4 Financial Stocks Doomed To Trade Higher

Post on: 15 Апрель, 2015 No Comment

Following the announcement of the U.S. Federal Reserve’s latest quantitative easing program QE3 on September 12, 2012, financial shares leaped forward, with the Dow Jones U.S. General Financial Index (^DJUSFN) increasing by 3% in two days from 293.81 on September 12, 2012 to its recent high of 302.65 on September 14, 2012. As a matter of a fact, at its high of 302.65, the index had appreciated by as much as 20% since its June 4, 2012 level of 252.2 2.

DJUSFN 6-Months Chart- Source: www.wikiinvest.com

As Federal Reserve Bank of Philadelphia President Charles Plosser said on September 25, 201 2, t hat it is unlikely that QE3 will boost economic growth, the financial index dropped by over 1.4% to 291.21 from its previous day close of 295.3 6. At such level, the index is below its level of 293.81 where it had closed prior to the actual announcement of QE3. The index has erased some of its 20% gains since June 2, 2012, now standing only 15.46% higher.

Despite such setback, financial shares that can benefit from QE3 are actually doomed to trade higher. How can a stock be doomed to trade higher? Well, simply consider Mr. Plosser’s statement, and put it in perspective with Mr. Bernanke’s statements. Mr. Plosser’s pessimism stems from his belief that quantitative easing a nd its associated asset purchases are unlikely to result in much of an improvement in the economy, nor an improvement in employment. We actually agree with him, as stated in our article published on September 14, 2012, La fed aux folles .

Meanwhile, Mr. Bernanke has clearly stated that as long as the economy remains weak and unemployment remains high, then the Federal Reserve will continue its program of asset purchases indefinitely, and will even maintain such action during early signs of employment improvement. Now if we combine Mr. Plosser’s logic with Mr. Bernanke’s logic, the combined odd conclusion would be: QE3 is here for a very long time, because, as per Mr. Plosser, it is unlikely to improve employment, and, as per Mr. Bernanke, it will not abate while unemployment is high.

If one believes Mr. Plosser’s view of an economy doomed to experience mediocre growth, combined with Mr. Bernanke’s pledge of a resulting infinite QE3, then the outcome of infinite asset purchases will actually benefit financial companies that are positioned to take advantage of such program. Financial companies holding mortgage securities can reduce their inventory by selling at favorable prices to the Fed. Meanwhile, in case such infinite program results in inflation, then financial companies can increase loan rates to their clients, while maintaining a source of cheap funding from the Fed, hence improving their profit margins.

The combination of selling existing mortgage securities inventory at favorable prices, along with the potential of improved lending margins, will most likely offset any negative effect implied by Plosser’s prediction that growth would not be boosted (unless we experience a very serious recession/depression, which at this stage is highly improbable); even Mr. Plosser still believes that GDP growth will be around 3% for 2013 and 2014 .

In case a severely higher inflation rate causes the Fed to re-evaluate its QE3, such scenario is unlikely to materialize before one to two years, hence providing financial companies ample time to cash in on QE3. Furthermore, it is very likely that savvy financial companies would see such potential developing, hence possibly positioning themselves favorably from a trading perspective to generate trading profits from a rising inflation environment.

Four financial companies that are well positioned to take advantage of the above profitability opportunities are Citigroup (NYSE:C ), Bank of America (NYSE:BAC ), Morgan Stanley (NYSE:MS ), and Goldman Sachs (NYSE:GS ).

Citigroup, Inc.

As of September 25, 2012, Citigroup had a market capitalization of about $96.36 billion. with its share price having increased by 24.9% year-to-date from 26.31 on December 30, 2012 to 32.86 on September 25, 2012. Despite such healthy appreciation, Citigroup’s market capitalization today is still less than 40% of its market capitalization of around $247 billion in December 2006. Its current book value of $62.61 per share yields a price/book ratio of 0.52 .

Citigroup stands to benefit both from QE3 asset purchases, as well as the potential for increased profits in its lending businesses. With earning estimates of $4.53 per share for next year ending December 2013, Citigroup’s resulting forward P/E ratio of 7.25 is quite favorable in the current low interest rate environment.

