4 Winning Tips For Profitable ETF Trading (How We Gained 44% In $TAN)

Post on: 29 Март, 2015 No Comment

Oct 15, 2013

13 Flares LinkedIn 7 Twitter 1 Facebook 2 Google+ 3 13 Flares

On July 2 of this year, we bought Guggenheim Solar Energy ETF ($TAN) in The Wagner Daily newsletter. Three months later, we sold those shares of $TAN for a cool price gain of 44.3%.

In this trading strategy article, we detail the top 4 technical tips that prompted us to buy $TAN when we did.

Then, we walk you through to the day when we eventually exited the trade to lock in the profits.

Heres a snapshot of how the daily chart of $TAN appeared at the time of our initial trade entry. The 4 reasons we bought this ETF immediately follow:

4 Big Tips For ETF Traders

- Sector Relative Strength - As detailed in my first ETF book. one of the first steps of my ETF trading strategy is to identify the industry sector showing the most relative strength to the benchmark S&P 500 Index. In early May, the relative strength of the solar energy sector became very apparent to us, prompting us to add $TAN to our watchlist for potential trade entry.

So, What Happened Next?

Below is a snapshot of the price action that followed our July 2 buy entry into $TAN:

After our initial buy entry on July 2, $TAN acted as anticipated by subsequently cruising to a new high less than two weeks later.

Thereafter, $TAN appeared to be forming a bull flag chart pattern. which prompted us to add to the position on July 22 (at $27.91).

However, since the bull flag pattern did not follow-through to the upside, we maintained a very tight stop on the additional shares, which we closed for a tiny loss of 1.6% on August 2.

After chopping around in a range for a few weeks, and again coming into support of its 50-day moving average several times, $TAN eventually broke out to new highs again.

As we frequently remind traders, one important psychological aspect of profitable trading is having the discipline and willingness to quickly close out losing trades when youre wrong, while still not being afraid to re-enter the trade if it still looks good.

As such, we again bought additional shares of $TAN when it broke out on September 6 (bear in mind that we still held the initial position from our July 2 entry because those shares never went against us).

After buying the breakout to new highs in early September, $TAN consolidated for a few more weeks, then ripped higher as volume began surging higher again.

Rather than attempting to guess when a powerful rally will end, we often close winning trades by trailing protective stops tighter and tighter, until a pullback eventually causes us to lock in the profits.

But in the case of $TAN, we instead made the decision to sell into strength of the rally due to prior resistance from back in February 2012 (visible on a weekly chart).

Upon selling $TAN on October 1, the final tally was a 44.3% share price gain from our initial July 2 entry, and a 15.4% gain from our September 6 buy entry.

Is 44% A Big Gain For An ETF Trade?

When trading individual stocks, we typically shoot for an average price gain of 20 to 30% for short to intermediate-term momentum trades.

Sometimes, bullish momentum propels stocks with massive relative strength 40 to 50% higher before we eventually sell and take profits. For example, in our Wagner Daily ETF and stock picking portfolio, we are presently sitting on unrealized gains of 49% in Silica ($SLCA) and 35% in Yelp ($YELP).

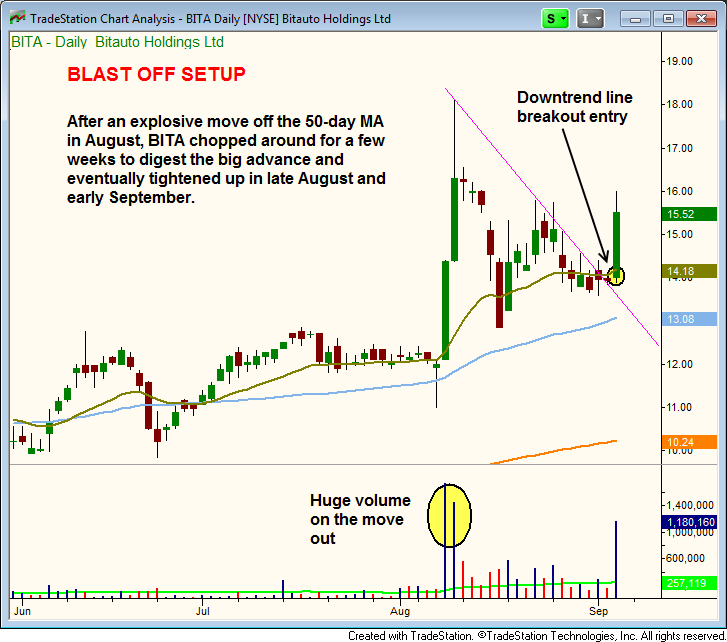

On October 8, we also closed a swing trade in Bitauto ($BITA) for a price gain of 36.7% with just a 1-month holding period.

However, because they are comprised of a basket of actual stocks, ETFs are generally much less volatile than the individual small to mid-cap growth stocks we trade in bull markets.

As such, we consider a solid gain for an ETF swing trade to be in the neighborhood of 10 to 15%, rather than 20 to 30%.

In addition to the various leveraged ETFs, $TAN is one of the few non-leveraged ETFs that trades with the volatility of a typical small to mid-cap stock.

Thats why we managed to snag a 44.3% gain by trading $TAN, despite it being an ETF.

In between, there was just a tiny 1.6% loss from our bull flag entry attempt on July 22.

You can screw up a lot of things in trading, but still be profitable if you consistently get just one thing right:

Let the profits ride when youre right, but get the hell outta Dodge when youre wrong!

To profit from our next big winning trade, sign up now for your risk-free subscription to our swing trading newsletter.