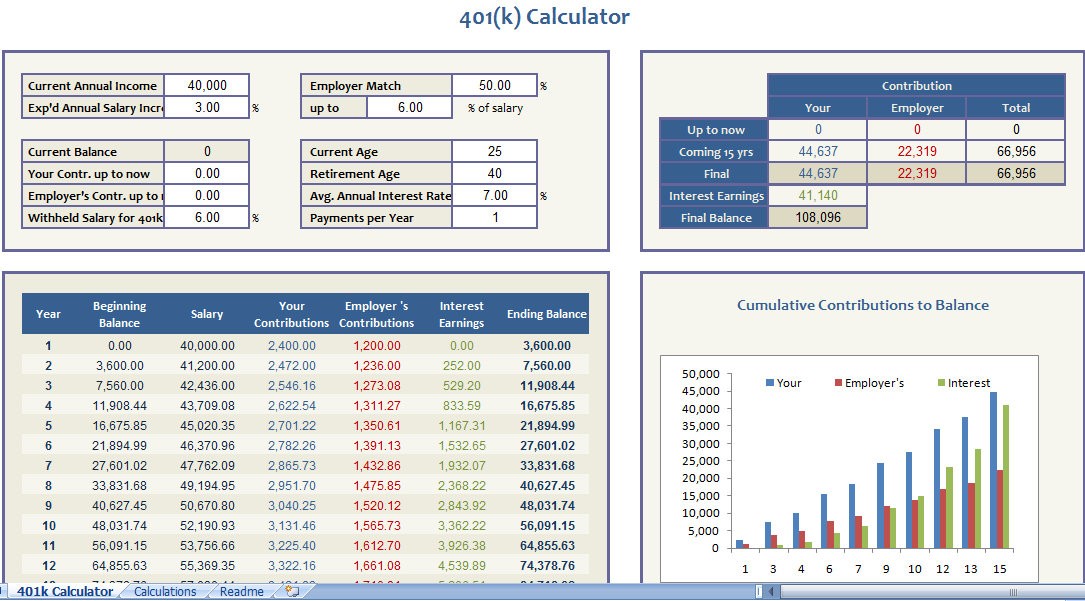

The 401K calculator enables you to estimate your 401K balance at retirement as well as the payout after retirement based on income, contribution percentage, age, salary increase, and investment returns. If you can input a reasonable average annual inflation rate, you can get an approximation of the real value that the 401K balance will be at retirement age.

What is a 401K?

In 1978, Congress passed section 401(k) of the Internal Revenue Code. This part of the tax law dealt with retirement plans that enjoy considerable tax benefits, hence the name 401K plans.

The 401K plan is called a defined contribution plan. This means that you and your employer each define the amount that you contribute to the plan. You can contribute up to a certain percent of your salary into the plan each month. The employer has the right to limit that amount. It is in your interest to try to put in as much as you are able to, but the IRS limits your total annual contribution. This amount might be increased along the cost-of-living on yearly base. The 2015 deferral limits for 401(k) plans is $18,000. Many employers make or match a part of the contribution. There is no limitation on the amount that employer can contribute, except that the annual contribution to a participant’s account cannot exceed the lesser of 100% of the participant’s compensation or $53,000 for 2015.

Both the amounts you contribute, and the money put in by your employer, go into the plan untaxed, and the money that stays in the plan isn’t taxed while it’s there. That means that the taxes you pay on your total earnings are lower too. Normally, you can’t touch this money without penalty until you retired, died, disabled, etc, so it’s a nice way to save for the time when you will need it. In some situations, you can borrow against your 401k. However, many people believe that a 401k loan should be your last resort.

Finally, an administrator someone who has nothing to do with your employer invests the money for you. You decide what kind of investment you choose to make. The administrator will provide you with a choice of possibilities as well as educational material about the kinds of investments you can make. The money is kept safe in custodial accounts so that, even if your employer should fail, your 401K is protected.

Your 401K versus an IRA versus a Roth IRA

A 401K has a certain number of advantages over a traditional IRA. Contributions to a traditional IRA may or may not be tax deductible: It depends on your tax bracket, and what other retirement plans you participate in (the money within an IRA stays free of tax until you distribute it). Contributions to a 401K, both from you and from your employer, are always deductible pre-tax. Similarly, with a Roth IRA, contributions are always post-tax, and thus not tax deductible.

Selecting Funds for Your 401K based on Age/Expectation

You will be managing your 401K portfolio for a long time for most of your life, and for your entire working life. You won’t want to have the same kind of portfolio at age 25 that you have at age 55. Your tolerance of risk and your need to earn more will change over the years, decreasing as you get older normally.

Generally, stock funds are considered riskier than fixed income funds (cash and bond funds). Experts suggest a rule for managing your portfolio is to use your age as a percentage of your savings: Put your money in safe fixed income based funds (cash and bond funds) at a percentage equal to your age (a low percentage when you’re young, and a high one when you’re old) and the rest in stock funds (so if you are 55, you might put 55 percent in fixed-income securities, and 45 percent in stocks or other more risky investments).

But you may feel comfortable managing your portfolio at a higher level of risk. This means you can determine your allocations based on your own risk tolerance and expectations. Just bear in mind that you want to build up a balance for your retirement, so you probably don’t want to go too close to the cutting edge, whatever the return.