4 More Ways to Spot the Best Dividend Stocks Investing Daily

Post on: 18 Май, 2015 No Comment

By Chad Fraser on August 31, 2013

In a recent Investing Daily article, we examined three telltale signs that separate the best dividend stocks from the rest of the pack. You can read the full article on stocks with high dividends here .

Below, well build on that article by analyzing four more ways to spot the best dividend stocks for both capital gains and rising income.

Concerns about higher interest rates have weighed on even the best dividend paying stocks this summer. Thats partly because rising rates increase the appeal of less risky investments like U.S. Treasury bills, notes and bonds, which draws investor attention away from dividend-paying companies.

However, dividends continue to be hugely important for investors over the long term, as illustrated by a recent report from Guinness Atkinson Funds.

For an average holding period of one year, dividends accounted for 27% of total returns for the S&P 500 since 1940, says the report. If we increase the holding period to three years, dividends account for 38%, five years it increases to 42%, over a 10-year period it rises to 48%, and with a 20-year holding period dividends account for some 60% of total returns.

Here are four more things to keep in mind when looking for the best dividend stocks to add to your portfolio:

- Take the long view: As we wrote in a November 2011 article. if youre investing for income, your focus should always be on the health of the underlying business. The best dividend stocks are the ones that are in good shape and growing, so they can maintain and raise their payouts.

Over time, stock prices will follow those dividends higher, so youll pocket capital gains by buying and holding, as well. This approach also leads to less-frequent trading, which cuts your brokerage fees.

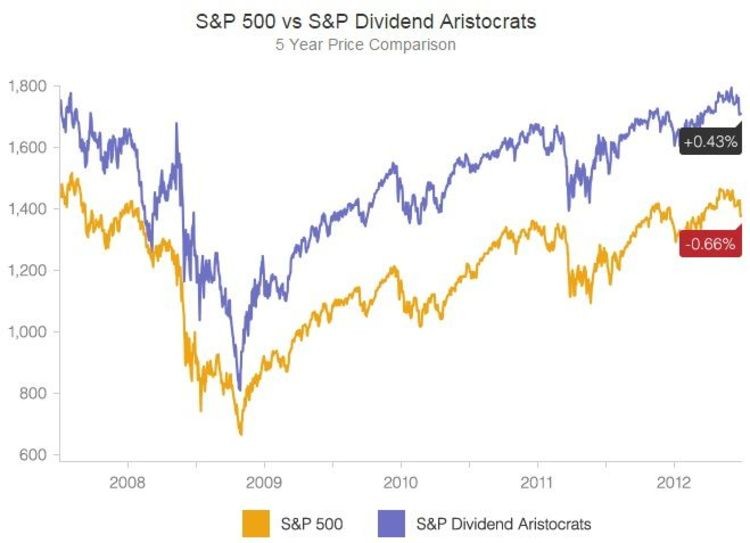

Of course, this is sometimes easier said than done, particularly during tumultuous periods like the 2008/09 financial crisis, but this strategy has consistently built wealth. As Warren Buffett wrote in Berkshire Hathaways 1990 shareholder letter. Lethargy bordering on sloth remains the cornerstone of our investment style.

- Focus on revenue reliability: Have the stocks revenue and dividends held up well during past downturns, such as the 2008 financial crisis? If so, thats a pretty good reason to be confident of their durability in future market storms.

Examples of dividend-paying sectors with very reliable revenues include regulated electric, gas and water utilities, fee-generating energy midstream companies, such as pipelines, and big U.S. telecom firms.

Note that energy companies generally dont produce consistently reliable revenues, due to their exposure to unpredictable oil and gas prices. However, there are some exceptions, such as large cap oil stocks whose massive scale gives them a big edge when it comes to weathering downturns.

- Dont overlook debt: In our earlier article, we looked at one of the most important figures for zeroing in on the best dividend stocks: the payout ratio. However, something thats also crucial to dividend stability is debt. Youll want to look for companies with healthy balance sheets, including significant cash holdings and low debt.

However, its important to keep in mind that what is considered a high debt level varies by industry. Utilities, for example, typically have higher debt loads because of the large sums they must invest to maintain and grow their operations. However, as noted above, they tend to benefit from more reliable revenue streams.

Most important of all keep it simple. This tip applies to all investments, not just dividend stocks. Peter Lynch said it best in his 1994 book Beating the Street. Never invest in anything that you cant illustrate with a crayon.

Were not into newfangled financial vehicles, wrote Investing Daily investment strategist David Dittman in an August 9, 2013, article in our Canadian Edge newsletter. We prefer traditional equities, issued by companies that run easy-to-understand, so-simple-a-caveman-could-get-it businesses.

Steering clear of the newfangled means avoiding initial public offerings, too, he added. We like a trading history, and, of course, as dividend-focused investors, we like to see a trail of dividends over time. And we also like to see a backlog of public filings and the history of financial and operating performance they detail.