4 Reasons Why Spinoffs Outperform the Market Index

Post on: 8 Июль, 2015 No Comment

Archive

4 Reasons Why Spinoffs Outperform the Market Index

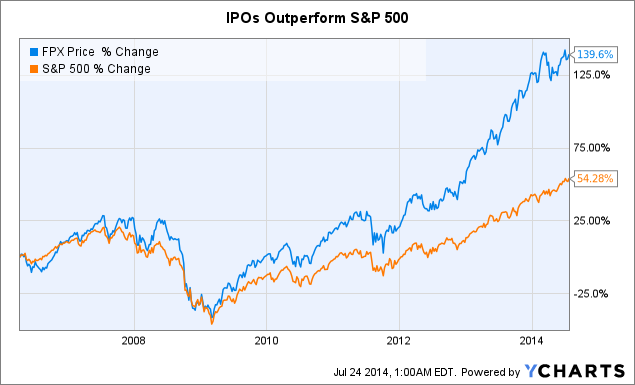

In 1993, Patrick J. Cusatis, James A. Miles and J. Randall Woolridge did a research study on the stock performance of spinoff companies from 1963 to 1988. From the research, they found that spinoffs outperformed the S&P 500 by about 10% per year in the first three years of their independence. The study also found that parent companies of spinoffs also outperformed the index by more than 6% per year for the same three years.

A 1999 McKinsey study researched the performance of spinoffs between 1988 and 1998 and showed that spinoffs gave shareholders 27% annualized returns over two years vs. 17% for the S&P 500 .

The Guggenheim Spin-Off ETF, which is based on the Beacon Spin-Off Index, has also generated a return of 384% since the March 9th 2009 bottom compared to 203% for the S&P 500 in the same time period.

It looks as if investing in spinoffs are a great way to boost your investment returns in the short term!

What are Spinoffs?

Spinoffs are a form of corporate restructuring where a parent company, usually a conglomerate, decides to separate a subsidiary business as a new independent entity.

Referring to the diagram below: Pre-spinoff, shareholders only own shares of the parent company. The parent company owns two different businesses — subsidiary A and B. When subsidiary B is spun off as a new entity, the parent company will distribute the shares of this new company to existing shareholders.

Post-spinoff, shareholders now own shares of the parent company and the spinoff (Subsidiary B). The spinoff will have its own management team and board of directors, different from its parent company.

Types of Spinoffs

The scenario we described above is what we called a regular spinoff where 100% of the spinoff’s shares are distributed to shareholders of the parent company. But there are cases where management does a carve-out or split-off .

A carve-out happens when a parent company decides to sell a full or partial stake in its subsidiary to the public through an IPO. Unlike regular spinoffs, carve-outs raise fresh capital (cash) since shares are sold to the public via its IPO.

A split-off happens when a parent company offers shareholders to exchange their shares for shares of the new split-off. The new shares are usually offered at a discount. For example, the parent company will offer shareholders the option to exchange $100 worth of shares for $110 worth of the new split-off’s shares.

Why Spinoffs Outperform the Index in the Short Term

- Markets and investors generally favor pure play companies that are focused on one core business. Conglomerates, on the other hand, have the complexity of owning and operating multiple different businesses units under their umbrella.

- Many spinoffs are spun off to realize their full value as subsidiaries are usually undervalued when merged with its parent company. For this reason, many spinoffs significantly rise in value the moment they are separated

- Spinoffs have a smaller market capitalization compared to its parent. Consequently, many fund managers have to sell shares of spinoffs when they receive them because their funds’ mandate is to invest in large-cap companies. This sell-off drives down shares prices of the spinoff at the start, giving other investors a chance at a bargain investment.

- The new board of directors and management team usually own a stake in the spinoff. They are largely compensated based on equity incentives which is tagged to the performance of the new spinoff. It is their interest to ensure that the spinoff performs well.

Are you looking for a formula that can consistently pick out the best companies to invest in and make you a LOT of money in the stock market? If you are, then this might finally be the answer you’ve been looking for. Because this is the same exact formula we used to create 7-figure results in a single stock portfolio — and we did it in just two years. Find out what this formula is right here .

Do you think that it’s nearly impossible to double or triple your investment in blue-chip stocks? If you want the stability and security of a blue-chip company but are looking for the supercharged returns of smaller, high-growth stocks, then we want to tell you that it is possible. In fact, we want to show you how we uncovered one company that’s a market leader in its industry. but was still growing its revenues by up to 20.4% a year and its net profits by up to 39.8% a year. Click here to find out which company and download a FREE report that shows you how we made 243.5% returns in this super investment .

If you enjoyed this article, get email updates (it’s free).

This is not a recommendation to purchase or sell any of the securities mentioned on this site. The information contained herein are the opinions and ideas of the authors and is strictly for educational purposes only. This information should not be construed as and does not constitute financial, investment or any form of advice. Any investment involves substantial risks, including complete loss of capital. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent research or to contact a licensed professional before making any investment decisions. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information set forth herein. Fifth Person Pte. Ltd. its related and affiliate companies and/or their employees shall in no event be held liable to any party for any direct, indirect, punitive, special, incidental, or consequential damages arising directly or indirectly from the use of any of this material.