4 ETFs to Expose Your Portfolio to Emerging Markets

Post on: 31 Март, 2015 No Comment

By Aaron Levitt, InvestorPlace Contributor

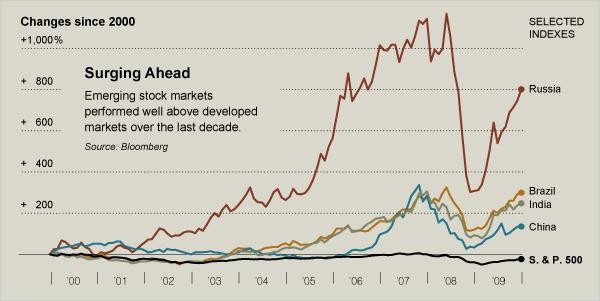

When it comes to finding a long-term growth engine for your portfolio, you can’t find anything better than emerging market stocks.

As many developed economies continue trudge along with low GDP growth each year, numerous emerging market economies continue to prosper. Rapid urbanization and industrialization, growing middle classes along with vast commodity wealth and general fiscal responsibility have been the hallmark of many of these emerging market nations.

So, it’s easy to see how the broad MSCI Emerging Market Index has managed to produce a 987% since its inception back in 1988. And more big gains could be in store for long term and patient investors.

However, given the variety of countries that fall under the emerging market umbrella and the relative difficulty of buying individual emerging market stocks, adding the sector can be a quite a chore. That is, if you’re not using exchange-traded funds to get your emerging markets fix.

ETF issuers continue to dive head first into various corners of the emerging market stock and bond markets. For investors, using ETFs is really the only way to gain access to these countries.

Here’s four ETFs to round out your exposure to developing markets.

Emerging Markets ETFs to Buy #1: iShares Core MSCI Emerging Markets (IEMG )

While the iShares MSCI Emerging Markets ETF (EEM ) remains the most popular emerging market ETF, its sister fund — the iShares Core MSCI Emerging Markets ETF (IEMG) — is actually the best fund for retail investors looking for broad exposure to these nations.

Unlike EEM — which uses a sampling approach to track its index — IEMG uses a full replication strategy. That means IEMG holds all the stocks in the previously mentioned MSCI Emerging Market Index — currently 1776 versus EEM’s 843. That includes plenty of large-cap emerging market stocks like China’s China Mobile (CHL ) and South African media giant Naspers (NPSNY). However, the kicker for IEMG is that it includes mid- and small-caps as well. That’s something that no other emerging market ETF currently does and this extra exposure to these smaller players make IEMG the best all-around core solution for investors.

IEMG also helps on the returns front. IEMG has managed to outperform EEM since its inception in 2012.

Expenses for IEMG also beat its sister fund. As part of iShares “Core line-up,” IEMG is one of the cheapest funds tracking the sector. All in all, IEMG costs just 0.18% — or $18 per $10,000 invested — to own.

Emerging Markets ETFs to Buy #2: PowerShares DWA Emerging Markets Momentum ETF (PIE )

For investors looking to add more “oomph” to their emerging market’s cores, the PowerShares DWA Emerging Markets Momentum ETF (PIE) could be a welcome addition. The $360 million tracks the Dorsey Wright Emerging Markets Technical Leaders Index, which holds stocks with great relative strength characteristics.

Relative strength (RSI) is essentially “buy high, sell higher.” By using various technical indicators, investors using the strategy attempt to ride various trends in stocks that have the greatest momentum. Investors using this technique will sell their holdings as soon as they begin to appear weak. This is trading pure and simple.

Which is why you should leave to the professionals that run PIE.

Over the last five years, PIE has managed to outperform the MSCI Emerging Markets Index by about 5%. However, that extra return has come with extra-large price swings and periods of underperformance. That places PIE very much into the satellite position camp. Also, keeping PIE as a non-core position — its hefty expense ratio. The ETF charges 0.9% in expenses.

However, for investors looking for something more from their emerging markets portfolio, PIE is a great ETF choice.

Emerging Markets ETFs to Buy #3: SPDR S&P Emerging Markets Dividend ETF (EDIV )

For many investors, there is a perception that just because a stock is based in an emerging market, somehow it is financially unsound and risky. The truth is many are in fact actually sounder than many of their developed counterparts- due to extremely low debt levels- and are huge dividend payers.

Enter the SPDR S&P Emerging Markets Dividend ETF (EDIV).

EDIV tracks performance of the S&P Emerging Markets Dividend Opportunities Index- which is a benchmark of developing market stocks that have high dividends. To be included in the index, firms must have positive 3-year earnings growth and profitability. No single stock can have more than a 3% weighting in the fund, nor can any country have a 25% weighting. Stocks are weighted by annual dividend yield. EDIV currently has 122 high and strong dividend payers.

This focus allows the $486 million EDIV to produce a juicy 4.13% dividend yield. That’s substantially higher than the S&P 500 and most bond funds. Expenses for the ETF run a relatively cheap 0.59%.

All in all, EDIV helps prove that you can get plenty of income and dividends from emerging markets.

Emerging Markets ETFs to Buy #4: Vanguard Emerging Markets Government Bond ETF (VWOB )

Another area that most investors skip when it comes to emerging markets is bonds. However, these nations can be a fruitful place for investors looking to pick-up extra yield over U.S. bonds- despite the fact that a variety of emerging market nations feature “investment grade” debt ratings.

Tracking the often missed opportunity is the Vanguard Emerging Markets Government Bond ETF (VWOB).

VWOB focuses its attention on dollar-denominated bonds issued by governments and government related issuers in emerging market countries. “Dollar-denominated” bonds differ from local currency bonds as these debts are bought and sold in exchange for U.S. dollars. That provides some security to the underlying price of the bond. The majority of VWOB’s 697 bonds are rated between Aa and Baa. Top issuers are Russia, Brazil and Mexico.

That produces a great yield of 4.53% and like all of Vanguard’s offerings VWOB is a dirt cheap fund to own. Expenses or the emerging market bond Etf run at 0.35%. That makes it the low cost leader in the sector.