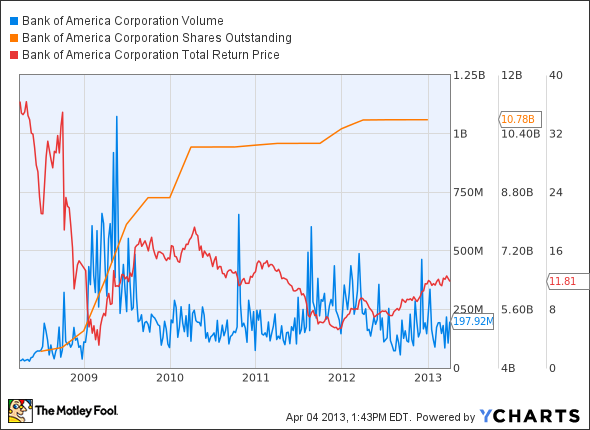

Bank of America

As of September 25, 2012, Bank of America had a market capitalization of about $96.18 billion. with its share price having increased by 62.2% year-to-date from 5.56 on December 30, 2012 to 8.93 on September 25, 2012. Bank of America’s market capitalization today is still less than 47% of its market capitalization of around $206 billion in December 2006. Its current book value of $20.16 per share yields a price/book ratio of 0.4 4.

Bank of America also stands to benefit both from QE3 asset purchases, as well as the potential for increased profits in its lending businesses. With earning estimates of $0.91 per share for next year ending December 2013, Bank of America’s resulting forward P/E ratio of 9.81 is still favorable in the current low interest rate environment. Although Bank of America’s forward P/E ratio is higher than Citigroup’s P/E ratio, its price/book ratio of 0.44 is actually lower than Citigroup’s. In a QE3 environment of asset purchases by the Fed, Bank of America’s current price/book ratio could prove to be excessively small, hence possibly allowing for substantial upside in the price of its shares.

Morgan Stanley

In an article we published on March 19, 2012, 5 reasons why these 2 financial stocks can move much higher , we expressed our opinion why both Goldman Sachs and Morgan Stanley can move much higher by the end of 2012. At the time of publication of such article, Goldman Sachs’ share price stood at 123.06 (above its current level of 113.50) while Morgan Stanley share price stood at 19.51 (also above its current price of 16.60). Although both shares have dropped in price since then, the year has not ended yet, and we still believe there is a good chance they can appreciate substantially by the end of the year, boosted by QE3.

As of September 25, 2012, Morgan Stanley had a market capitalization of about $32.79 billion. with its share price having increased by 9.7% year-to-date from 15.13 on December 30, 2012 to 16.60 on September 25, 2012. Morgan Stanley’s market capitalization today is still less than 49% of its market capitalization of around $68.1 billion in December 2006. Its current book value of $31.02 per share yields a price/book ratio of 0.5 4.

With earning estimates of $1.95 per share for next year ending December 2013, Morgan Stanley’s resulting forward P/E ratio of 8.51 is still favorable in the current low interest rate environment. In a QE3 environment of asset purchases by the Fed, in addition to Morgan Stanley’s potential for increasing its trading profits, current low price/book ratio could also prove to be excessively small. Accompanied by its reasonable forward P/E ratio, Morgan Stanley share price could have substantial upside potential by the end of the year.

The Goldman Sachs Group, Inc.

As of September 25, 2012, Goldman Sachs had a market capitalization of about $56.34 billion. with its share price having increased by 25.5% year-to-date from 90.43 on December 30, 2012 to 113.50 on September 25, 2012. Goldman Sachs, market capitalization today is still less than 58% of its market capitalization of around $96.92 billion in October 2007. Its current book value of $137 per share yields a price/book ratio of 0.8 3.

With earning estimates of $12.49 per share for next year ending December 2013, Goldman Sachs’ resulting forward P/E ratio of 9.09 is also quite favorable in the current low interest rate environment. When compared to Morgan Stanley, Citigroup and Bank of America, Goldman Sachs’ price/book ratio is substantially higher, although still under 1. Due to its trading savvy, in addition to benefits from QE3, coupled with its favorable P/E ratio, Goldman Sachs could also see a substantial appreciation in its share price from current levels by the end of the year.

As the market pulls back from its recent highs due to Plosser’s comments, as well as renewed nervousness about Europe, this could prove to be a good buying opportunity of financial shares such as Citigroup, Morgan Stanley, Goldman Sachs and Bank of America. In the perverse logic world of today, Plosser’s comments of subdued GDP growth rates should provide further fuel to an extension of Bernanke’s QE3, hence lending further support to financial shares.

Disclosure: I am long BAC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.