4 Charts to make you smarter about ‘smart beta’ ETFs

Post on: 6 Август, 2015 No Comment

VictorReklaitis

Markets writer

NEW YORK (MarketWatch) — Smart beta ETFs. Alternatively-weighted ETFs. Indexing 2.0. Whatever you want to call this trend in exchange-traded funds, it’s attracting more investor dollars.

These ETFs offer a twist on index-based investing, a decades-old approach that’s epitomized by well-established products like the SPDR S&P 500 ETF SPY, -0.61%

Stock indexes have been around for more than a century, providing a way to gauge the general market. Then a few decades ago, index funds came on the scene, offering a low-cost, passive way to get the market return.

Now for the last few years, smart beta ETFs have grabbed more assets, while living in a place between basic passive indexing and traditional active management. Investors get “beta” or exposure to the market, but it’s smarter or more strategic, according to proponents of these ETFs.

Smart beta ETFs use newer, tailor-made indexes that have been constructed with outperformance, lower volatility or some other goal in mind besides just tracking a market. Skeptics say these products are mostly about smart marketing, and they emphasize such ETFs are pricier and more complicated.

One provider of indexes — FTSE, a unit of the London Stock Exchange Group LSE, +0.44% — views a blurred distinction between active and passive investing as the latest step in the evolution of indexing, which started out with just illustrating market performance.

The biggest smart beta ETFs

An example of a smart-beta product is the Guggenheim S&P 500 Equal Weight ETF RSP, -0.74% RSP gives the same weight to each S&P 500 company, while the SPY has mega-cap stocks like Apple Inc. AAPL, +0.01% as its biggest holdings, since it follows tradition in weighting by market capitalization.

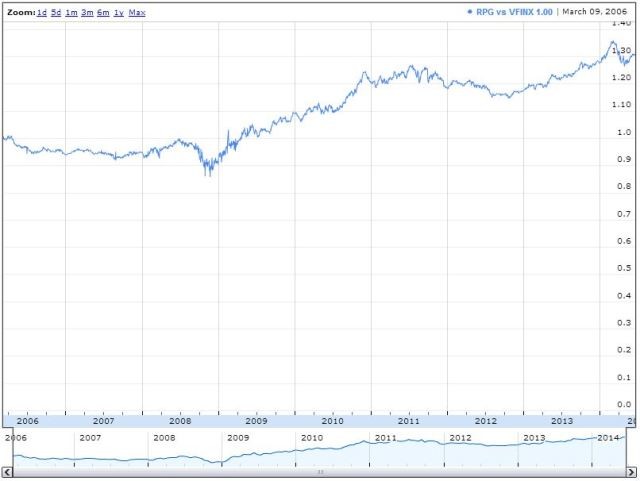

With its smaller-cap and value tilt, RSP has outperformed the SPY over the past decade. It’s achieved an annualized return of 9.1% versus 7.3% for the SPY, although that outperformance could be ending. GMO’s James Montier has argued that it’s not a good time to go with such a smart beta strategy, as small and value aren’t expected to outperform .

RSP is the 10th largest “strategic beta ETF” by assets, according to Morningstar, which steers clear of the term “smart beta.”

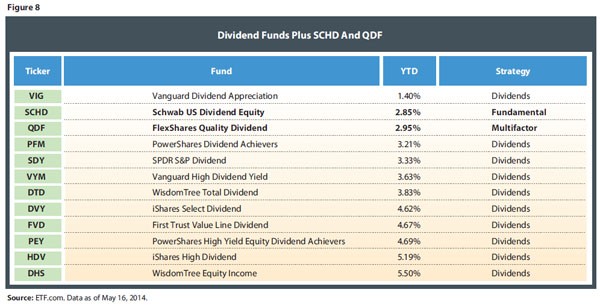

The iShares Russell 1000 Growth IWF, -0.52% and the iShares Russell 1000 Value IWD, -0.67% are among the 10 biggest strategic beta ETFs, by Morningstar’s reckoning. Beyond smaller-cap and value tilts, other common tilts for smart beta ETFs are toward growth, dividends or reduced volatility.

Overall, Morningstar slaps its “strategic beta” label on more than 340 ETFs that together have attracted more than $310 billion in assets. The entire U.S. ETF industry consists of about 1,600 products with $1.7 trillion in assets, so strategic beta has 18% of the asset pie.

Michael Rawson, a Morningstar analyst, said he and his colleagues continue to debate which ETFs should count as strategic beta ETFs. They’ve tried to be inclusive rather than strict with their current list, he said. He notes a purist could argue only a product like the Vanguard Total Stock Market ETF VTI, -0.59% is truly passive, and everything else has a tilt – even the SPY since it excludes small- and micro-cap stocks.

Elisabeth Kashner, director of research at ETF.com, also says it’s highly debatable what counts as a smart beta ETF.